Bitcoin Surge Triggers $539M in Crypto Liquidations, Are Bears Finally Broken?

- A $539M crypto liquidation wiped out 119K traders after BTC, ETH, and SOL surged sharply.

- Short squeezes intensified as BTC broke $112K, ETH increased by 7%, and SOL soared above $158.

- ETF inflows hit $429M in a day, led by BlackRock’s IBIT and ETHA, reflecting rising demand.

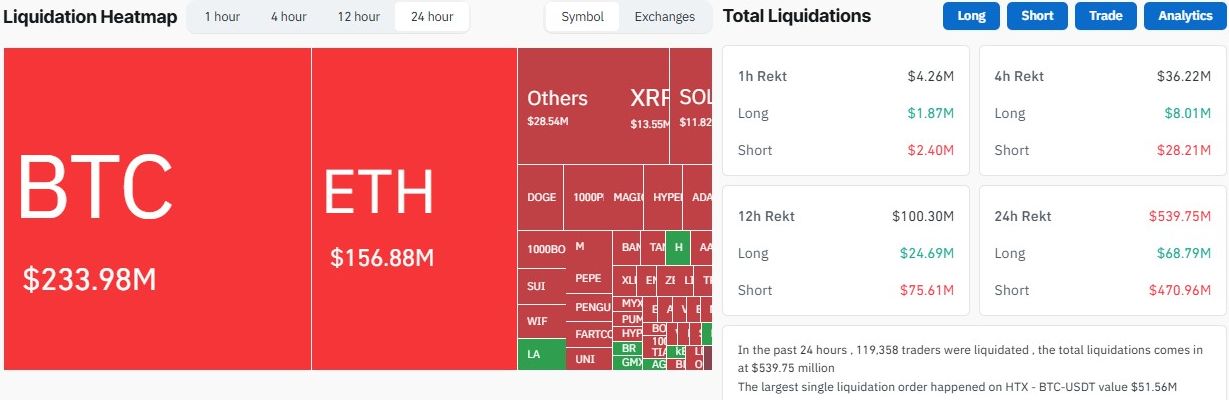

A surprise surge in cryptocurrency prices over the last 24 hours caught traders off guard and triggered the largest short squeeze in nearly two months. According to Coinglass data, the abrupt movement wiped out over $539 million in positions, with most of the losses, approximately $470 million, coming from traders who had bet on the market falling.

More than 119,000 traders had their positions liquidated as Bitcoin surged above $112,000, Ethereum jumped 7% to over $2,700, and Solana (SOL) crossed the $158 mark. The largest single liquidation was a short position of $51.56 million BTC-USDT on the HTX exchange.

Source:

CoinGlass

Source:

CoinGlass

These types of events, often referred to as short squeezes, occur when traders using leverage, borrowing funds to increase their exposure, are forced to exit losing trades. When prices move quickly against their position, their accounts fall below the margin requirements, prompting exchanges to close their trades to limit further losses automatically.

The result is often a rapid and self-reinforcing price surge. As one position is closed, the forced buying pressure adds upward momentum, triggering more liquidations and continuing the cycle. In this case, a strong move by Bitcoin and Ethereum started the chain reaction.

ETF Inflows Offer Clues to Institutional Behavior

The price surge did not happen in isolation. Institutional money is moving steadily into the crypto space, particularly through regulated exchange-traded funds (ETFs). On July 9, Bitcoin ETFs brought in $218.04 million in daily net inflows, according to figures from SoSoValue.

Leading the pack was BlackRock’s IBIT, which attracted $125.58 million in a single day. In total, Bitcoin ETFs have now seen over $50.16 billion in cumulative inflows, making them one of the largest investment vehicles for digital assets in traditional finance.

Ethereum ETFs, on the same day, recorded $211.32 million in new capital. BlackRock’s ETHA again led the field with $158.62 million in inflows. These ETFs now hold $11.84 billion in total assets, indicating that institutional appetite for ETH exposure is also growing.

This steady movement of capital from professional investors is helping support prices and adding confidence to the broader market. ETF inflows tend to reflect longer-term positioning, unlike the shorter-term bets often seen in leveraged trading.

Related: BlackRock’s Bitcoin ETF IBIT Grows Fast to Rank Top 3 in ETF Rankings

Altcoins Begin to Catch the Wave

Bitcoin may have sparked the rally, but other major cryptocurrencies are starting to pick up momentum. While BTC remains only slightly up on the week, around 2%, Ethereum and other large-cap tokens like XRP and SOL have posted gains of 7% or more.

This shift has drawn attention from market analysts who are tracking whether money is beginning to rotate out of Bitcoin into altcoins. One of them, crypto analyst Wimar.X, has pointed to a recurring chart pattern known as the “Support Breakdown.”

Source:

X

Source:

X

According to Wimar.X, this pattern has preceded past altcoin rallies, appearing before the explosive runs in 2017 and 2021. He claims the same setup is now emerging in 2025. Based on historical trends, Wimar.X estimates that the total altcoin market cap could eventually move toward $2.2 trillion.

This has caught the eye of traders who specialize in altcoin cycles. Often, when Bitcoin consolidates or slows down after a rally, capital begins flowing into smaller tokens, especially as confidence grows and investors look for higher returns.

The post Bitcoin Surge Triggers $539M in Crypto Liquidations, Are Bears Finally Broken? appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Senate Evaluates Trump’s CFTC Chair Nominee

WLFI Tokens Restrict Founder Unlocks at Launch

Bitcoin Standard Treasury Reserve Lists on Nasdaq

SharpLink Gaming Leads $1.4B Ethereum Accumulation Surge