Trump says Bitcoin and tech boom show US economy is back, urges Fed to cut rates

Key Takeaways

- Trump highlights surging US tech stocks and Bitcoin as signs of economic strength.

- He urges the Federal Reserve to cut interest rates, crediting tariffs and trade policies for the boom.

With tech stocks soaring and Bitcoin hitting fresh highs, President Trump is renewing pressure on the central bank to ease monetary policy, framing market performance as a sign of economic strength.

Bitcoin reached a new all-time high above $112,000 on Wednesday amid increasing global demand for digital assets. The surge also pushed the overall crypto market capitalization back up to $3.4 trillion, a peak last seen in June 2025.

Despite recent gains, the total market value is still below the December 2024 record of $3.7 trillion. Bitcoin was trading at around $111,300 at the time of writing, per TradingView .

Trump has repeatedly urged the Fed to lower interest rates, but markets see little chance of a cut before September. The central bank has kept its benchmark rate steady at 4.25%–4.50% since December 2024.

While policymakers indicated in June the potential for two cuts by the end of the year, there was no agreement on near-term action.

Market pricing now reflects less than a 7% chance of a rate cut at the upcoming July 29–30 meeting, according to data from CME FedWatch.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

First crypto bill vote fails to get 100% Republican support despite Trump’s call

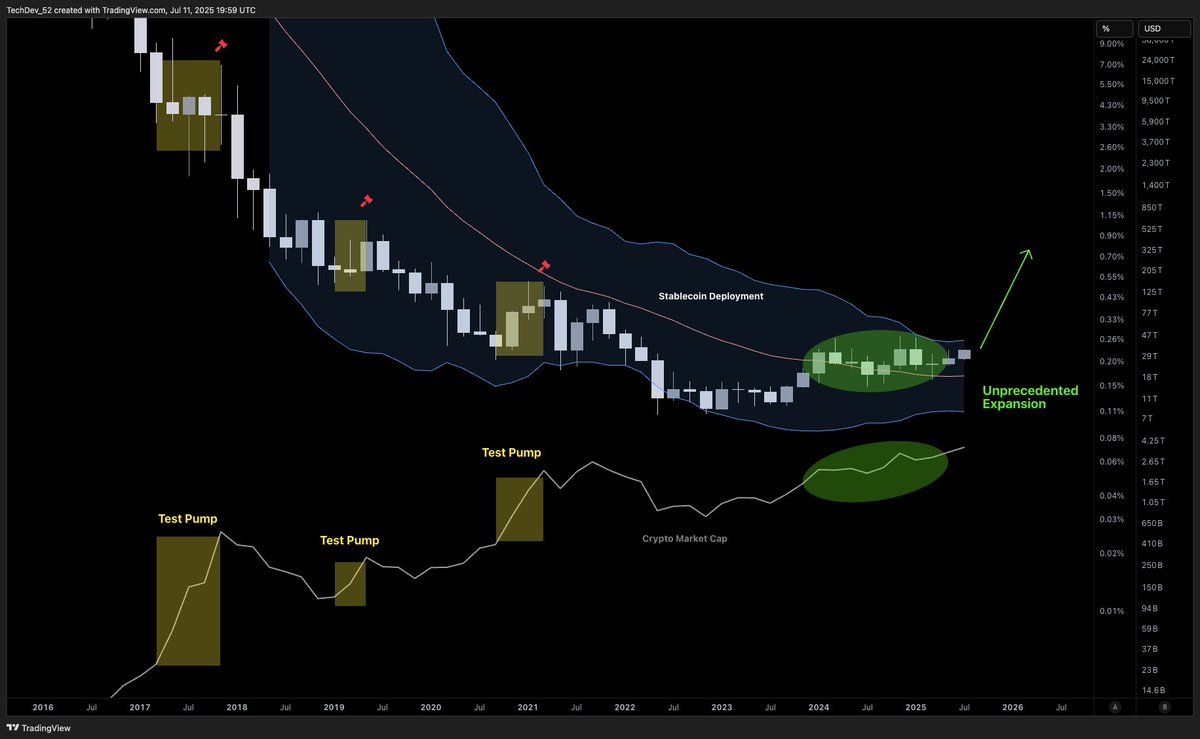

Rare Altcoin Signal Brewing Since 2020 Foreshadowing Parabolic Expansion, According to Crypto Analyst

Crypto Perpetual Futures: Unveiling the Shocking 24-Hour Liquidation Storm

Spot Ethereum ETFs Soar: $404.54M Inflows Mark Astounding Eleventh Day of Growth