Date: Sun, Nov 30, 2025 | 01:15 PM GMT

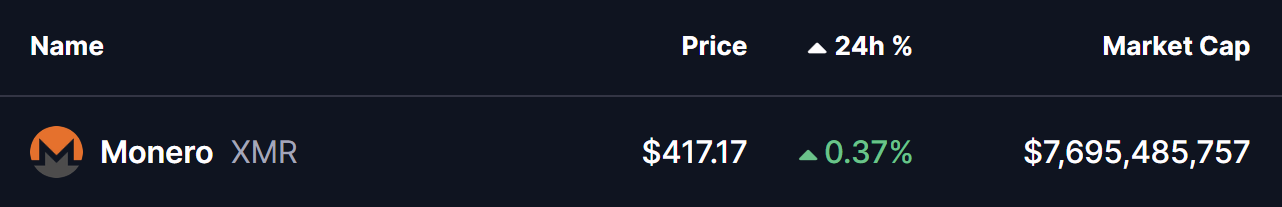

In the cryptocurrency market, privacy-focused tokens like Zcash (ZEC) and Dash (DASH) have recently delivered strong rallies. Monero (XMR), however, has been slower to follow — but the latest daily chart suggests that may be about to change. A major bullish pattern is unfolding, and XMR is now pressing against a level that has repeatedly acted as a ceiling for almost seven months.

Source: Coinmarketcap

Source: Coinmarketcap

Cup and Handle in Play

The chart shows a clearly defined Cup and Handle formation, one of the most reliable bullish reversal patterns in technical analysis. The “cup” began forming in early June after XMR rejected the neckline around $420, initiating a multi-month decline that bottomed near $232. From there, price slowly curved upward through July, August and September, shaping the rounded bottom characteristic of this setup.

Momentum strengthened in October and November, pushing XMR right back into the neckline region. A brief correction followed, creating the “handle” — a healthy consolidation as the price retraced toward the $319 area before bouncing strongly from the 50-day MA. This pullback was shallow and controlled, matching the typical structure of a handle that forms just before a breakout attempt.

Monero (XMR) Daily Chart/Coinsprobe (Source: Tradingview)

Monero (XMR) Daily Chart/Coinsprobe (Source: Tradingview)

Now, Monero is once again testing the neckline zone around $417–$420, which is marked clearly as the key horizontal barrier on the chart. This level has rejected price multiple times, making it crucial for confirming any continuation higher. XMR is trading just below it, suggesting that another breakout attempt is now in motion.

What’s Next for XMR?

If bulls manage to secure a clean daily breakout and sustain a weekly close above $420, the Cup and Handle formation would be fully confirmed. Such a move would likely accelerate buying pressure, with the pattern’s measured target sitting near $608 — representing roughly a 45% potential upside from current levels. The long consolidation and repeated tests of the neckline add further weight to this setup.

Still, traders should remain patient. Previous breakout attempts have failed at this same level, so confirmation is essential. A retest of $420 as support after the breakout would strengthen the bullish case significantly.