News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Crypto, TradFi sentiment improves: Will Bitcoin traders clear shorts above $93K?2Bitcoin catches a bid, but data shows pro traders skeptical of rally above $92K3Bitget Daily Digest (Dec. 9)|Michael Saylor is promoting a Bitcoin-backed banking system to governments; the CFTC has launched a digital asset pilot program allowing BTC, ETH, and USDC to be used as collateral

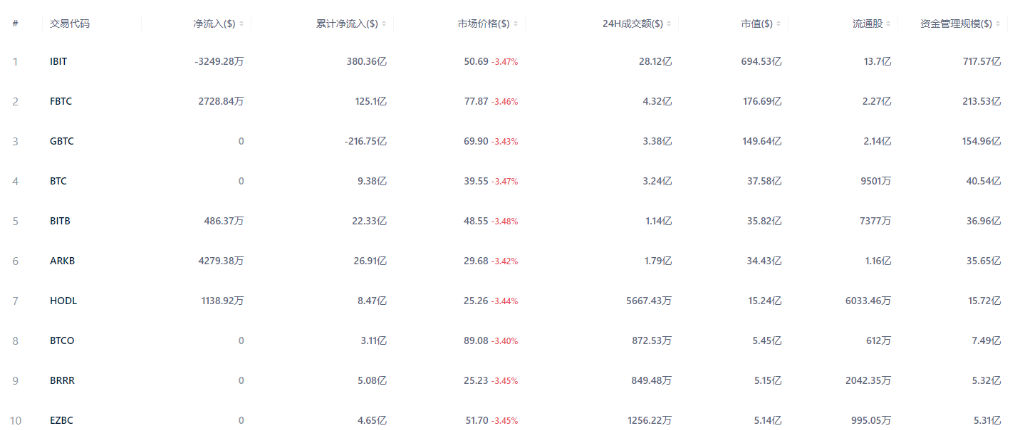

Spot Bitcoin ETFs Stumble: $60.5 Million Flees in Sharp Reversal

BitcoinWorld·2025/12/09 05:27

US Spot ETH ETFs Surge Back with $35.5 Million Inflow Reversal

BitcoinWorld·2025/12/09 05:27

MetaMask Unleashes Game-Changing Perpetual Futures Trading on Mobile

BitcoinWorld·2025/12/09 05:27

Solana Validator Count Plummets: A Staggering 68% Drop Since 2023

BitcoinWorld·2025/12/09 05:27

Revealed: How Bitcoin Options Traders Are Betting on Explosive Long-Term Volatility

BitcoinWorld·2025/12/09 05:27

Morning Brief | Nasdaq NCT announces strategic acquisition of Starks Network; AllScale completes $5 million seed round financing; WET token public sale shares sold out instantly again

Overview of major market events on December 8th.

Chaincatcher·2025/12/09 03:38

Bitcoin's $100,000 Dream Shattered? Market Falls into Year-End Uncertainty

AICoin·2025/12/09 03:29

After a five-year exploration and a $1 billion valuation, why did it finally "give up"?

Bitpush·2025/12/09 03:22

Flash

- 06:29Barclays: The Federal Reserve is expected to cut interest rates by 25 basis points this week and make two more cuts next yearAccording to ChainCatcher, citing Golden Ten Data, Barclays expects that the Federal Reserve will lower interest rates by 25 basis points to a range of 3.5% - 3.75% at this week's policy meeting. The post-meeting statement may include hawkish language, suggesting a pause in rate cuts in January next year. The bank maintains its forecast for two 25 basis point rate cuts in March and June next year, and believes the new Summary of Economic Projections may show little change in economic forecasts. The dot plot is expected to reflect one rate cut each in 2026 and 2027, each by 25 basis points, and the median long-term interest rate forecast is expected to remain at 3%.

- 06:16Former Bitget Wallet founder reveals Bitget Wallet is raising funds at a $2 billion valuationAccording to ChainCatcher, 0xKevin, founder of UXUY and former founder of Bitget Wallet (formerly BitKeep), revealed on the X platform that Bitget Wallet is currently raising funds at a valuation of 2 billion USD. 0xKevin sent his best wishes regarding this matter and stated: "On-chain is no longer a paradise for geeks, but the main battlefield for stablecoins. The on-chain trading gateway is becoming the entry point for new finance. The competition for the next generation of on-chain trading gateways has just begun."

- 06:15Zcash proposes a dynamic fee mechanism to address network congestion and rising transaction costsChainCatcher news, according to CoinDesk, the Zcash core development team Shielded Labs has released a detailed proposal for a dynamic fee market, aiming to address network congestion and rising transaction costs. The proposal suggests adopting a dynamic pricing mechanism based on the median fee of the previous 50 blocks and opening a priority channel during periods of high demand. Currently, Zcash uses a static fee model, initially set at 10,000 zatoshi and later reduced to 1,000 zatoshi. Although the previous ZIP-317 proposal introduced a behavior-based charging method, it still maintained a predictable low-fee structure. With the recovery of ZEC price, an increase in retail users, and growing institutional interest, developers believe the current fee model is no longer sustainable. The new proposal will be implemented in phases, starting with off-chain monitoring, then as a wallet strategy, and finally as a consensus change after approval. This mechanism avoids the complexity of EIP-1559 while maintaining Zcash's privacy features. Risk Warning

News

![[Bitpush Daily News Highlights] Strategy increases holdings by another 10,624 bitcoin, bringing total holdings to 660,624; BitMine added 138,452 ETH last week, Tom Lee is optimistic about Ethereum strengthening in the coming months; US CFTC approves Ethereum, Bitcoin, and USDC as collateral for derivatives markets.](https://img.bgstatic.com/multiLang/image/social/7e5c26545777dcf500ecdd4ceb4b3f701765168389911.png)