Can IREN Stock Price Hit New Highs? AI Cloud Surge Explained

What happens when one of the world’s major Bitcoin miners pivots away from its original sector and places a bold bet on the future of artificial intelligence? That’s the reality for Iris Energy Ltd. (NASDAQ: IREN), an Australia-based company known for its substantial operations in green Bitcoin mining. Founded in 2018, IREN has spent recent years rapidly rebranding itself as a next-generation operator in data centers tailored for AI and high-performance computing (HPC), leveraging vertical integration and renewable-energy-driven infrastructure.

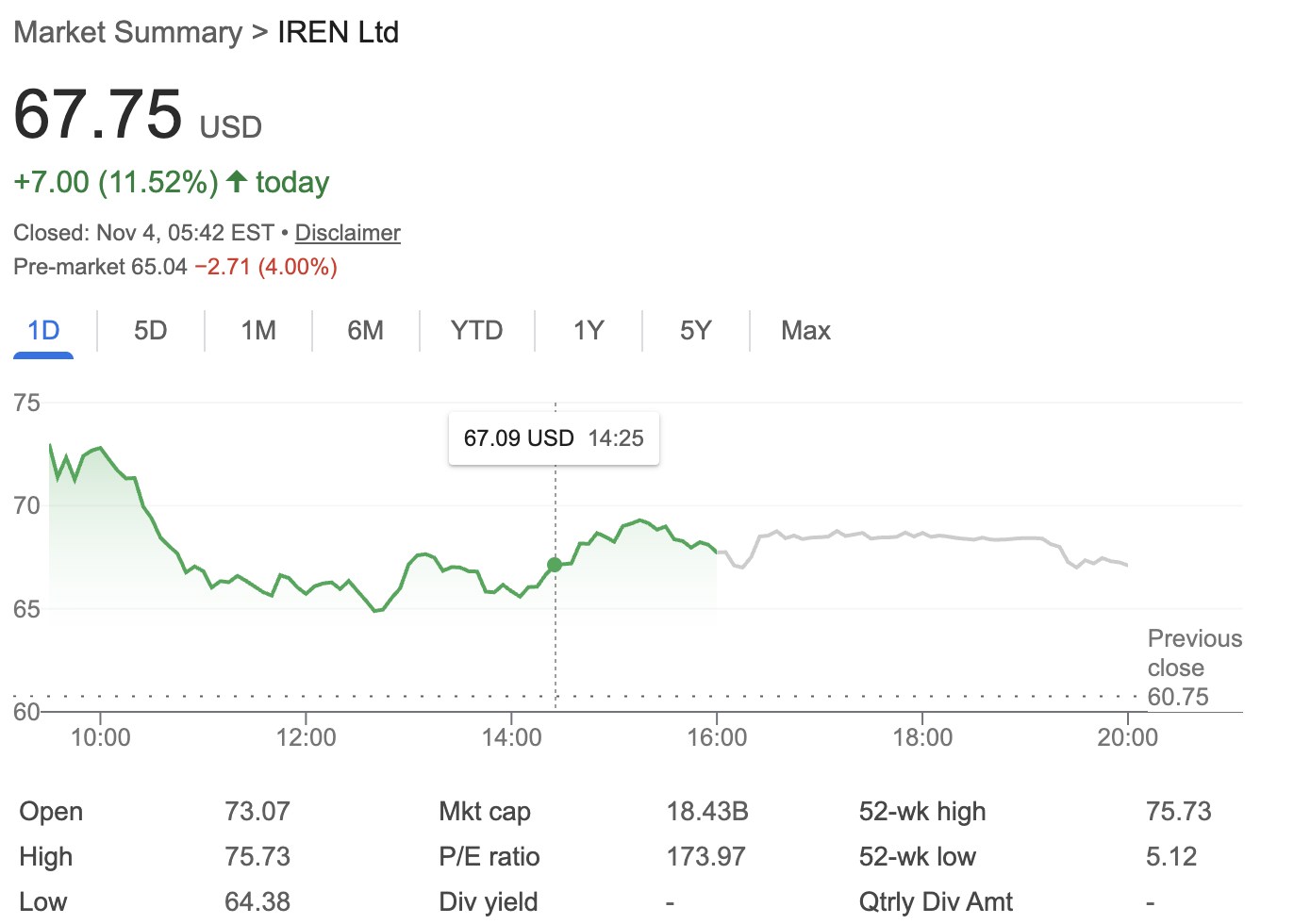

Investors are taking notice. With shares having surged over 500% in 2025 and analyst targets climbing as high as $82, IREN’s trajectory epitomizes the growing convergence of crypto-mining assets and AI infrastructure demand. This article offers an in-depth look at IREN’s strategic transformation, an analysis of its share performance following major business decisions like its Microsoft partnership, its current business model, Wall Street’s forecasts, and the broader context of the booming AI cloud sector.

Source: Google Finance

The Deal with Microsoft

A landmark moment for IREN—and one that immediately rippled across markets—arrived when Microsoft signed a $9.7 billion, five-year agreement with Iris Energy. This deal gives Microsoft priority access to advanced Nvidia AI chips housed at IREN’s major data centers, most notably at Sweetwater, Texas, and through a $5.8 billion hardware partnership with Dell.

The agreement’s direct impact was immediate and dramatic: IREN stock jumped as much as 24.7% to a record high during pre-market, and trading volume soared. The deal forms part of Microsoft’s broader AI infrastructure push—which has also included multi-billion-dollar contracts with other data center companies such as Lambda and Nebius. For IREN, being chosen by Microsoft is a clear validation of its pivot from Bitcoin mining to high-value, AI-centric cloud hosting.

IREN Stock Price Performance After Strategic Moves

IREN’s share price has closely tracked its strategic evolution, marking volatility and sharp rallies in response to each major decision:

-

Microsoft Partnership: After the deal, IREN’s share price surged by more than 20% in pre-market action, settling near $73, up from $17 just a few months prior. This rally marked a staggering 530% gain over six months, with the company’s market cap exceeding $16.5 billion.

-

AI Expansion Announcements: When announcing its $674 million GPU procurement—expanding its AI cloud to roughly 23,000 GPUs from Nvidia and AMD—Iren’s stock leapt 16.6% in one day, with annualized run-rate revenue from this segment guided above $500 million.

-

Analyst Upgrades: Analyst enthusiasm has also driven price jumps. Bernstein tripled its price target to $75, while Arete Research set theirs at $78, both crediting IREN’s unique vertical integration and liquidity to rapidly scale AI cloud infrastructure.

-

Mixed Wall Street Views: Not all reactions have been bullish. On news of rapid gains and capex commitments, JPMorgan downgraded IREN to “Underweight” with a $24 target, arguing the stock was pricing in an extremely optimistic infrastructure buildout that could expose IREN to execution risk and massive capital outlays.

The stock’s rapid ascent underscores both Wall Street’s conviction in its new business model and the sector’s inherent volatility.

IREN’s Business: From Bitcoin Mining to AI Cloud

IREN built its reputation as a sustainability-focused Bitcoin miner, controlling its own land, renewable power contracts, and self-built data centers—a vertically integrated model rare in the sector. In FY2025, this structure helped the company deliver $501 million in revenue (up 168% YoY) and $86.9 million in net income, despite the sector-wide pressures caused by crypto market fluctuations and Bitcoin’s halving cycles.

The real paradigm shift, however, is IREN’s aggressive entry into AI hosting:

-

The company doubled down on GPUs, completing procurement of over 23,000 chips and developing a 75MW liquid-cooled hyperscale data center in Texas aimed directly at serving AI and high-performance computing loads.

-

Revenue projections for AI cloud have now reached $500 million annualized, targeted for late 2025 or early 2026.

-

With ownership of land, power, and digital infrastructure, IREN can “toggle” its resources between crypto and AI, maximizing per-megawatt economic yield. AI hosting brings in $10 million+ per MW, compared to $2 million for traditional colocation.

-

The company’s focus on renewable energy aligns with trends in ESG investing and regulatory scrutiny, raising its appeal for AI clients under Europe’s Corporate Sustainability Reporting Directive.

The transition addresses two key industry risks: the downturns in cryptocurrency pricing and the halving of mining rewards, while capitalizing on the global race for GPU-based computational power.

IREN Stock Price Prediction by Wall Street

Opinions among analysts are divided but generally optimistic:

-

Bullish Targets: Bernstein raised its target to $75, forecasting exponential revenue growth from scaled AI cloud deployment. Arete Research initiated at $78. Roth Capital/MKM put the figure as high as $82 by projecting $2.7 billion in revenue and $1.2 billion EBITDA by FY2028.

-

Moderate/Neutral: Compass Point took a midline with a $50 target, citing strong economics but also elevated capex requirements.

-

Bearish Skepticism: JPMorgan notably downgraded IREN, warning that growth targets may be overheated and the stock already prices in a >1GW build—an investment that could run up to $10 billion in capital costs. Questions remain about the company achieving its own AI revenue guidance, given modest recent contributions ($2.7 million in Q2 FY25 from AI cloud).

The consensus, per MarketBeat, stands at a moderate “Buy” with a 12-month average target of $47.73, but there are significant outliers predicated on execution risk and sector volatility.

Why Is the AI Cloud Stock Sector Surging?

Several converging trends explain why companies like IREN—and stocks in the broader AI cloud sector—are soaring:

-

Booming AI Demand: AI workloads, generative models (such as ChatGPT), and advanced LLMs require exponentially more GPU-accelerated infrastructure than legacy workloads. Major tech firms often face compute shortages, limiting their ability to ramp AI services for customers and themselves.

-

Big Tech Spending Boom: Microsoft, Amazon, and Google are pouring tens of billions into data center expansion and “neocloud” partnerships. Notably, Microsoft inked a combined $33 billion in new partnerships for AI capacity, including $19.4 billion with Nebius (100,000 NVidia GB300 GPUs) and a multi-billion-dollar arrangement with IREN.

-

Capital Market Fervor: Analysts and institutional investors recognize that data center real estate, now tailored for AI, is potentially far more valuable than traditional colocation or even Bitcoin mining. Ownership of land, power, and next-generation GPUs is now considered a prime asset.

-

Flexible Infrastructure: IREN and peers can direct resources between mining and AI based on current economics—a strategic flexibility not available to less vertically integrated competitors.

Conclusion

IREN’s strategic pivot—from renewable-powered Bitcoin mining to vertically integrated AI data centers—crystallizes the changing landscape of digital infrastructure. Its historic Microsoft deal cements its role as a cornerstone supplier of next-gen AI computing power. The share price has responded accordingly, soaring to historic highs alongside growing analyst enthusiasm.

Yet, investors should note the risks: execution challenges, intense capital requirements, supply chain uncertainty for leading-edge GPUs, and fierce competition from established industry giants.

In sum, IREN is now at the heart of two revolutions—crypto mining and AI cloud infrastructure. If IREN continues to deliver on its bold promises, today’s aggressive price targets may yet prove conservative.

Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.