NVIDIA Stock Analysis: Institutional Sell-off, Q3 Earnings Preview, and Future Growth Outlook

This November, the spotlight will be squarely on NVIDIA stock as the company unveils its highly anticipated third-quarter earnings report. For months, NVIDIA has been the star of the AI investment rush, with its share price and market value repeatedly smashing records. But as the earnings date approaches, the mood in the market has grown far less certain. While many analysts still predict blockbuster numbers and continued growth, some of NVIDIA’s biggest institutional shareholders are quietly heading for the exits. This article offers a complete analysis of the key earnings metrics, recent major investor moves, potential risks, and the factors shaping NVIDIA stock’s future outlook.

NVIDIA’s Q3 Earnings Report: What Should Investors Watch?

The third-quarter earnings report for NVIDIA stock is crucial for several reasons, with both the market and analysts focusing on the following areas:

-

Record Data Center Growth Expected: NVIDIA’s Data Center division continues to deliver standout performance, powered by insatiable AI demand.

-

Earnings and Revenue Estimates: FactSet’s consensus projects NVIDIA stock to deliver an adjusted EPS of $1.23 and revenues of $54.83 billion.

-

Positive Guidance Hopes: Analysts believe NVIDIA stock will benefit from a robust backlog and pipeline, particularly with upcoming top-tier chips such as the Blackwell series and Vera Rubin.

-

Supply and Demand Dynamics: Suppliers like Quanta expect ongoing supply constraints and order demand into 2027, highlighting AI server demand supporting NVIDIA stock for years to come.

However, it’s important to note that despite these strong fundamentals, a wave of institutional selling has called the near-term upside—and risks—of NVIDIA stock into question.

Institutional Sell-off: From Peter Thiel to Bridgewater and SoftBank

Massive Portfolio Moves Amid Historic Valuations

-

Peter Thiel’s Thiel Macro LLC: In Q3, the billionaire investor’s fund liquidated all 537,742 NVIDIA shares, representing about 40% of its previous portfolio weight. Simultaneously, it cut its total US stock holdings by two-thirds, from $212 million to $74 million, and reallocated capital into Microsoft and Apple. Thiel also sold the fund's entire holding in Vistra Energy and pared its exposure to Tesla by 76%.

-

Bridgewater Associates: The world’s largest hedge fund, led by Ray Dalio, slashed its NVIDIA holdings by 65%. This came immediately after Bridgewater had significantly increased its NVDA position in Q2, illustrating a dramatic strategic pivot from momentum-chasing to explicit risk management.

-

SoftBank: Disclosed a full exit from NVIDIA, continuing a trend to rotate out of the AI sector.

-

These sales happened just as NVIDIA’s market cap breached $5 trillion—a symbolic level that some compare to the excesses seen at the peak of the industry bubble.

Why the Sudden Turn?

While these funds acknowledge NVIDIA’s leadership in AI chips and hardware, their actions suggest escalating concerns about valuation risk, market concentration, and the sustainability of the current AI “mania”—all in an environment of mounting macroeconomic and geopolitical uncertainty.

Is There Still Growth Ahead? Demand Fundamentals Remain Strong for NVIDIA Stock

Despite signs of a potential AI bubble, the demand driving NVIDIA stock continues to be robust:

-

Unprecedented Data Center and AI Demand: According to Morgan Stanley, Q3 saw client demand for NVIDIA stock-related products exceed already-aggressive forecasts, with hyperscaler capital expenditures for 2026 now projected at $1.42 trillion—a 60% rise in just one quarter.

-

AI Server Boom Through 2027: Suppliers such as Quanta anticipate doubling AI server output, confirming that demand for NVIDIA stock extends right into 2027.

-

New Chip Launches: The roll-out of the Blackwell series is expected to spur further sequential growth, strengthening NVIDIA stock’s leadership in AI hardware.

-

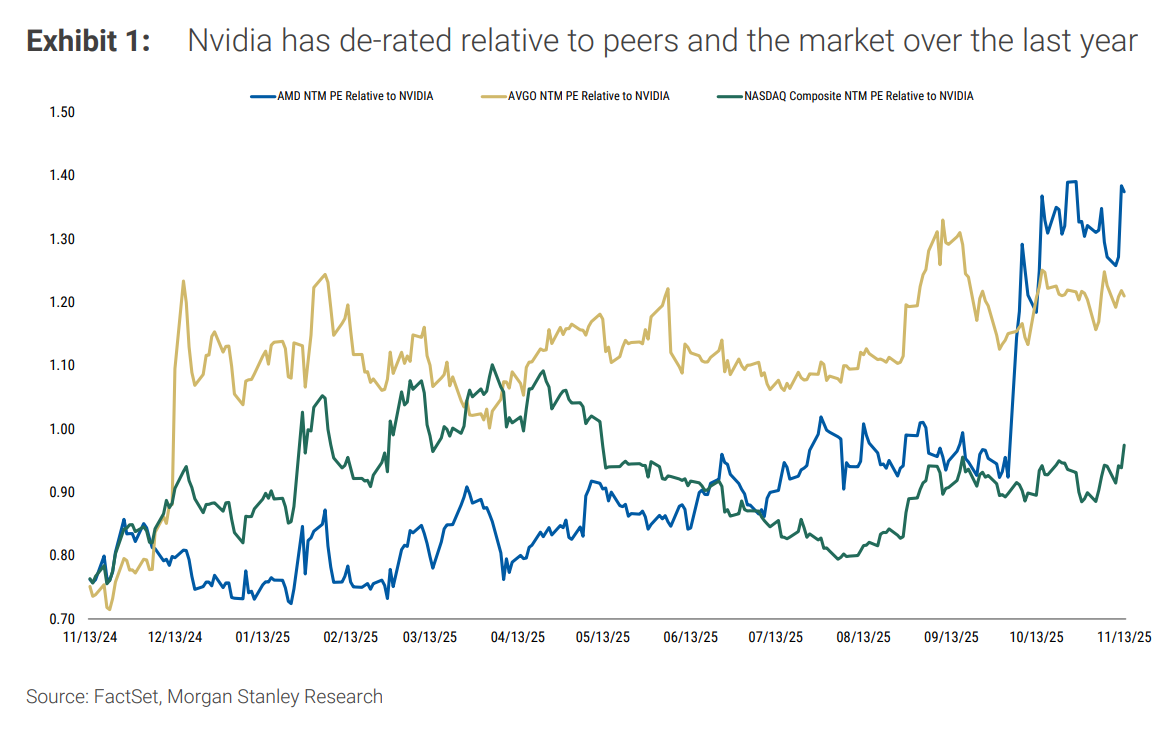

Upward-Revised Analyst Targets: Morgan Stanley now models $298.5 billion in revenues for FY2027 and non-GAAP EPS of $7.11. Price targets for NVIDIA stock currently range from $215 to $250, based on a forward price-to-earnings ratio of 25-26x for 2027, which is slightly discounted versus the previous two-year average but reflects moderated—but aggressive—growth.

What Are Analysts and Insiders Actually Saying?

Despite high-profile exits, Wall Street consensus remains bullish on the prospects for NVIDIA stock:

-

D.A. Davidson: Reiterated a buy rating with a $250 price target. Analyst Gil Luria reports no sign of weakening demand for NVIDIA stock products from hyperscale cloud providers or AI innovators.

-

J.P. Morgan: Maintains an overweight rating and a $215 target for NVIDIA stock, emphasizing upside surprises could again hinge on NVIDIA’s ability to unlock further supply chain expansion.

-

Risk-Adjusted Valuation: Even as institutional money reduces exposure to NVIDIA stock, target prices still assume above-average growth relative to semiconductor sector peers.

Where Is the Big Money Moving After Selling NVIDIA Stock?

Notably, major institutional investors aren’t leaving technology altogether. Instead, there’s a trend to rotate away from high-valuation names into more diversified, platform-oriented giants:

-

Thiel Macro LLC: After selling NVIDIA stock, Thiel’s fund opened major new positions in Microsoft (49,000 shares) and Apple (79,181 shares) while reducing Tesla exposure. This points to a strategy favoring steady cash flows, cloud leadership, and business diversification during uncertain times.

-

Bridgewater: Added to broad U.S. equity ETFs and trimmed emerging markets, reflecting a shift to safer, more liquid investments post-NVIDIA stock exit.

AI Bubble or Long-Term Innovation? What’s Next for NVIDIA Stock

NVIDIA stock’s meteoric rise and commanding position in U.S. market indices evoke memories of prior financial manias. However, unlike the previous cycle, NVIDIA’s earnings growth is grounded in real demand for AI hardware. Nevertheless, investors and industry thought leaders—including Jeff Bezos, Goldman Sachs’ David Solomon, and James Anderson—have flagged the risk of overexuberance in AI-related stocks.

As NVIDIA prepares to report record performance, its Q3 results could determine whether bullish analysts or cautious mega-funds are reading the market more accurately.

Conclusion: Is NVIDIA Stock Still a Buy?

As NVIDIA stock approaches another critical earnings milestone, the signal from institutional investors is mixed: fundamentals look strong, but a prudent reassessment of risk is underway. While analysts remain positive, heavy selling by top funds signals caution about chasing NVIDIA stock at all-time highs.

For now, NVIDIA stock remains at the center of the market debate—a company with unmatched growth and innovation, but facing rising scrutiny at today’s stratospheric valuations.

Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.