Novo Nordisk Stock Faces Major Setbacks: Weight-Loss Drug Price War, and Q4 Outlook

Novo Nordisk has long been recognized as a global pharmaceutical powerhouse, especially for its innovations in diabetes and obesity care. However, 2024-2025 has been a rollercoaster for Novo Nordisk stock investors. With significant swings triggered by clinical trial disappointments and shifting competitive dynamics, many investors are asking: What’s next for Novo Nordisk?

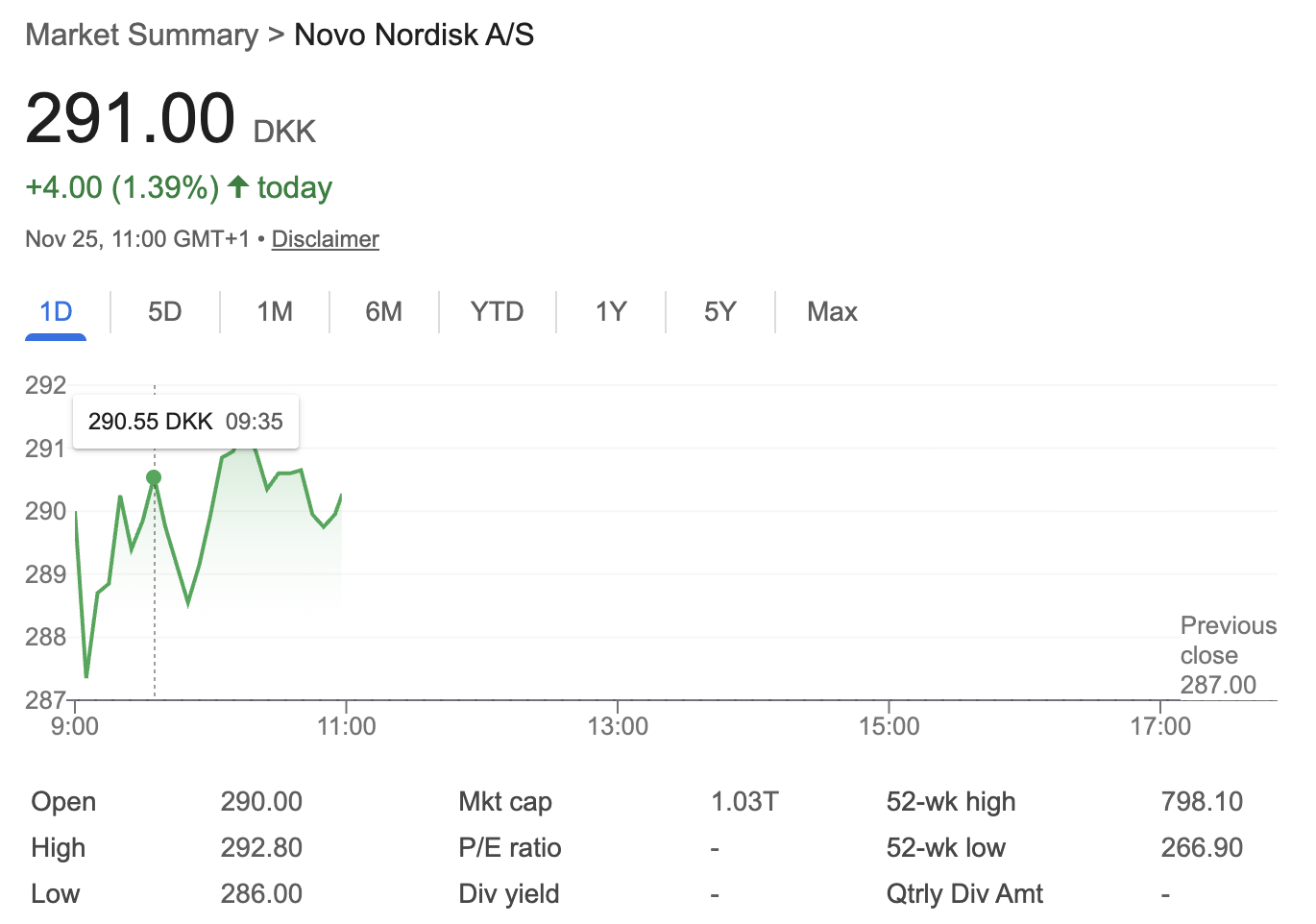

As of November 2025, Novo Nordisk stock hit its lowest value since July 2021, plunging more than 12% in a single day. Year-to-date, shares have dropped by over 50%. This dramatic slide is mainly attributed to the failed Alzheimer's clinical trials and intensifying market competition, especially with Eli Lilly.

Source: Google Finance

Breaking News: Oral Ozempic for Alzheimer’s Fails

A major setback for Novo Nordisk came when its oral Ozempic failed to slow cognitive decline in Alzheimer’s patients during two large-scale trials. Hopes were high that repurposing semaglutide (Ozempic/Wegovy) could open a new billion-dollar market. Instead, patients saw no meaningful cognitive improvement, prompting Novo Nordisk to immediately cancel its planned extended study.

This clinical blow wiped out significant value from Novo Nordisk stock. According to Morgan Stanley, had the trial succeeded, it could have added $5 billion in annual revenue for the company. Novo Nordisk acknowledged early on that treating Alzheimer’s was high-risk, but the rapid share price collapse highlighted investor sensitivity to pipeline news.

Competitors also reacted—Eli Lilly shares slipped, while Alzheimer's drug developer Biogen’s stock gained over 6%. This underscores the interconnectedness of the pharmaceutical sector and the immense market potential for successful new treatments.

Market Shake-Up: Weight-Loss Drug Price War and U.S. Agreement

The hottest battleground for Novo Nordisk is obesity medicine. The "weight-loss drug war" between Novo Nordisk and Eli Lilly just escalated, as both firms struck a deal with the U.S. government to radically lower prices for GLP-1 medications like Wegovy and Ozempic.

Starting 2026, under a plan revealed by former President Trump, Novo Nordisk drugs such as Wegovy will cost Medicare and Medicaid patients only $245/month, with a maximum out-of-pocket fee of $50. On TrumpRx.com, most doses of Wegovy are $350/month, on schedule to fall further. These price points, while aggressive, are not as low as many feared if government price negotiations had forced prices down to $150-200.

Leading analysts at Goldman Sachs interpret this deal as “price for volume.” Lower prices unlock tens of millions of government-insured patients, greatly boosting sales potential even as margins are pressured. Goldman Sachs holds firm on their forecast of a $95 billion global market for obesity drugs by 2030, with Novo Nordisk as one of the main players.

Competitive Pressure: Eli Lilly Takes the Lead

While both companies now reinforce their duopoly in the U.S. obesity drug market, the terms currently favor Eli Lilly. Lilly’s Zepbound is leading in both insurance (60% market share vs. Wegovy’s 40%) and cash-pay channels (a staggering 85% vs. Wegovy’s 15%). Lilly’s oral obesity drug could hit the market before Novo Nordisk’s thanks to a regulatory shortcut, potentially generating $1 billion in extra sales for 2026.

For Novo Nordisk, new pricing brings added challenges. The firm already faces revenue headwinds from international competition, Medicare negotiations, and future generic alternatives. The company anticipates that pricing changes will shave low-single-digit percentages off 2026 revenue—a tough pill to swallow on top of other mounting pressures.

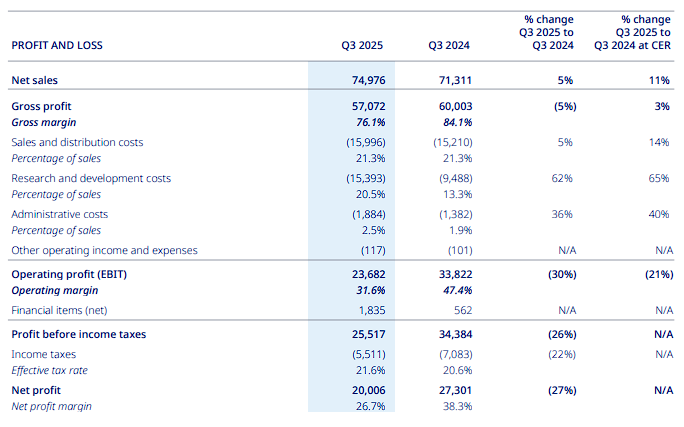

Q3 2025 Earnings: Growth Slows and Financial Pressure Rises

The latest earnings release underlines the shifting fortunes of Novo Nordisk. In the third quarter of 2025, sales increased just 5% to 75 billion Danish kroner ($11.7 billion USD), missing analyst targets. Net profit came in at DKK 20 billion, again falling short of expectations. Novo Nordisk’s operating profit margin slipped from 47.4% to just 31.6%, while R&D expenses surged 62%, showing the company’s commitment to developing new treatments but reflecting the cost of staying competitive.

Crucially, Novo Nordisk cut its full-year sales guidance for the fourth time in 2025, now expecting growth between 8% and 11%. This tightens the company’s outlook amid slowed Wegovy sales, stiffer competition, and overall market uncertainty.

Conclusion: What’s Next for Novo Nordisk Stock?

The future of Novo Nordisk stock will depend on several key factors: the company's ability to defend and grow its share in the lucrative obesity drug market, success in advancing its R&D pipeline, and strategies to weather future pricing and policy changes. While the failed Alzheimer’s trial is a setback, Novo Nordisk still benefits from its dominant position in diabetes and weight management drugs.

However, with Eli Lilly pressing its advantage and regulators pushing for lower drug prices, Novo Nordisk stock faces a challenging road ahead. Investors should watch closely for updates on new drug launches, pricing strategies, and future quarterly results to gauge the company's recovery and long-term prospects.