Why Strategy (MSTR) Stocks Are Falling Out of Favor With Big Investors

Strategy Inc. (Nasdaq: MSTR), formerly MicroStrategy, is learning the hard way that being a corporate bitcoin giant comes with unique risks — especially when big money starts walking away. In Q3 2025, major institutional investors, including BlackRock, Vanguard, and Fidelity dumped a combined $5.4 billion worth of MSTR stock. The move wasn’t triggered by a collapse in bitcoin itself, but by something deeper: a growing loss of confidence in Strategy’s role as a reliable crypto proxy, compounded by fears of index exclusion and structural vulnerabilities like dilution and leverage.

The stock — once prized for giving investors high-beta exposure to bitcoin — has fallen out of favor. It now trades at levels near its net asset value (NAV), signaling that the market sees it less as a software company and more as a complex, crypto-holding vehicle. With index providers raising red flags, and bitcoin ETFs offering cleaner access to digital assets, Strategy’s once-sparkling thesis has lost much of its shine in the eyes of large institutional holders.

Institutional Outflows: Big Money Heads for the Exit

In the third quarter of 2025, institutional sentiment toward Strategy Inc. decisively turned. According to 13F filings, BlackRock, Vanguard Group, and Fidelity offloaded nearly $5.4 billion worth of MSTR stock — a staggering pullback by three of the largest asset managers in the world.

This wasn’t simply a reaction to bitcoin price volatility. Instead, it reflected a fundamental shift in how large funds view the company. Once seen as a high-beta, equity-based bitcoin play, Strategy is now viewed by many as an overleveraged, diluted proxy for crypto exposure — one that’s more volatile and structurally risky than directly owning bitcoin or investing in a regulated ETF.

For institutional portfolios seeking clean, benchmark-compliant exposure, Strategy’s hybrid model no longer fits. With spot bitcoin ETFs and other crypto vehicles becoming widely available and more cost-efficient, there’s far less reason to hold a company whose primary function appears to be raising capital to buy bitcoin — especially when that comes with recurring equity dilution and growing index-inclusion uncertainty.

Index Pressure and S&P 500 Exclusion

One of the most pressing concerns weighing on Strategy Inc. stock is its standing with major index providers — and the consequences of potentially losing that inclusion.

Although Strategy met the technical requirements for S&P 500 inclusion earlier this year, the index committee passed on it. The reason? Despite its software roots, the company is now overwhelmingly perceived as a bitcoin holding vehicle. Analysts say that distinction likely disqualified it in the eyes of S&P Dow Jones Indices, which traditionally excludes closed-end funds and other non-operating entities.

But the bigger threat now comes from MSCI Inc., which is actively reviewing whether companies like Strategy — whose balance sheets are dominated by crypto assets — should remain in key equity benchmarks. A verdict is expected by January 15, 2026, and the implications are significant.

According to JPMorgan, if Strategy is removed from MSCI’s U.S. index, roughly $2.8 billion in passive fund assets would be forced to sell. If the Nasdaq-100 follows suit, that estimate jumps to nearly $9 billion. TD Cowen has issued similar warnings, citing the potential for mass rebalancing.

Such forced selling isn’t based on fundamentals — it’s mechanical. And that’s what has investors worried. When benchmarked funds are compelled to liquidate, it can send stocks into tailspins that have little to do with business performance. For a stock as volatile and sentiment-sensitive as MSTR, that kind of exodus could trigger a cascade.

Simply put: when you fall out of the index club, you fall hard.

Strategy’s Business Model and Identity Shift

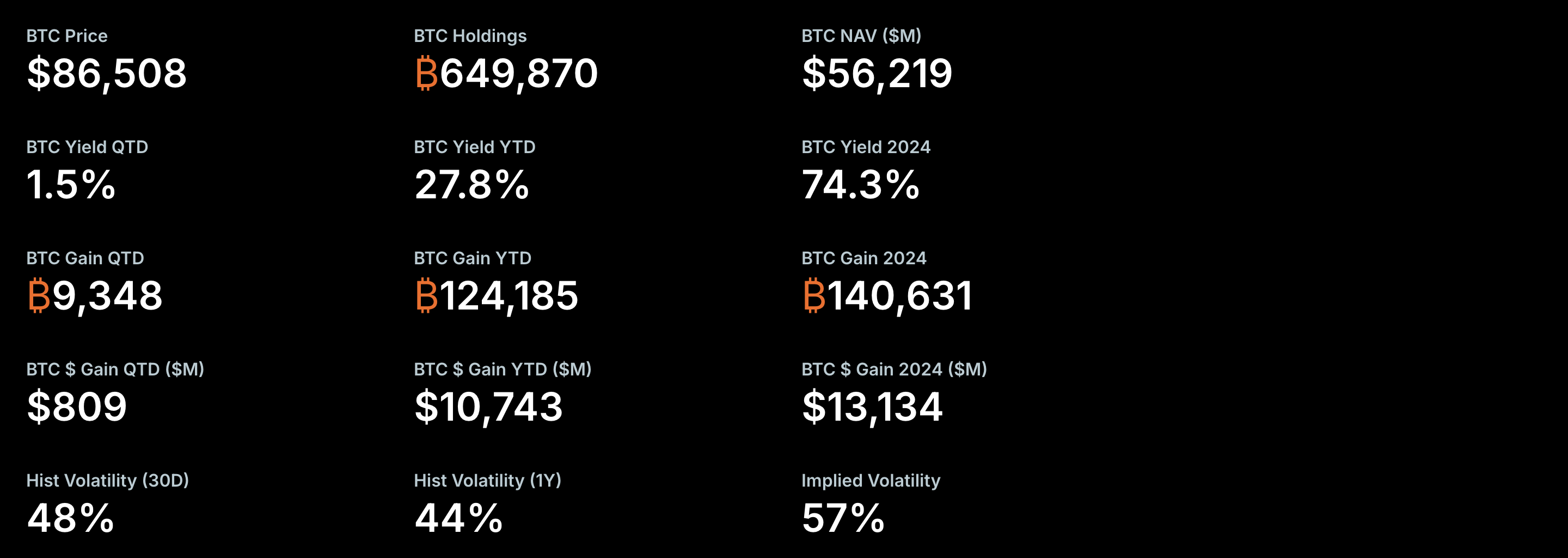

BTC Metrics of MicroStrategy

MicroStrategy’s rebrand to “Strategy Inc.” in early 2025 wasn’t just cosmetic — it cemented the company’s pivot away from enterprise software and toward becoming what CEO Michael Saylor calls the world’s first “Bitcoin Treasury Company.” With over 649,000 BTC on its balance sheet, valued at around $56–58 billion, Strategy controls more than 3% of the world’s bitcoin supply — a staggering figure compared to its sub-$1 billion software revenue.

While the move has generated headlines and applause from crypto maximalists, institutional investors see a different story: a public company acting more like a leveraged, perpetual bitcoin fund than a traditional operating business.

This identity shift has significant consequences. Benchmark index providers, rating agencies, and risk managers increasingly view Strategy not as a tech firm with bitcoin exposure, but as a single-asset, crypto-concentrated entity. That raises flags around corporate governance, risk management, and index eligibility.

For institutions governed by mandates around sector diversification, equity profile, or crypto exposure caps, Strategy’s structure is increasingly hard to justify. It doesn’t behave like a tech stock. It doesn’t scale like a SaaS firm. And it doesn’t provide the transparency or regulatory framework of a dedicated crypto fund.

Valuation Reset: Premium No More

At the peak of bitcoin euphoria, Strategy Inc. traded at a hefty premium to its net asset value (NAV) — with investors willing to pay 2× or even 2.5× more than the dollar value of its bitcoin holdings, thanks to the perceived upside of its software business and its aggressive crypto strategy.

But by late 2025, that premium has effectively vanished.

Today, MSTR trades at roughly 1.1× NAV, meaning its stock price barely exceeds the book value of the bitcoin it holds. The company’s software operations — once a core value driver — now appear to carry little weight in the eyes of the market. The message is clear: investors no longer see a compelling operating story or growth narrative beyond bitcoin itself.

This flattening of valuation reflects not only market skepticism, but also a broader shift in how Strategy is benchmarked. Rather than being evaluated like a growth stock, it's now priced like a bitcoin trust, and a volatile one at that — with additional risks stemming from leverage, dilution, and liquidity constraints.

Without a premium, the stock’s margin of safety has eroded. And for institutional investors accustomed to risk-adjusted alpha, holding a company that simply mirrors the value of its bitcoin stash — without a regulatory fund structure — is becoming increasingly difficult to justify.

Leverage and Dilution Risk

Strategy Inc.’s capital-raising model — built on issuing over $20 billion in convertible debt and equity since 2020 — is wearing thin with institutional investors. While it fueled the company’s massive bitcoin buying spree, it also led to significant shareholder dilution and added long-term liabilities through zero- and low-coupon bonds.

In late November 2025, the company paused its weekly equity sales for the first time in six weeks. TD Cowen noted that Strategy didn’t issue any new stock or buy additional bitcoin during the period — a move likely tied to the fact that its market cap had fallen close to, or below, the value of its BTC holdings. At those levels, issuing new shares risks destroying value rather than creating it.

That pause signals growing limitations in Strategy’s funding playbook. With dilution concerns rising and the stock trading near net asset value, big investors are increasingly uneasy about the sustainability of a business model so tightly bound to capital markets — especially one that depends on bitcoin holding its ground.

Bitcoin’s Role in MSTR’s Decline

Strategy Inc (MSTR) Stock Price

Source: Yahoo Finance

Despite all the structural and strategic concerns, one undeniable reality remains: Strategy Inc. still moves with Bitcoin. When BTC rallies, MSTR tends to follow. But when crypto stumbles, the stock often suffers even more — and that’s exactly what’s happened in recent weeks.

From early October to late November 2025, Bitcoin dropped from over $126,000 to the mid-$80,000s, a decline of roughly 30%. MSTR, in response, plunged about 38% during the same period — a sharper correction that reflects both its tight correlation to BTC and the leverage embedded in its balance sheet. For investors, this amplifies the risk-reward tradeoff: MSTR doesn’t just track Bitcoin — it magnifies its moves, for better or worse.

The bigger issue is that institutions now have cleaner options. With regulated spot Bitcoin ETFs widely available, many funds see little reason to hold a volatile equity proxy that carries corporate risk, dilution, and debt on top of crypto exposure. As one analyst put it: “If you want Bitcoin, buy Bitcoin. You don’t need to wrap it in a leveraged public company anymore.”

Investor Watchlist: What Comes Next

For investors still watching Strategy Inc. from the sidelines — or considering whether the sell-off has gone too far — several key events could shape the stock’s next chapter.

1. MSCI’s index decision (January 15, 2026)

MSCI is expected to rule on whether Strategy’s crypto-heavy profile disqualifies it from major benchmarks. JPMorgan estimates up to $2.8 billion in forced selling if it’s removed from the MSCI USA Index — and up to $9 billion if the Nasdaq-100 follows. This could significantly pressure the stock, regardless of fundamentals.

2. Bitcoin price stability

MSTR remains tightly tethered to Bitcoin’s trajectory. A sustained recovery above $90,000 could help restore some confidence, while a break below the low-$80,000s may deepen outflows and valuation stress.

3. Capital-raising behavior

Will Strategy resume issuing shares or debt to keep buying Bitcoin? A return to dilution-heavy funding could drag the stock further. Conversely, if management halts capital raises due to market conditions, it could signal a more shareholder-friendly phase.

4. Institutional positioning

More 13F filings and fund updates will reveal whether major investors continue cutting exposure — or begin bottom-fishing. So far, the trend remains clearly in retreat.

Conclusion

Strategy Inc. was once the poster child for bold corporate Bitcoin exposure — a hybrid of software ambition and crypto conviction that gave institutional investors a high-octane way to ride the digital asset wave. But that pitch has unraveled. With mounting dilution, growing index exclusion risk, and a funding model tightly linked to volatile markets, the stock has lost much of its premium appeal. MSTR now trades close to its net asset value, a signal that investors see it less as an innovator and more as a proxy with baggage.

As cleaner vehicles like spot Bitcoin ETFs enter the mainstream, big funds are rethinking the need to own a leveraged, crypto-centric public company. Whether Strategy adapts or continues its aggressive path, the market is clearly recalibrating — and institutions are opting out. For now, the trade that once sparkled with upside is dimmed by structural doubts.

Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.