Campbell Soup Scandal Shakes Investor Confidence: What It Means for Campbell Soup Stock’s Outlook

In recent weeks, Campbell Soup—a household name best known for its iconic red-and-white canned goods—has found itself at the center of a brewing controversy that is rattling investor confidence and raising tough questions about the brand’s future. News broke in late November 2025 that a senior Campbell Soup executive allegedly made offensive comments about both the company’s products and employees, resulting in a high-profile lawsuit. As the scandal unfolds and negative headlines mount, Campbell Soup stock has come under fresh pressure, with share prices lagging and analyst outlooks turning cautious.

In this article, we break down the Campbell Soup legal controversy from the ground up, analyze the latest financial results, and provide a Campbell Soup stock forecast based on mounting internal and external headwinds. If you’re considering an investment in Campbell Soup stock or simply want to understand how corporate scandals can impact major U.S. brands, read on for everything you need to know.

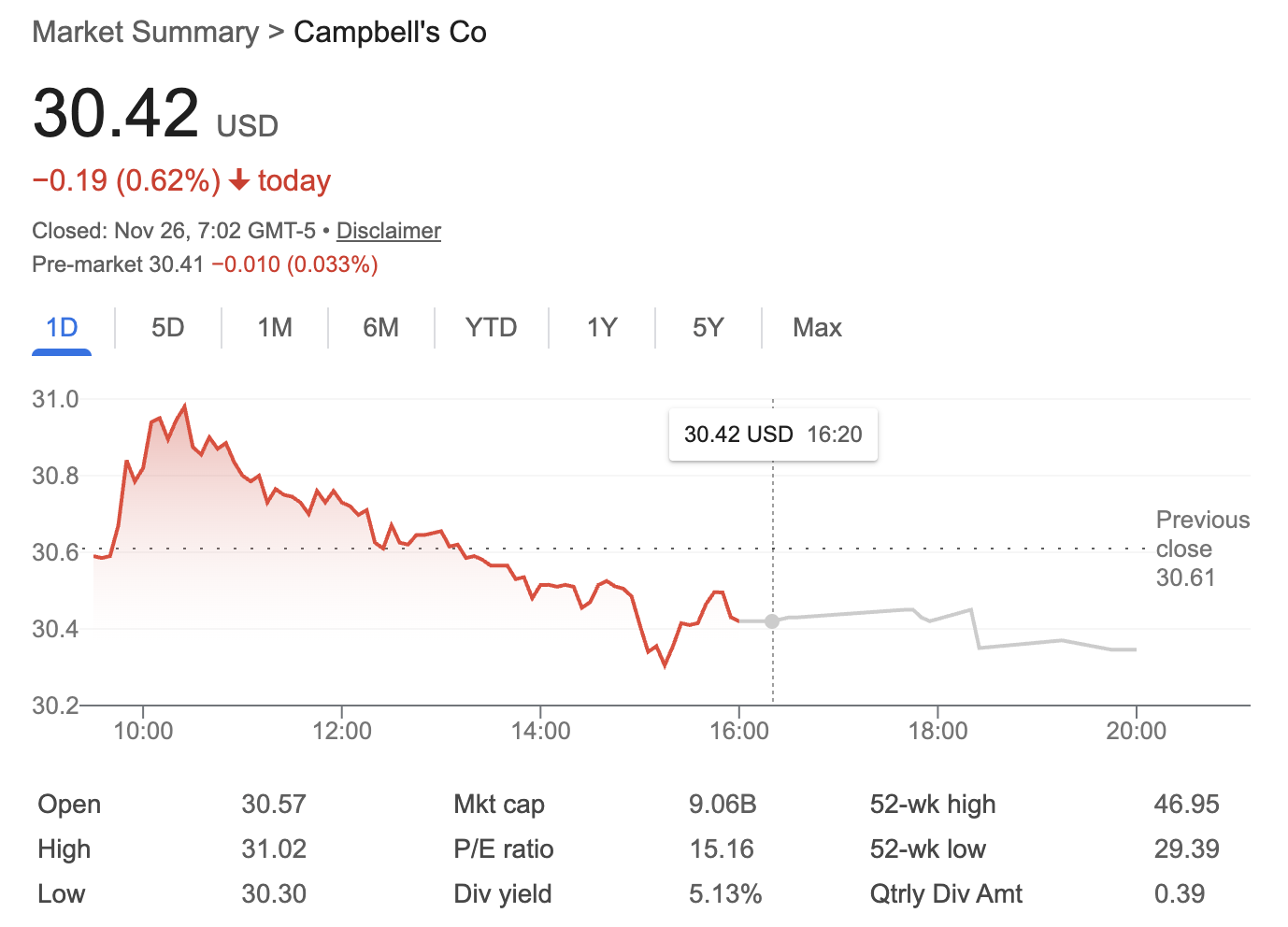

Source: Google Finance

What’s Behind the Headlines? Exploring the Campbell Soup Scandal

What Sparked the Campbell Soup Lawsuit?

The current legal troubles for Campbell Soup began when Robert Garza, a former IT security analyst, filed a lawsuit alleging workplace discrimination and retaliation. According to reports, Garza recorded Campbell Soup’s Vice President and Chief Information Security Officer, Martin Bally, making derogatory statements—including claims that Campbell Soup’s products were only fit for “poor people” and racially charged remarks about Indian colleagues. The lawsuit further alleges that Campbell Soup terminated Garza’s employment shortly after he reported this misconduct, making it a case study in whistleblower retaliation.

Why Are Campbell Soup’s Leadership Actions Under Scrutiny?

The fallout from the recording led to an immediate investigation, with Campbell Soup placing the executive on leave. The company publicly stated that, if the recording is authentic, it does not reflect Campbell Soup’s culture—a move seen as an effort to contain reputational damage. Nevertheless, the scandal has already raised questions about executive accountability, workplace inclusivity, and how a legacy brand like Campbell Soup addresses potential misconduct at the highest levels.

What’s Impacting Campbell Soup Stock Performance?

Decline in Snack Sales Weighs on Campbell Soup Stock

While the Campbell Soup scandal dominates headlines, other challenges are fueling bearish sentiment surrounding Campbell Soup stock. Weak demand for the company’s popular snack brands, such as Goldfish crackers and Snyder’s of Hanover pretzels, has triggered several downward revisions to its earnings forecasts. In fiscal 2025, Campbell Soup reported that net Snack segment sales dropped by 6% year over year, causing total operating earnings for Snacks to fall by nearly 30%. This slowdown comes as intense competition from private labels puts further pressure on Campbell Soup’s market share.

Tariffs and Inflation Add to Campbell Soup’s Margin Pressure

Campbell Soup is also grappling with higher production costs due to tariffs on imported goods and relentless inflation, both of which are making it harder to protect profit margins. Management has flagged expectations for input tariffs to comprise as much as 4% of its cost of goods sold. As a result, adjusted earnings per share for Campbell Soup have been revised downward, with guidance now between $2.95 and $3.05—lower than the previous forecast and well below earlier analyst expectations.

Campbell Soup Stock Forecast: Consensus Remains Cautious

Analyst Reactions to the Campbell Soup Scandal and Weak Earnings

Campbell Soup stock is currently trading near $30, down sharply from its 52-week high. In recent months, analysts have responded to the unfolding scandal and operational struggles with a wave of cautious reports. Barclays slashed its Campbell Soup stock price target to $35. UBS lowered its target to $30, maintaining a negative outlook citing “challenging fundamentals” for Campbell Soup. CFRA, while slightly more optimistic, set a $37 price target but stopped short of upgrading Campbell Soup stock.

With Campbell Soup’s management now expecting net sales growth of just 6%-8% for the year—and further legal and reputational risks ahead—most analysts believe Campbell Soup stock faces continued headwinds.

What Investors Need to Watch Next

For investors considering Campbell Soup stock, the stakes have never been higher. The Campbell Soup scandal could have long-lasting effects on investor trust and brand reputation, while sluggish sales in the core Snacks division and external cost pressures threaten ongoing profitability. Key factors to watch include updates from the legal proceedings, further reductions in guidance, and the company’s ability to repair both its workplace culture and market position.

Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.