Netflix Stock Forecast 2026: Analysis After the 2025 Stock Split

Netflix (NASDAQ: NFLX) remains one of the most closely-watched stocks among retail and institutional investors. In November 2025, the streaming giant announced a major 10-for-1 stock split, reshaping its price per share and widening accessibility for individual investors. With this pivotal shift, many are now asking: where is Netflix stock headed in 2026? This comprehensive guide provides a detailed outlook on the 2025 Netflix stock split, summarizes the latest business performance, and shares consensus price forecasts and what could drive the stock higher or lower in 2026.

Source: Google Finance

What Was the Netflix 2025 Stock Split? Key Dates and Insights

Why Did Netflix Split Its Stock in 2025?

On October 30, 2025, Netflix revealed a 10-for-1 forward stock split. Every shareholder of record as of November 10 received nine additional shares for each share owned, and trading began on a post-split basis on November 17, 2025. This move lowered the stock price from around $1,100 to roughly $110 per share, aiming to make shares more attractive to retail investors and employees.

Key Netflix Stock Split Dates:

-

Stock Split Announcement: October 30, 2025

-

Shareholder Record Date: November 10, 2025

-

Distribution Date: November 14, 2025

-

First Day Trading Post-Split: November 17, 2025

A stock split does not change Netflix’s market capitalization or underlying value. Instead, it increases the number of outstanding shares while reducing the price per share, boosting liquidity and enabling easier entry for small investors.

Netflix Business Performance: Q3 2025 Review & Latest Trends

Revenue & Earnings Snapshot

Netflix delivered strong financial performance going into 2026:

-

Q2 2025 Revenue: $11.08 billion (up ~16% YoY)

-

Q3 2025 Revenue: $11.51 billion (up 17% YoY)

-

Net Income (Q2): $3.13 billion

-

Operating Margin (Q3): 28% (temporarily impacted by a one-time $619M Brazilian tax expense)

-

Full-Year 2025 Revenue Guidance: $44.8–$45.2 billion (+15–16%)

-

Free Cash Flow Guidance: About $9 billion for 2025 (raised from previous $8-8.5B estimate)

Growth Catalysts: Ad-Supported Tiers and Content Strategy

A major theme for Netflix’s future is the rapid rise of the ad-supported plan, now estimated to reach 190 million monthly active viewers globally. According to eMarketer, Netflix earns an average of $43.29 per month per ad-tier user—far above the $10.50 per ad-free user, blending subscription and advertising revenues.

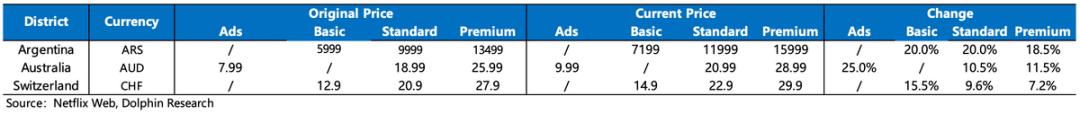

Increased pricing for ad-free tiers in major markets and upcoming blockbuster content (such as new seasons of hit series) are aimed at sustaining subscriber growth and strengthening margins, despite rising competition from Disney+, Amazon, and other platforms.

Netflix Stock Forecast 2026: Target Price Expectations & Analyst Ratings

Consensus Price Targets for Netflix in 2026

Where do experts predict Netflix stock will trade post-split in the next year? Here’s what major market data providers say:

-

MarketBeat: $133.90 average target (45 analysts) – about 24% upside from $107.58

-

Investing.com: $134.44 average from 44 analysts

-

StockAnalysis.com: $134.09 average; $140 median target

-

Wall Street Journal & MarketWatch: $139 median, high of $160, low near $95

Optimistic forecasts from certain analysts reach as high as $150–$160 per share. On the other end, conservative estimates are in the $70–$95 zone, reflecting ongoing uncertainty and sector competition.

Analyst Ratings & Market Sentiment

-

General Consensus: "Moderate Buy" or “Outperform”

-

MarketBeat: 30 Buy, 2 Strong Buy, 12 Hold, 1 Sell

-

TipRanks average: $139.13

-

Bullish Outlooks: Rosenblatt Securities – $152 target price (+40%)

What’s Driving Price Targets?

-

Key Bullish Factors: Double-digit ad revenue growth, robust cash flows, new content pipeline, and aggressive international expansion.

-

Risks: Stiffening competition, saturation in mature markets, and high valuation multiples (currently around 35x forward earnings).

Is Netflix Stock a Good Buy After the Split? Insider Trading Activity and Netflix Stock Valuation

Recent insider trading reports over the past six months reveal that there have been no purchases of Netflix stock by insiders; instead, all 274 reported insider transactions were sales. This pattern primarily reflects profit-taking by top Netflix executives at or near historic high prices rather than indicating a lack of confidence in the company’s long-term prospects. Such insider sales are common after significant stock appreciation, especially following high-profile events like stock splits when liquidity and attention are elevated. While insider selling can sometimes be interpreted as a cautionary sign, in this context it is seen largely as executives monetizing part of their holdings after a prolonged period of strong stock performance.

From a valuation perspective, it is important to highlight that stock splits, such as Netflix’s recent 10-for-1 split, do not alter a company's intrinsic value or underlying business fundamentals. Instead, a stock split serves to increase the number of shares outstanding and reduce the price per share, which can make the stock more accessible to a wider range of investors and often leads to increased trading volume and liquidity.

Despite trading at premium valuations—with forward price-to-earnings multiples hovering around 35x—Netflix continues to justify market optimism due to its projected 15% to 17% annual revenue growth and strong momentum in advertising monetization. However, prospective investors should be aware that, while the company is well-positioned for further expansion, there remain inherent risks. If Netflix’s future earnings growth falls short of current expectations, the stock could be vulnerable to valuation corrections or heightened volatility, especially given the intense competition in the streaming and digital media landscape.

Conclusion: Netflix Stock Outlook for 2026

Following its 10-for-1 split, Netflix shares are more accessible and remain a magnet for investors seeking exposure to leading media and entertainment technology. While 2025’s tax-related earnings miss was a temporary headwind, the company’s strong ad revenue trajectory, global content dominance, and robust cash flow profile are fueling positive Wall Street forecasts. Most analysts project 20–30% potential upside by late 2026, with targets largely clustered around $135–$140 per share. Investors, however, should remain cautious of valuation risks and sector competition in their decision-making process.

Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.