Tesla Stock Outlook: Elon Musk’s $1 Trillion Pay Plan and AI Chip Fab Strategy

Tesla’s annual shareholder meeting made headlines by approving a record-breaking compensation package for CEO Elon Musk, while also outlining a bold new chapter for Tesla’s ambitions in artificial intelligence and chip manufacturing.

In this article, we explore the latest developments in Tesla stock as of November 2025, including Elon Musk’s unprecedented $1 trillion pay package, Tesla’s bold plans to build its own AI chip manufacturing facility, and how these major moves could impact the company’s future growth and stock performance. Whether you’re an investor or a Tesla enthusiast, this guide will help you understand the key strategies, opportunities, and risks shaping Tesla’s next chapter.

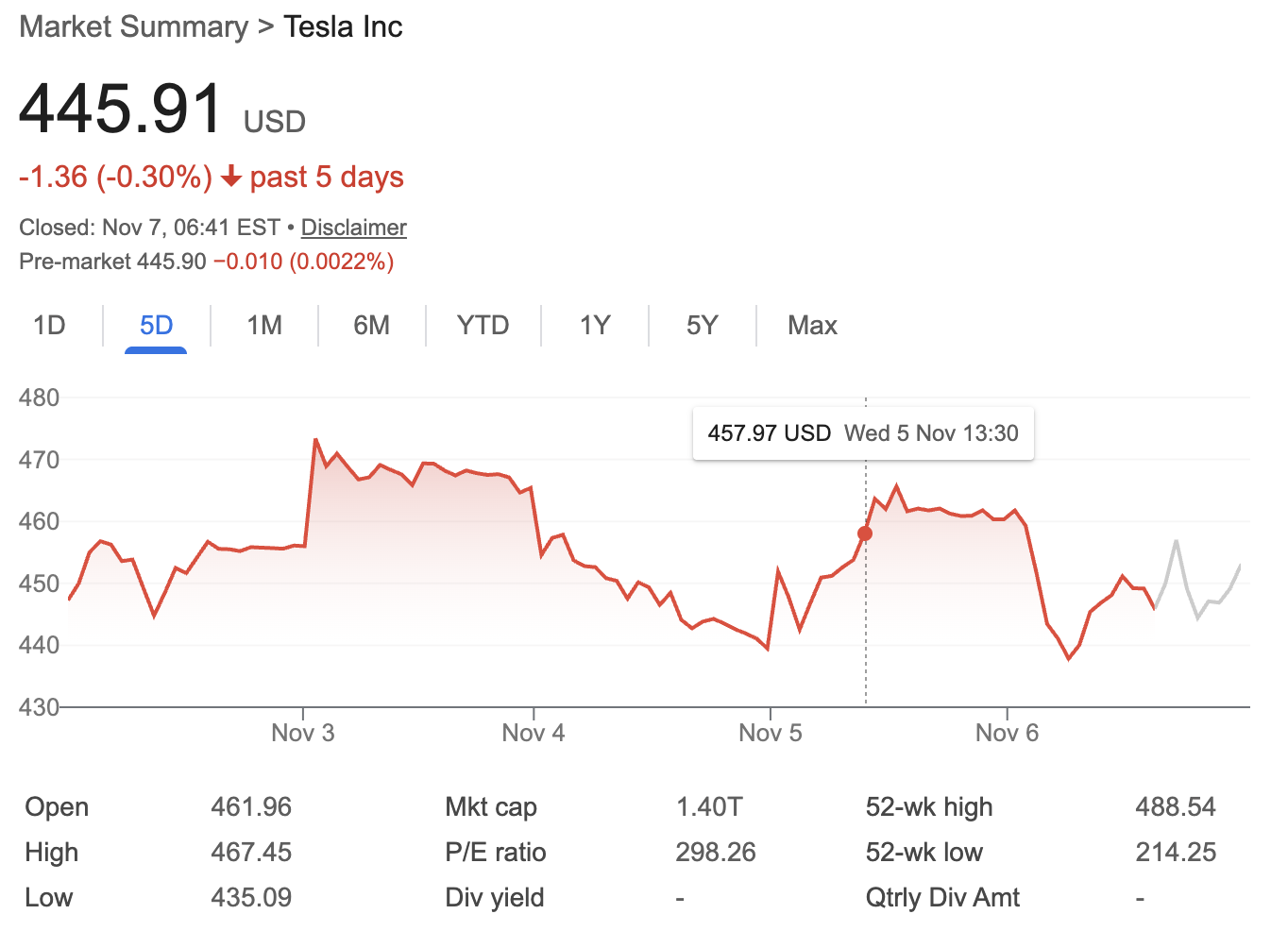

Source: Google Finance

Source: Google Finance

Elon Musk’s $1 Trillion Pay Package—An Unprecedented Bet on Tesla’s Future

At the heart of Tesla’s latest corporate strategy is an unprecedented compensation plan for Elon Musk. Approved by over 75% of voting shareholders at Tesla’s 2024 annual meeting in Austin, Texas, this package is unparalleled in scale—potentially amounting to $1 trillion if all targets are met.

Key Features of the Pay Package:

-

Twelve Tranches: The compensation is split into 12 tranches. Each tranche awards Musk approximately 1% of Tesla’s stock, conditional upon Tesla achieving both a $500 billion market capitalization increment and an operational milestone, such as cumulative delivery of the 20 millionth Tesla vehicle.

-

Performance Driven: All 12 milestones combine financial growth with ambitious operational targets. Only if Musk delivers on both for each tranche does the stock allocation vest.

-

Scale and Industry Comparison: In 2024, top industry CEO pay pales in comparison—Microsoft’s Satya Nadella earned $79 million, Apple’s Tim Cook $75 million, and Starbucks’ Laxman Narasimhan just below $100 million. Musk’s potential earnings dwarf all these figures.

-

No Base Salary: Elon Musk does not take a traditional salary from Tesla. This plan ties his reward entirely to company performance and value creation.

-

Potential Equity Stake: If Musk completes every milestone, he would own roughly 12% of Tesla, worth about $1 trillion at target valuations.

Controversy and Executive Control

The size of the package triggered sharp criticism from noted investment groups, proxy advisory firms, and some significant shareholders. For instance, the Norwegian sovereign wealth fund voted against the package, citing its “excessive size” and the risk of overconcentration of control. Critics also note that the package gives Tesla’s Board considerable discretion regarding how and when milestones are deemed achieved. Governance experts like Nell Minow have expressed concerns that the Board could, in practice, award Musk the stock even if all targets aren’t strictly met.

On the other hand, the Board—led by Chair Robyn Denholm—emphasized the need to retain Musk as CEO at this pivotal moment, arguing that his vision is essential for Tesla’s transformation into an AI and robotics powerhouse. The plan is explicitly performance-based and designed to incentivize Musk to remain at Tesla, rather than divert his attention to other ventures like his AI start-up xAI.

Musk himself has openly stated that having strong influence over Tesla’s future—particularly in AI and robotics—is more important to him than monetary compensation, stemming from a desire to ensure he can direct Tesla’s evolution without losing voting control.

Tesla’s New Chapter: Investing in Artificial Intelligence and Robotics

Musk used the shareholder meeting platform to unveil a “completely new book” for Tesla. Formerly known for the mission to "accelerate the world’s transition to sustainable energy," Tesla is now positioning itself to achieve "sustainable abundance"—anchored in next-generation technologies like humanoid robots (Optimus), autonomous vehicles (Cybercab), and cutting-edge AI-powered software.

-

Optimus Robot: Musk envisions deploying potentially billions of humanoid robots, shifting the company’s long-term business model beyond electric vehicles and into household, industrial, and medical robotics.

-

AI and Autonomous Driving: Tesla’s roadmap leverages AI as the backbone of its Full Self-Driving software, with ambitions to scale a massive autonomous driving fleet in the coming years.

The Gigantic Chip Fab: Musk’s Semiconductor Ambitions

Integral to this vision is Tesla’s newfound focus on building its own chip manufacturing capabilities. In a first, Musk publicly suggested that Tesla may need to create “a gigantic chip fab” to supply the AI chips necessary for scaling its robotics and self-driving operations.

Details Revealed at the 2024 Annual Meeting:

-

Fifth-Generation AI Chip (AI5): Tesla is currently designing its fifth-generation AI chip, critical for powering next-gen autonomous systems. While earlier chips have been produced in partnership with TSMC (Taiwan) and Samsung (South Korea), Tesla now faces an acute supply constraint.

-

Intel Partnership: Musk mentioned the potential to collaborate with Intel, which has its own semiconductor fabrication plants. “We haven’t signed any deal, but it’s probably worth having discussions with Intel,” Musk told shareholders, sparking a surge in Intel stock the following day.

-

Production Timeline:

-

Limited production of AI5 chips is expected in 2026.

-

Large-scale manufacturing will ramp in 2027.

-

Musk also hinted at an AI6 chip—anticipated to double performance—potentially reaching scale by mid-2028, using the same facilities.

-

Gigafab Scale: Musk asserted, “Even in the best-case scenario with our suppliers, it won’t be enough. We’ll probably have to do a Tesla terafab—a facility much larger than a typical gigafactory.” He suggested this fab would aim for at least 100,000 wafer starts per month—an enormous scale in chip manufacturing.

-

Efficiency Targets: The new Tesla chip is to be “inexpensive, power-efficient and optimized for Tesla’s own software,” consuming only a third of the power of Nvidia’s Blackwell chip and costing just 10% as much.

With these moves, Tesla could reduce dependency on external suppliers, lower chip costs, and rapidly accelerate development of its AI-enabled products.

Tesla Stock: Current Market Performance and Outlook

In parallel with these strategic moves, Tesla (TSLA) continues to draw intense focus from investors and analysts at Bitget and beyond.

-

Stock Price: As of November, 2025, Tesla shares trades at around $445.9, maintaining its position as one of the world’s most valuable automakers despite persistent volatility.

-

Investor Sentiment: While the approval of Musk’s pay package and AI roadmap has been met with optimism by some investors hoping for a Tesla-led revolution in AI-driven mobility and robotics, critics caution that the risks are significant. Much depends on execution—both in achieving the operational and valuation milestones tied to Musk’s compensation and in overcoming technical and logistical obstacles in chip manufacturing.

Conclusion

Tesla’s approval of Elon Musk’s $1 trillion performance-based pay plan and its contemplated move into large-scale chip manufacturing signal a pivotal evolution for the company. By tightly aligning Musk’s incentives with Tesla’s next phase—dominated by ambitions in artificial intelligence, robotics, and in-house chip development—Tesla is betting on sustained innovation and leadership.

For investors and market watchers, these moves reinforce Tesla’s high-risk, high-reward profile. Success could cement Tesla (TSLA) as not just a leader in EVs but as a transformative force in AI and robotics, potentially unlocking new waves of growth. However, the magnitude of this bet means that close monitoring of execution, competitive dynamics, and corporate governance remains essential.

Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.