Bitget Futures Market Updates: Solana’s 5-Hour Outage Causing a Dip in SOL Price

Bitget2024/02/07 04:32

By: Bitget

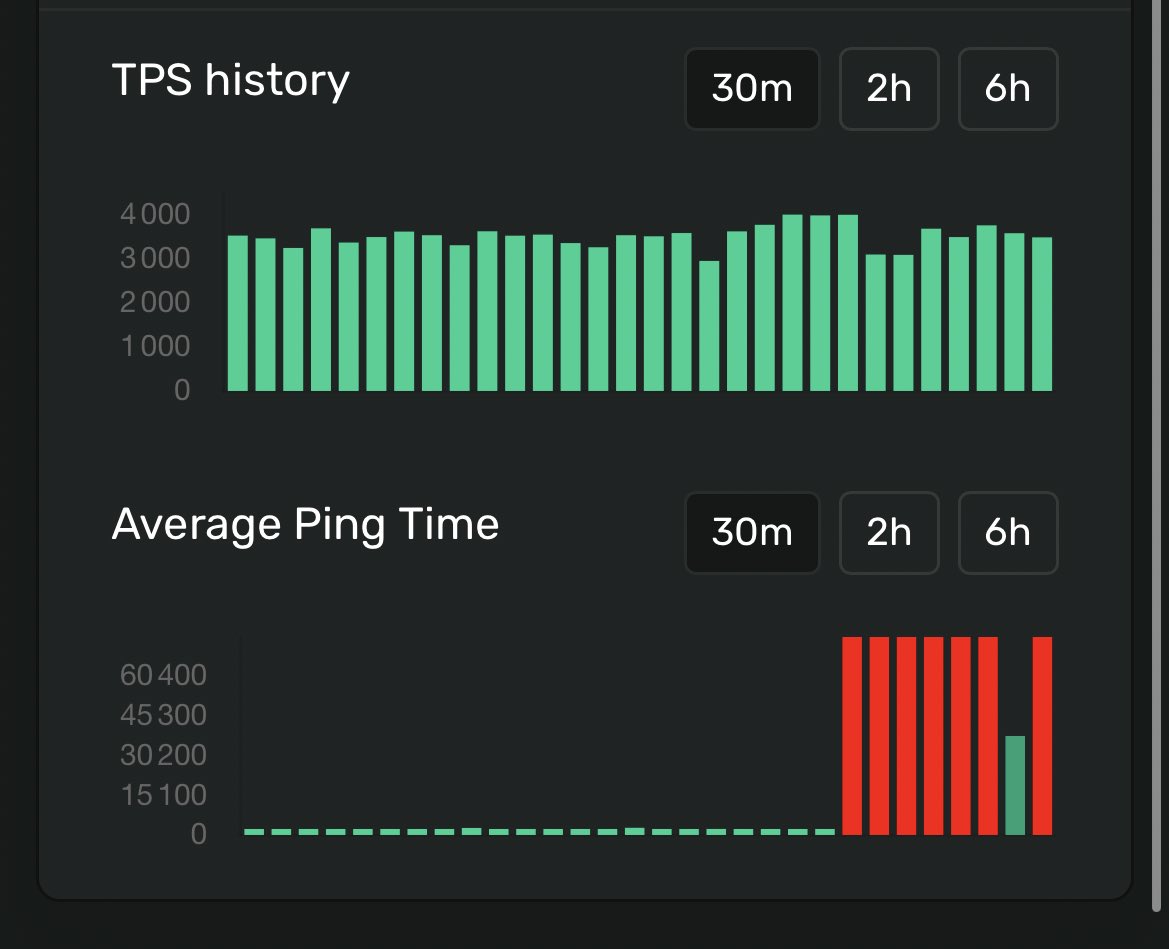

On February 6, 2024, the Solana network experienced a significant outage at 10:22 UTC that halted block production and core functionalities. The outage, lasting approximately five hours, prompted swift action from engineers and validators within the ecosystem. Solana validators commenced preparations for a restart by generating snapshots and ensuring consistency in the network's state. A software patch, version 1.17.20, was developed and deployed to address the issue. This patch enabled validators to upgrade their systems and coordinate efforts to resume normal network operation.

The outage, lasting approximately 5 hours, resulted in a 3% drop in the price of SOL to $93.39, though it later recovered to $95.14 by 15:30 UTC. It also impacted crypto exchanges like Upbit, leading to suspension of deposits and withdrawals of Solana-based tokens.

This incident is one of several outages Solana has faced since its launch, underscoring ongoing challenges in maintaining network stability despite its promise of scalability and lower transaction fees compared to Ethereum.

Futures market Updates

BTC futures market witnessed a slight increase in total open interest despite a decrease in trading volume. In contrast, ETH futures witnessed a rise in both total open interest and trading volume. The funding rate for Ether futures remained low at 0.0007%, with ETH topping the liquidation list over the past 24 hours.

Bitcoin Futures Updates

Total BTC Open Interest: $17.99B (+0.86%)

BTC Volume (24H): $28.27B (-16.78%)

BTC Liquidations (24H): $8.44M (Long)/$8.52M (Short)

Long/Short Ratio: 50.38%/49.62%

Funding Rate: 0.0093%

Ether Futures Updates

Total ETH Open Interest: $8.31B (+7.53%)

ETH Volume (24H): $16.98B (+29.85%)

ETH Liquidations (24H): $1.82M (Long)/$15.37M (Short)

Long/Short Ratio: 50.21%/49.79%

Funding Rate: 0.0007%

Top 3 OI Surges

MULTI: $4.18M (+212.68%)

XMR: $65.53M (+186.15%)

CHR: $34.98M (+133.07%)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

Lock now!

You may also like

Crypto prices

MoreBecome a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now