CryptoQuant sees bitcoin short-term holder supply decline as barrier to price breakout

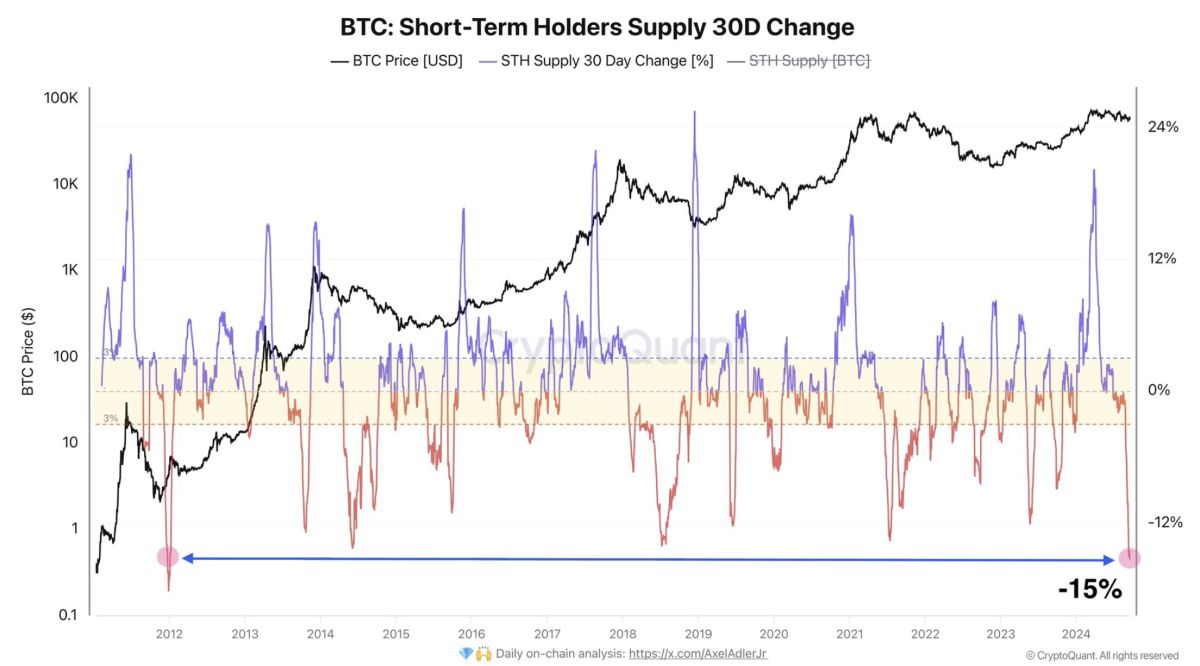

The 30-day change in bitcoin’s short-term holder (STH) supply has dropped to levels not seen since 2012, according to CryptoQuant data.

The supply has shifted toward long-term holders (LTH), a cohort that typically accumulates and holds bitcoin over extended periods, defined as addresses that have held bitcoin for 155 days or more. However, the lack of fresh demand from the short-term holder cohort could be restricting bitcoin's ability to break out of its current price range, according to an analyst at the market intelligence firm.

"Historically, bitcoin rallies to new highs as a result of new holders buying from long-term holders and bidding up prices in this process. Although, long-term holders accumulating bitcoin seems to be a pre-condition for further price appreciation, the reality is that bitcoin needs fresh demand, from short-term holders buying, in order to sustain a price rally. This is what has happened during bull cycles," CryptoQuant Head of Research Julio Moreno told The Block.

CryptoQuant's charts show a strong positive correlation between short-term holder activity and bitcoin’s price. Moreno added, "Currently there’s still no significant new demand from short term holders."

Bitcoin BTC -0.14% short-term holder supply drops to multi-year low. Image: CryptoQuant.

Bitcoin market dominance reaches highest level since April 2021

Meanwhile, bitcoin’s market capitalization has increased to 54.9% of the total cryptocurrency market, marking its highest level since April 2021. According to a report by Kaiko Research, bitcoin’s dominance over the top 50 altcoins is now at its strongest since the market last approached all-time highs in March of this year.

Bitcoin market cap dominance has reached a multi-year high. Image: TradingView.

During the sell-off on August 5—triggered by a sudden increase in interest rates in Japan—bitcoin's cumulative volume delta (CVD), a key indicator of buying and selling pressure, remained positive on U.S. exchanges. In contrast, many altcoins experienced heavy selling. This trend further cements bitcoin’s reputation as a "safe haven" during periods of market uncertainty, Kaiko Research analysts said.

"From August 4 to 6, amidst one of the worst crypto selloffs in recent years, bitcoin’s CVD—a key indicator of buying and selling pressure—remained strongly positive on U.S. exchanges. In contrast, altcoins struggled significantly, with the top five experiencing extensive selling across most exchanges," Kaiko Research analysts added.

The report said that the January launch of spot bitcoin exchange-traded funds (ETFs) in the U.S. has further solidified bitcoin’s position as an investable asset, attracting institutional capital. In contrast, altcoins continue to carry higher risk premiums, facing greater volatility in this uncertain macro environment.