- Greed-driven sentiment may trigger further volatility and potential market corrections.

- Surging spot volume reflects active trading but hints at short-term instability.

- Major cryptocurrencies face broad bearish trends amid declining Bitcoin dominance.

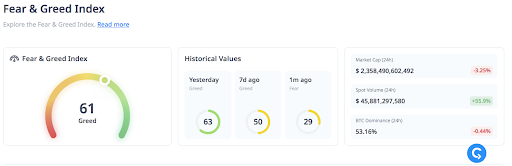

The cryptocurrency market is displaying a dichotomy: Despite heightened volatility and falling prices, the Fear & Greed Index sits at 61, signaling Greed.

Source: Cryptorank

Source: Cryptorank This contrasts with the typical association of greed with rising prices and suggests a degree of investor confidence that defies the current downturn. While the index is slightly lower than yesterday’s reading of 63, it still indicates positive sentiment, especially compared to the neutral reading of 50 a week ago and the fearful 29 a month ago.

This unusual combination of volatility and greed warrants close attention, as it could foreshadow either a strong market recovery or a deeper correction.

Market Capitalization and Volume Surge, But Weakness Remains

Although the overall market capitalization fell by 3.26% in the last 24 hours, spot trading volume increased by 54.2%. This jump in trading volume suggests that while investors are actively buying and selling, the market is unstable in the short term. Bitcoin’s dominance fell to 53.14%, a decrease of 0.45%, showing that other cryptocurrencies are becoming more important in the market.

Source: Cryptorank

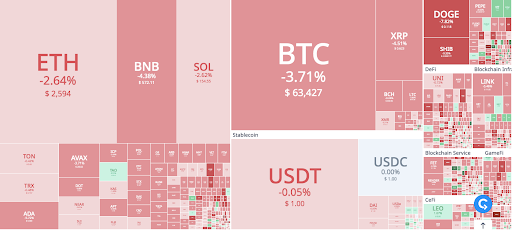

Source: Cryptorank Major Cryptos Face a Bearish Trend Amidst Greed

The heatmap for major cryptocurrencies shows a mostly bearish sentiment. Bitcoin, the largest crypto by market cap, fell by 3.72% to $63,372. Ethereum also dropped by 2.94% to $2,587.

Additionally, Binance Coin and Solana encountered notable drops, with BNB down by 4.51% and SOL decreasing by 2.29%. Hence, the broader market correction is not sparing even the largest assets.

Read also: Crypto Fear & Greed Index Hits ‘Greed’ Zone as Market Sentiment Improves

Altcoins experienced even more significant losses. XRP fell by 4.81%, while Dogecoin dropped by 7.41%. Stablecoins like USDT and USDC, typically used to hedge against market volatility, remained stable near their $1.00 pegs. Meme coins like Shiba Inu, which often experience large price swings, were hit hard, with SHIB falling by 8.31%.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.