News>

10x Research: every investor has a price threshold for deciding to accept bitcoin. As the price climbs, bitcoin gains legitimacy and attracts new converts

Bitget2024/10/26 22:16

In Bitget news, research firm 10x Research posted that,

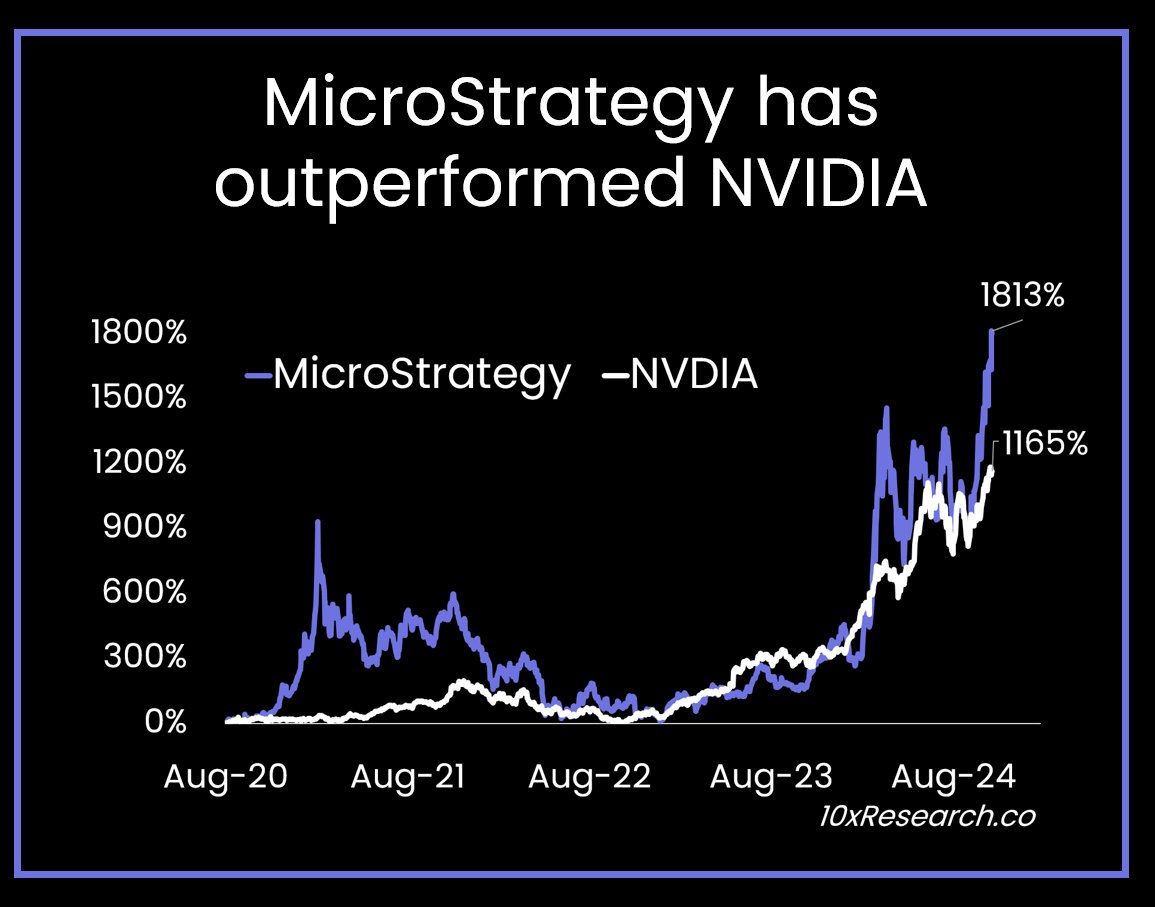

There’s a valuable lesson in Michael Saylor's transformation on #Bitcoin, though it may not be what you expect. Once a vocal skeptic, Saylor’s perspective shifted as prices rose, revealing a threshold where even staunch critics can become full believers. This phenomenon shows that everyone has a price point at which Bitcoin’s allure becomes undeniable. Saylor's journey from skeptic to Bitcoin powerhouse exemplifies this shift, and he’s certainly not alone— he followed many others, and many more will follow him. It’s just a matter of price – not time. Saylor’s shift in perspective on Bitcoin offers an insightful lesson. In 2013, he famously dismissed Bitcoin, saying that "its days are numbered" and showed little interest at $700 per BTC. Yet by 2020, he’d reversed course, leading MicroStrategy to invest at an average price of $11,650 per BTC. Since then, his company has acquired over $14 billion worth of Bitcoin, making MicroStrategy a key enabler and advocate during the last cycle. During the bear market, as Bitcoin dropped below $20,000—well below MicroStrategy’s average acquisition price near $30,000—speculation arose about potential forced liquidations. However, Saylor held firm, and as of now, MicroStrategy has delivered the best returns of any SP 500 company since its first Bitcoin purchase in August 2020, surpassing NVIDIA. The takeaway isn’t simply that Saylor bought and held Bitcoin; every investor has a price threshold where they decide to embrace it. As prices climb, Bitcoin gains legitimacy and attracts new believers.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

Lock now!

You may also like

Crypto prices

MoreBecome a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now