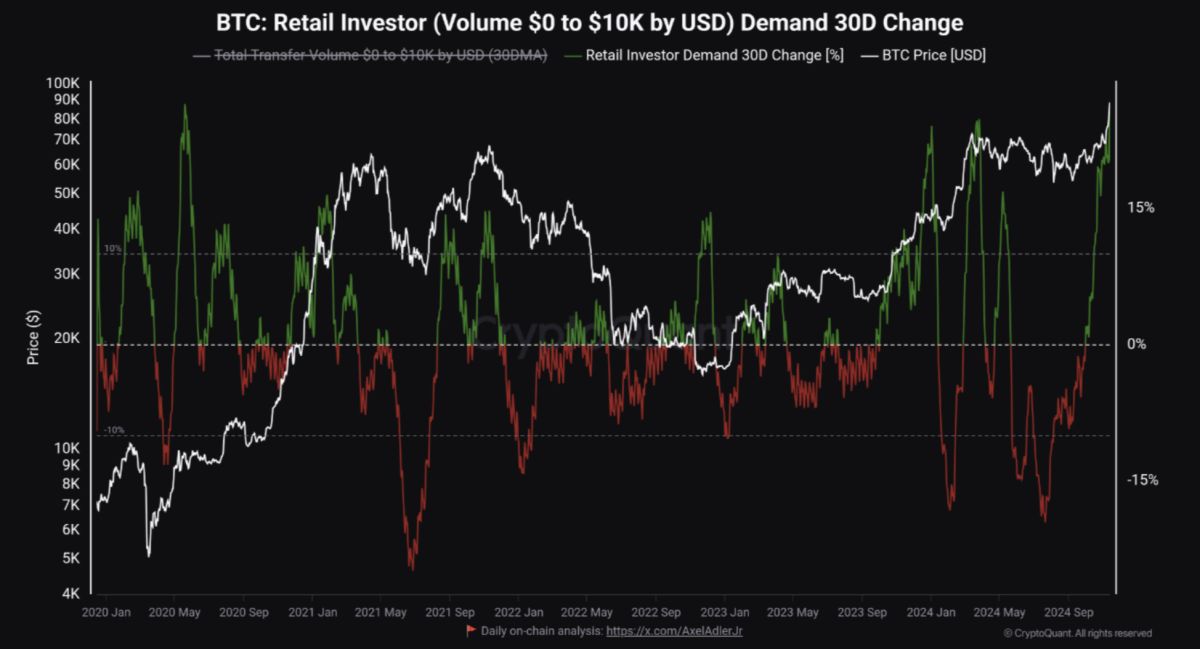

Bitcoin retail investor demand hits 52-month high as market momentum builds: CryptoQuant

Bitcoin’s retail investor activity has surged to a 52-month high, signaling a return of strong retail trading interest, according to CryptoQuant. Key metrics such as retail investor demand and funding rates indicate renewed enthusiasm fueled by surging altcoin markets and growing mainstream attention.

"It’s impossible to ignore that retail trading is fully back, with dogecoin surging, high funding rates, and a spike in Google searches for bitcoin, this can be observed as well in the retail investor demand change 30-day-moving-average," CryptoQuant analyst J.A. Maartunn said to The Block.

Bitcoin retail investor demand 30-day change has increased to a multi-month high. Image: CryptoQuant.

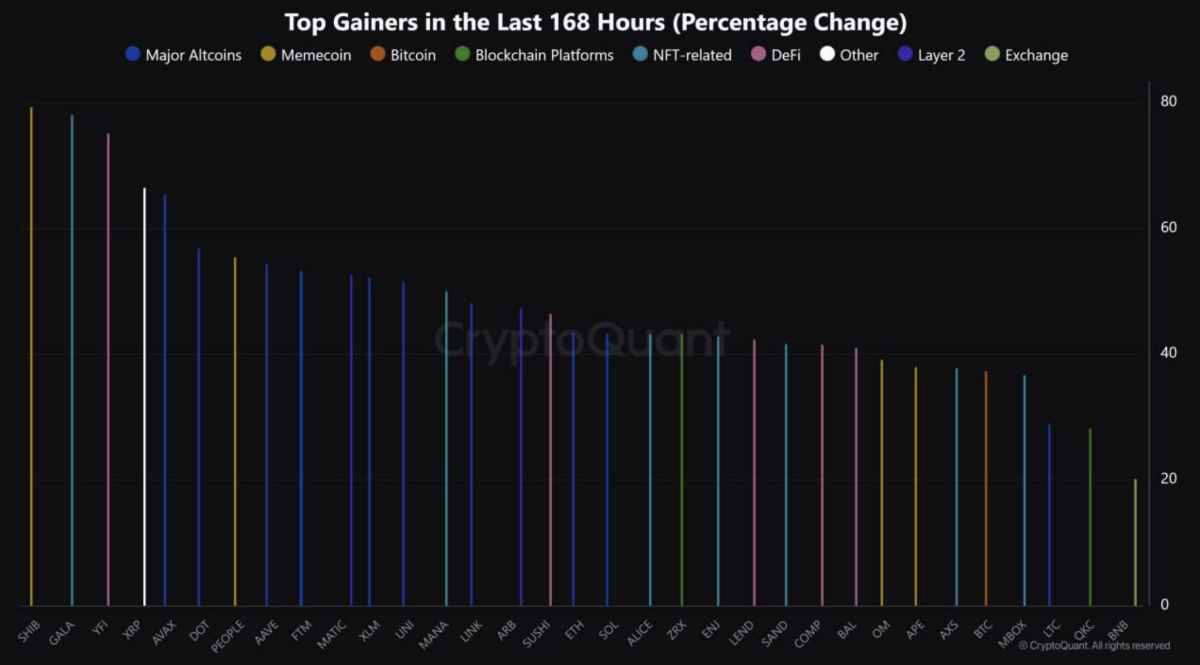

CryptoQuant data also shows retail interest extending beyond bitcoin . "Retail demand is also shifting towards other coins further down the risk curve," Maartunn said. The CryptoQuant analyst pointed to data that highlighted the top-gaining altcoins over the last 168 hours.

"Our data shows a retail demand targeting a mix of memecoins, DeFi projects, and major altcoins, and these categories appear to be the most popular among retail participants," he added.

Retail interest has shifted along the risk curve to memecoins and distinct DeFi tokens. Image: CryptoQuant

"Funding rates have surged, signaling a return of aggressive leverage, with many altcoin long positions incurring over 50% APY in funding," Ryze Labs analysts told The Block. "Retail interest has been heavily focused on memecoins, fueled by Robinhood and Coinbase's recent listings of PEPE and WIF."

YouHodler chief of markets Ruslan Lienkha has also observed this trend, citing a recent increase in leverage in altcoin long positions within the crypto market. "This trend typically heightens the risk of a potential long squeeze. Additionally, it could serve as an early indicator of an impending market correction and deleveraging," Lienkha told The Block.