SOL Bulls Push for $500 After Strong Breakout – Is a Rapid Rally Starting?

Solana (SOL) has continued its impressive 2024 performance, with the $500 mark increasingly in sight. The blockchain’s rapid rise is largely fueled by a surge in memecoins and high activity on decentralized exchanges (DEXs) within its ecosystem.

Recently, Solana secured the top position in global blockchain traffic, underscoring its growing appeal in the crypto market.

Solana’s DEX activity has reached unprecedented levels, with daily trading volumes exceeding $5 billion for three consecutive days.

According to DeFiLlama, Radium commands a 60% share of this volume, contributing over $16 billion between November 10 and 16.

Solana Dominates Blockchain Traffic

Solana ranked first in blockchain traffic and investor interest, surpassing other top-20 blockchains. As of November 14, Solana accounted for 38.79% of global traffic, with Coinbase’s Layer-2 platform, Base, following at 16.81%.

Together, they represent a 56% share of total blockchain traffic.

Solana’s popularity surged in early 2024, largely due to the growing memecoin sector on its platform. Users are drawn to Solana’s speed, reliability, and low gas fees.

Although Solana saw a 10% drop in investor interest between Q1 and Q4, Base experienced fivefold growth during the same period. Despite this shift, Solana maintained its top position in global traffic share.

Memecoins Fuel DEX Activity as High-Risk Tokens Surge

In the past week, DEXs saw 181,000 new tokens, with memecoin launches on platforms like Pump.fun driving the majority of activity. Launch sites like Pump.fun have streamlined token deployment, though only about 1% of these tokens reach listing on Raydium.

Solana’s ability to handle high transaction volumes without significant fee increases supports this continued activity.

Established memecoins performed strongly, trailing only major Layer 1 assets like ETH and SOL. Despite renewed interest in regulated products like Bitcoin ETFs, high-risk memecoins remain popular among investors.

Solana’s Liquid Staking Surges to $5.6 Billion Market Cap

Solana’s liquid staking ecosystem has also flourished, reaching a market cap of $5.67 billion with an 8.10% staking ratio.

Liquid staking allows users to lock assets while retaining the flexibility to trade, boosting flexibility and potential staking rewards.

Leading SOL-based liquid staking tokens include JitoSOL, with a 43% market share, Marinade’s mSOL at 16.8%, and jupSOL at 12%.

The rise of liquid staking reflects investor interest in maximizing returns without committing assets long-term.

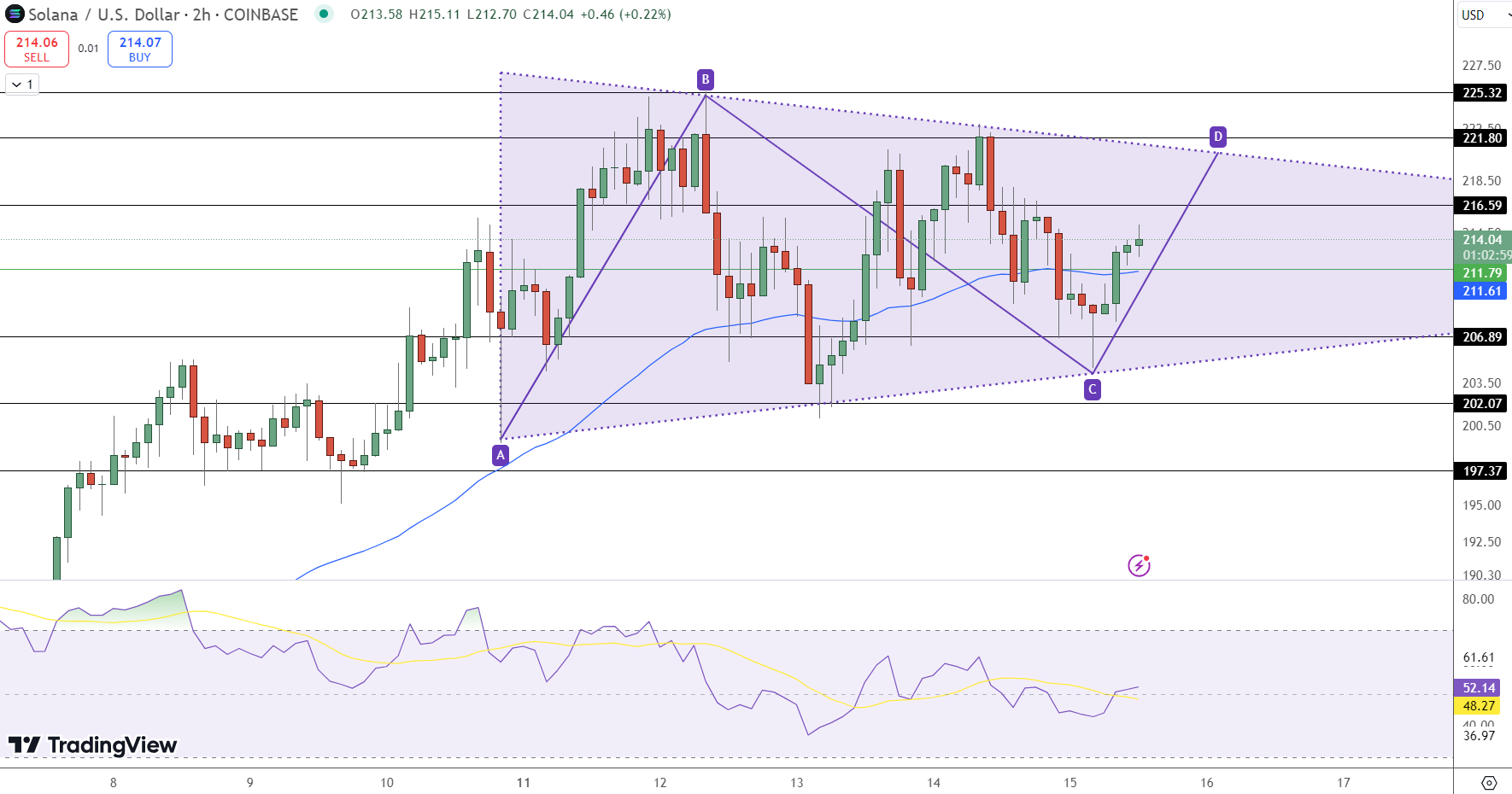

Solana Eyes Breakout: Triangle Pattern Signals Move

Solana (SOL) is trading within a symmetrical triangle pattern on the 2-hour chart, suggesting a potential breakout soon as the asset consolidates.

Currently priced around $214.04, Solana finds immediate resistance at $216, with the next major levels to watch at $221.80 and $225.30. This pattern often indicates market indecision, with buyers and sellers awaiting further signals.

A breakout above $216 could initiate an uptrend, while a dip below immediate support at $211.80 might lead to bearish pressure, with additional supports at $206.90 and $202.07.

The 50-day EMA, positioned near $211.60, is offering additional support, reinforcing the consolidation zone. The Relative Strength Index (RSI) sits at 48, reflecting a neutral stance, though any movement above 50 could strengthen bullish momentum.

In conclusion, Solana’s symmetrical triangle pattern signifies investor indecision, but a break above $216 may invite bullish interest, pushing prices higher.

Key Insights:

- Symmetrical triangle hints at potential breakout.

- Immediate resistance at $216; watch for a bullish move.

- RSI near 48 signals neutral sentiment with potential upward push.

Why Pepe Unchained ($PEPU) Could Be Your Next Portfolio Boost

As meme coins continue to gain traction, Pepe Unchained ($PEPU) stands out as a promising addition to the market, drawing attention for its potential to deliver significant returns.

Key Highlights:

- Presale Opportunity: Early investors in the $PEPU presale stand to benefit before prices rise further. Crypto expert Jacob Crypto Bury supports this, highlighting the potential for early presale gains.

- High APY Staking: With a 499% APY staking feature, $PEPU offers an attractive passive income opportunity, with 321 million tokens already staked – a clear sign of investor confidence.

- Secure Investment: $PEPU’s smart contract has been audited by Coinsult and SolidProof, ensuring added security for investors.

Act Fast on the Presale

With the presale nearly closing, Pepe Unchained has raised $31.1 million of its $31.5 million goal. Currently, 1 $PEPU is priced at $0.01283, but prices are expected to increase soon. Don’t miss the chance to invest before $PEPU lists on tier-1 exchanges.

Buy PEPU Here

- 13 Million XRP Burned, Analyst Predicts $6.4 Target as Scarcity Rises

- Dogecoin Price to $10 as Elon Musk Joins Trump Administration, Who’s Next from Crypto?

- Next PEPE is Pepe Unchained (PEPU) as Whales Dive in, Biggest Meme Coin Presale Ever Ends in 30 Days

- Bhutan Reaches $1 Billion in Bitcoin Holdings

- Best Crypto to Buy Now November 13 – Dogecoin, Bonk, Cronos

- Bitcoin (BTC) Price Prediction

- Ethereum (ETH) Price Prediction

- Ripple (XRP) Price Prediction

- Dogecoin (DOGE) Price Prediction

- Solana (SOL) Price Prediction

- Best Crypto Wallets

- Best Crypto to Buy Now

- Best Crypto Presales to Invest In

- Best New Meme Coins to Buy