- Despite a market-wide price decline at the start of last week, the crypto market recovered as Bitcoin closed the week at $102,800.

- Bitcoin has now reached a new all-time high of $106,000.

- Meanwhile, US spot crypto ETFs continue to log consecutive positive days of inflows.

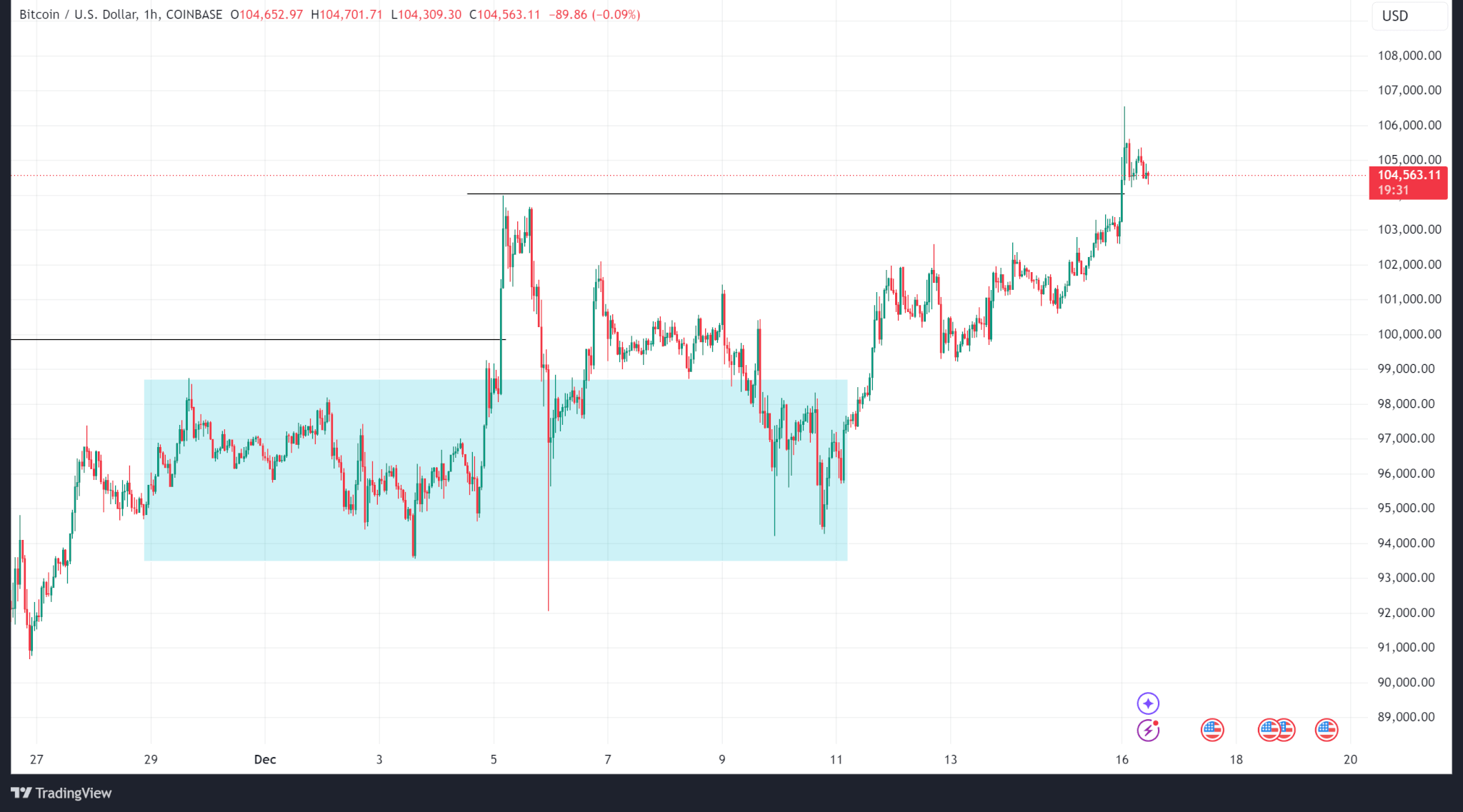

Bitcoin

Bitcoin has logged new highs of $106,400 since its dip last week to $94,000, driven largely by positive ETF inflows as US spot Bitcoin ETFs record another week of consecutively positive daily inflows.

From Dec. 9 to Dec. 13, $2.17 billion flowed into the top 10 US spot BTC ETFs.

Current price action shows Bitcoin has broken its previous high of $104,000 and trades at $104,500 after reaching a new high of $106,600.

The Fed rate policy decision coming up on Dec. 18 could significantly impact price action. Expectations are hawkish with more controlled slashes moving into next year, which could negatively impact risky assets like Bitcoin.

Price technicals support a hawkish stance as Bitcoin’s price could push downward to grab liquidity at lower levels around $100,000.

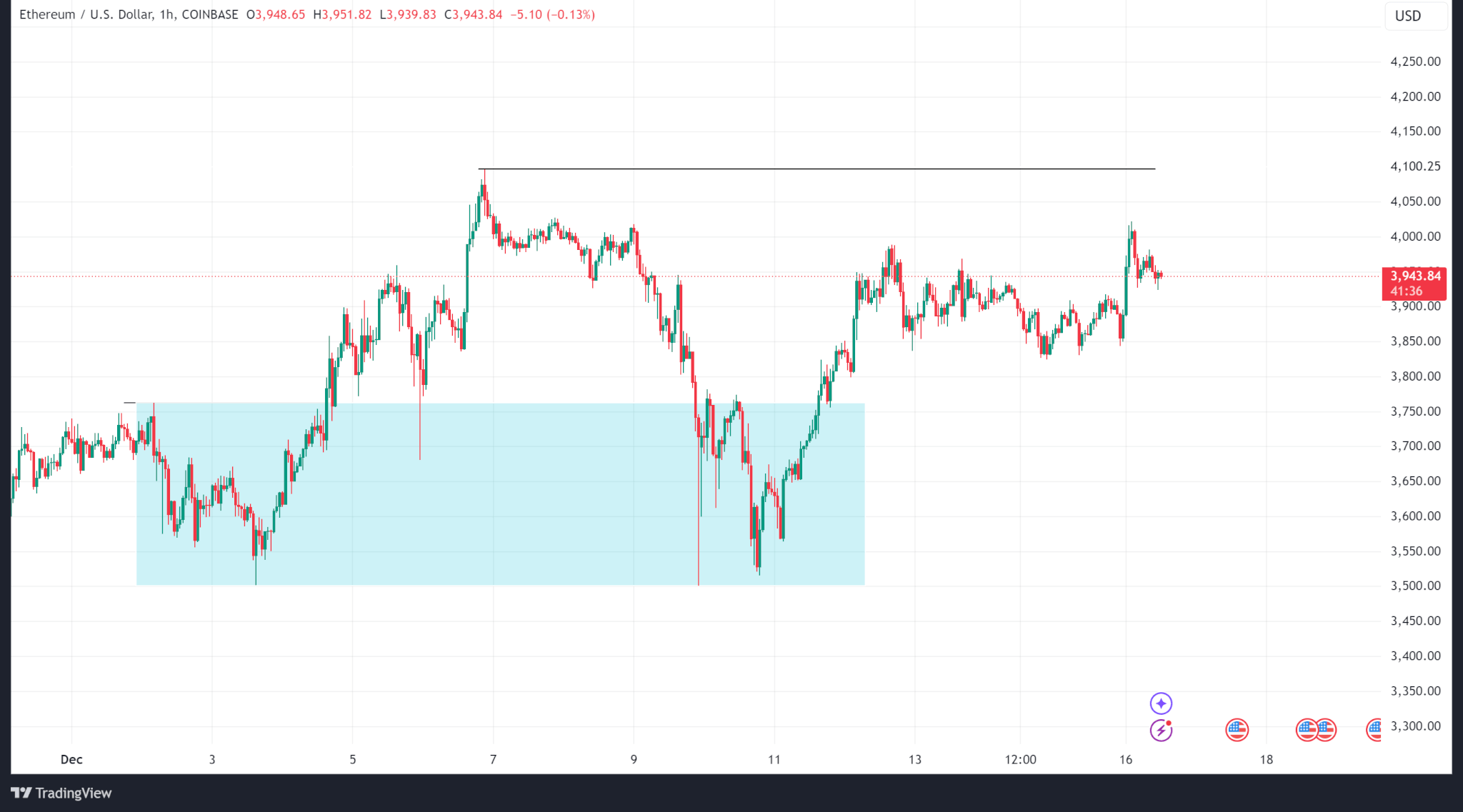

Ethereum

The second-largest crypto rebounded from a weekly low of $3,500 to a local high of $4,000. Unlike Bitcoin, it has not broken the previous high formed at the $4,100 level.

Meanwhile, Ethereum spot ETF inflows remained positive throughout last week, totalling $854.8 million.

Ethereum trades at $3,950 at the time of publishing.

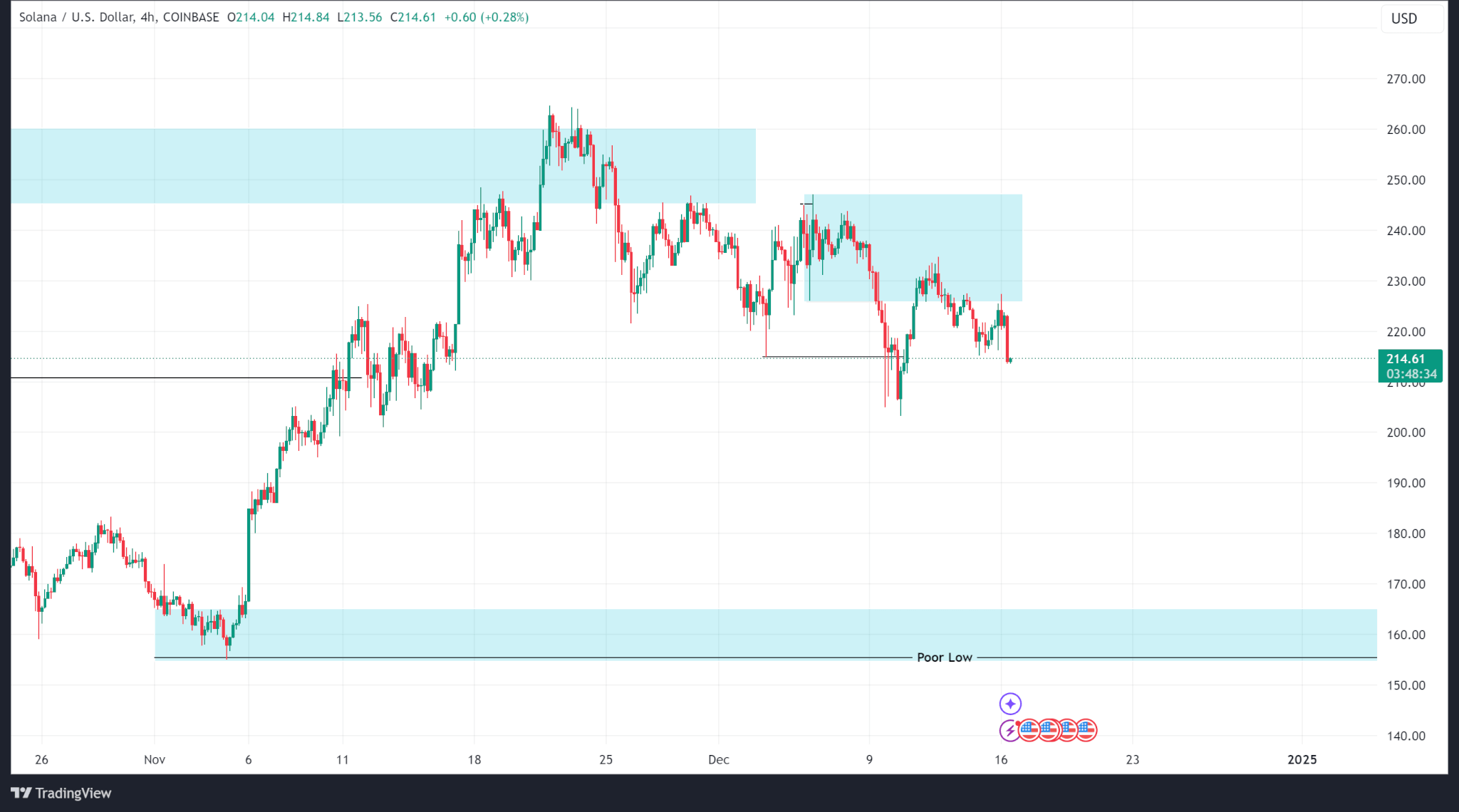

Solana

Unlike Bitcoin and Ethereum which have rebounded since last week, Solana’s price has declined since failing to close above its all-time high of $260 on the daily time frame.

Price action on intermediate time frames (H4/H1) shows rejection and sells from local supply zones which may continue until a logical demand zone at $160. Solana’s price will need to break above $247 on the H4 and eventually close above the all-time high on the daily time frame to resume its bullish motion.

Solana trades at $214 at the time of publishing.

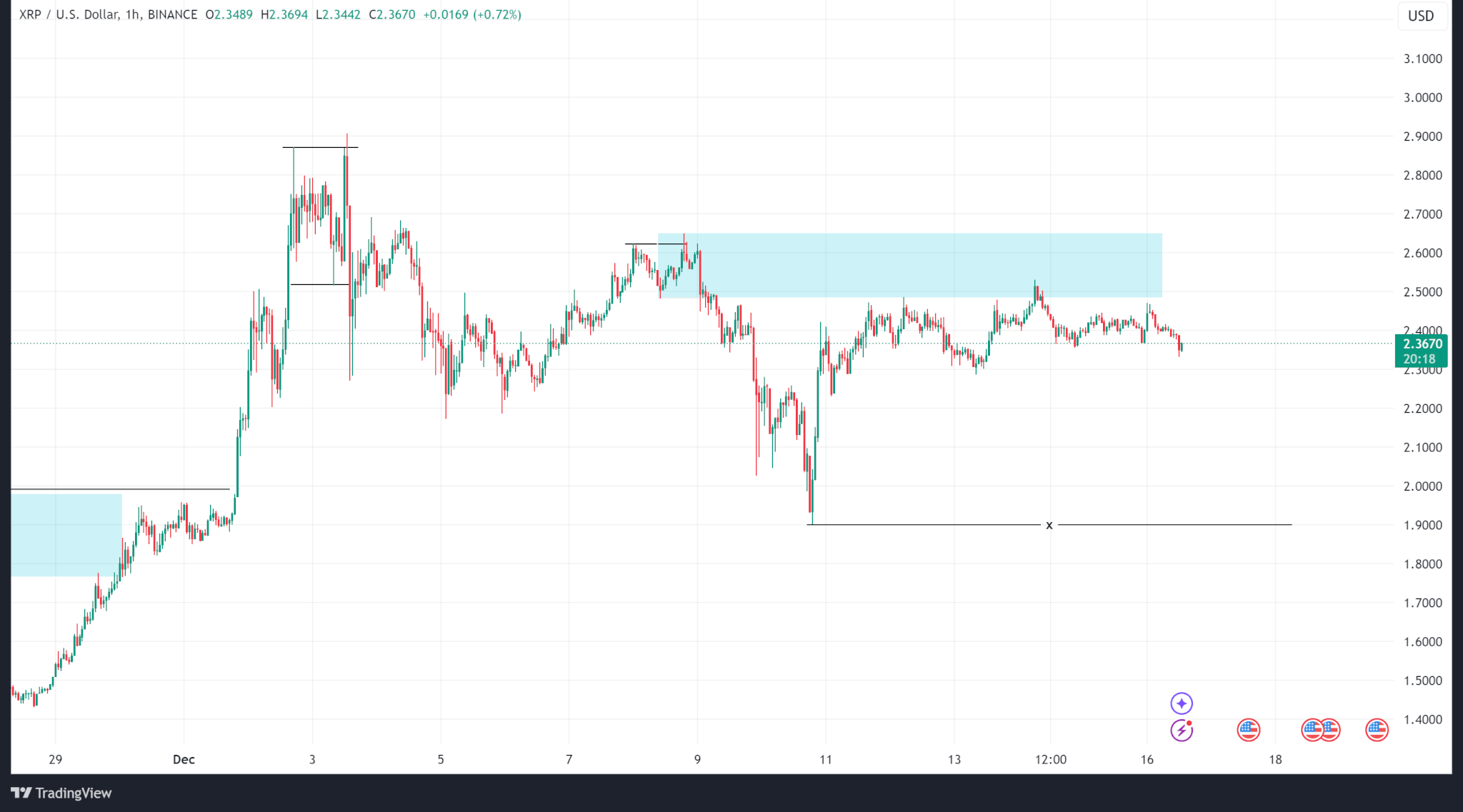

Ripple

Ripple’s price action has been incredibly bullish following its legal wins and expected changes to the US regulatory landscape. The crypto surpassed its former all-time high of $1.99 and formed a new ATH of $2.90 on Dec. 3.

More recent price action shows a pullback from highs as the price formed a new local supply zone, rejected, and sold from it. A continuation of the current trend would see price take liquidity at the $1.90 level while a reversal would see price break above $2.65.

Ripple trades at $2.36 at the time of publishing.