FCA’s Push to Regulate Illegal Crypto Ads in UK Hits Roadblock

Illegal cryptocurrency advertisements continue to circulate in the United Kingdom, even after the Financial Conduct Authority (FCA) ordered crypto projects to remove their promotions.

FCA set new rules for crypto promotions in June 2023 owing to the risky nature associated with crypto markets.

FCA’s Crypto Ad Takedown Requests Go Unanswered

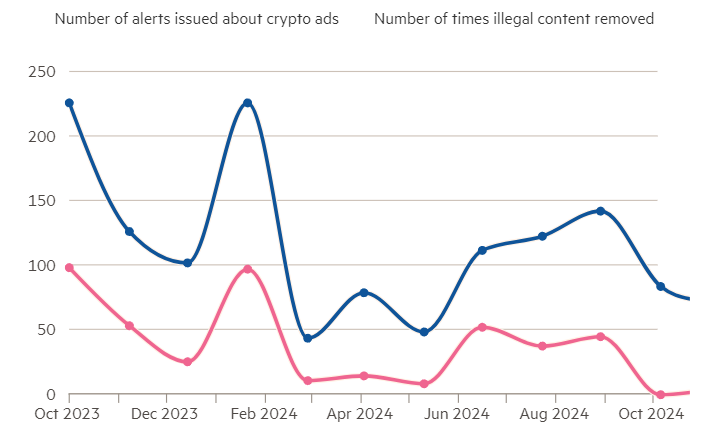

According to a Financial Times report, between October 2023 and October 2024, only 54% of the 1,702 alerts issued by the FCA led to the removal of illegal crypto ads. The remaining promotions remain active.

The British regulator announced in 2023 that if crypto firms fail to comply, they will face punishments. The penalties could include two years imprisonment, an unlimited fine, or both.

“We will take robust action against persons illegally promoting to UK consumers. This may include, but it is not limited to, placing firms on our warning list, taking steps to remove or block any illegal financial promotions such as websites, social media accounts and apps, and enforcement action,” FCA said.

Moreover, only FCA-authorised crypto promotions are allowed to be published in the UK.

“We want to provide clarity and prevent harm to consumers from investing in cryptoassets that do not match their risk appetite,” the regulator explained.

However, data shows that despite the FCA’s requests for removal, only about half of the ads are consistently removed.

In addition, despite the warnings, the FCA has yet to penalize companies or groups that violate its rules. Former FCA chair Charles Randell emphasized that penalizing companies that fail to remove content is crucial to addressing the “very frustrating” level of noncompliance.

The Ratio of Illegal Crypto Ads Identified and Removed by the FCA. Source: Financial Times

The Ratio of Illegal Crypto Ads Identified and Removed by the FCA. Source: Financial Times The latest developments follow the FCA’s announcement in November that it plans to finalize crypto regulations in the UK by Q1 2026. The key focus areas will be market abuse, trading platforms, lending, and stablecoins.

More recently, Solana’s Pump.fun restricted access to UK users following warnings from the British regulator. FCA announced in December 2024 that the platform is unauthorized to target UK users. The website itself cannot be accessed in the country now. Similarly, in 2023 Binance stopped onboarding new users after canceling registration with the FCA.

“This firm can no longer provide regulated activities and products, but previously was authorised by the FCA and/or PRA,” the regulator said.

Overall, the FCA has been trying hard to regulate the UK’s crypto industry, yet it’s not achieving the desired results. It will be interesting to see whether the regulator makes notable changes to its approach after the underwhelming results in 2024 or if it intensifies a crackdown against the industry.