Why These Altcoins Are Trending Today — January 2

As 2025 kicks off, investors are optimistic for a year of stronger gains. Interestingly, bar a few, most of the altcoins trending today have seen their prices increase in the last 24 hours.

According to CoinGecko, two of the top three altcoins — Virtuals Protocol (VIRTUAL) and Kekius Maximus (KEKIUS) — have recorded impressive double-digit growth, while ai16z (AI16Z) has bucked the trend with a decline. Here are the details.

Virtuals Protocol (VIRTUAL)

Throughout Q4 of last year, VIRTUAL was a regular on the trending list as one of the top-performing altcoins. Today, January 2, it continues to capture attention, surging by 23.60% in the last 24 hours.

VIRTUAL’s sustained rise could be attributed to the growing buzz around AI and gaming, which has propelled the altcoin to new heights. Following the price increase, VIRTUAL now trades at $4.89.

On the daily chart, VIRTUAL continues to hit a higher high, indicaitng notable demand for the altcoin. The Relative Strength Index (RSI) reading has also increased, indicating notable bullish momentum around the token.

Virtuals Protocol Daily Analysis. Source: TradingView

Virtuals Protocol Daily Analysis. Source: TradingView Should this trend continue, the altcoin’s value could climb to $6. However, if demand for the Virtuals Protocol token drops, it might face correction. In that case, the value could decline to $2.90.

Kekius Maximus (KEKIUS)

Unlike VIRTUAL, Kekius Maximus price has decreased by 50% in the last 24 hours. However, that is not the major reason it is part of the altcoins trending today.

Earlier on, the meme coin built on Ethereum recorded a mind-blogging increase after Elon Musk changed his X handle to Kekius Maximus. However, yesterday, the Tesla CEO switched back to his original name, causing the meme coin’s market cap to fall by $300 million within an hour.

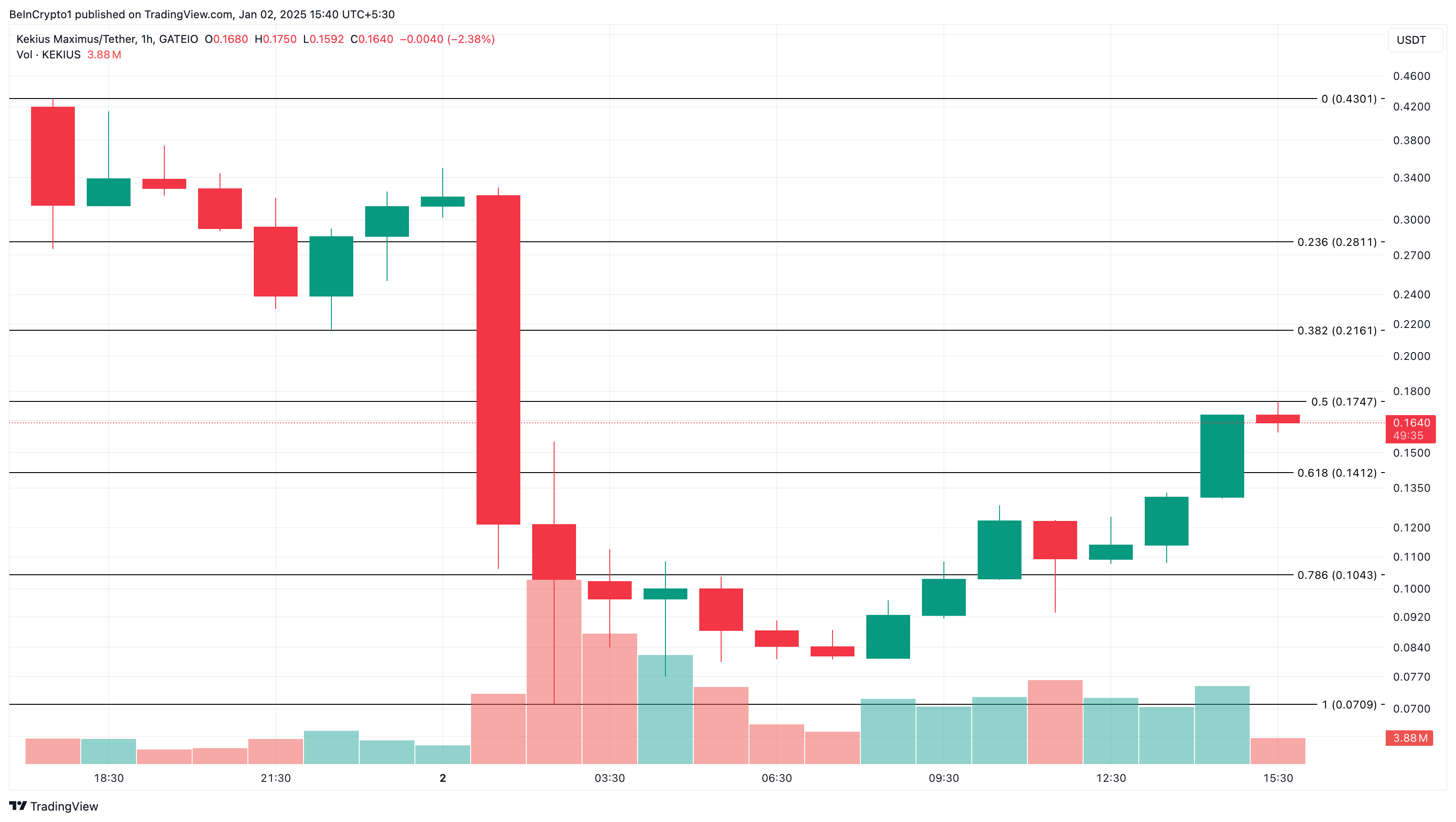

However, the 1-hour chart shows that the token has erased some of those losses. If sustained, KEKIUS value might rally toward $0.28 in the short term. On the flip side, if bears take over the price action, it could decline to $0.10.

Kekius Maximum 1-Hour Analysis. Source: TradingView

Kekius Maximum 1-Hour Analysis. Source: TradingView ai16z (AI16Z)

Ai16z, a token deployed by venture capital led by AI agents, has increased by 20% in the last 24 hours, which is why it is trending. Beyond that, the bullish sentiment around AI agent cryptos is another reason it is on the list.

As of this writing, AI16Z trades at $2.27. On the 4-hour chart, the Bull Bear Power (BBP) has remained in the positive region. This indicates that bulls are in control of the altcoin’s direction.

ai16z 4-Hour Analysis. Source: TradingView

ai16z 4-Hour Analysis. Source: TradingView Should this remain the same, then the token’s value might rally toward $3.50. However, if bears have the upper hand, the trend might change. If that is the case, AI16Z could decline to $1.73.