-

Recent movements in Bitcoin indicate a strong investor support as the cryptocurrency’s supply on exchanges sees a significant drop, while institutional interest continues to surge.

-

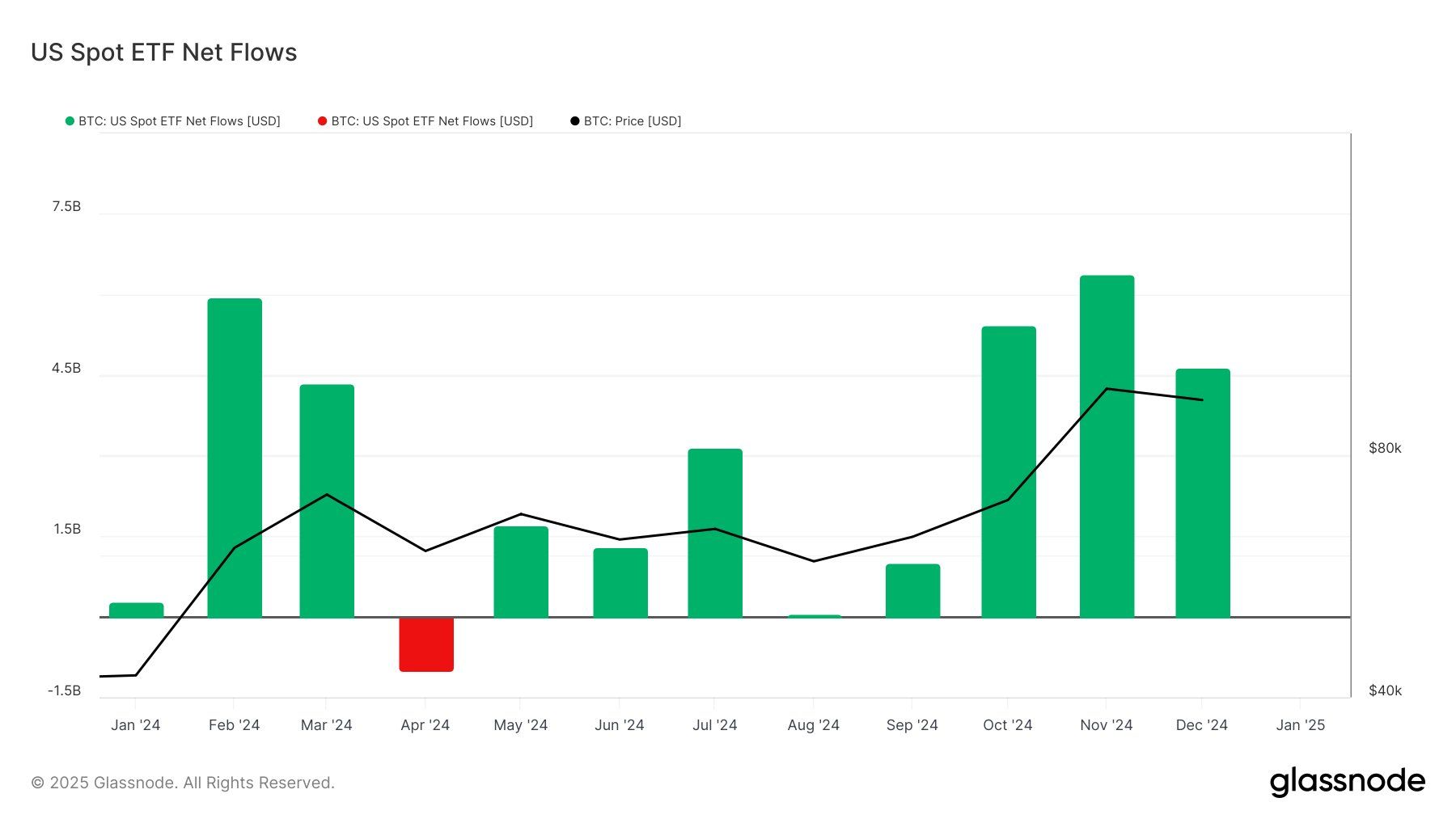

With December witnessing a massive $4.63 billion in net flows into Bitcoin ETFs, it’s clear that institutional investors are positioning themselves for a bullish market.

-

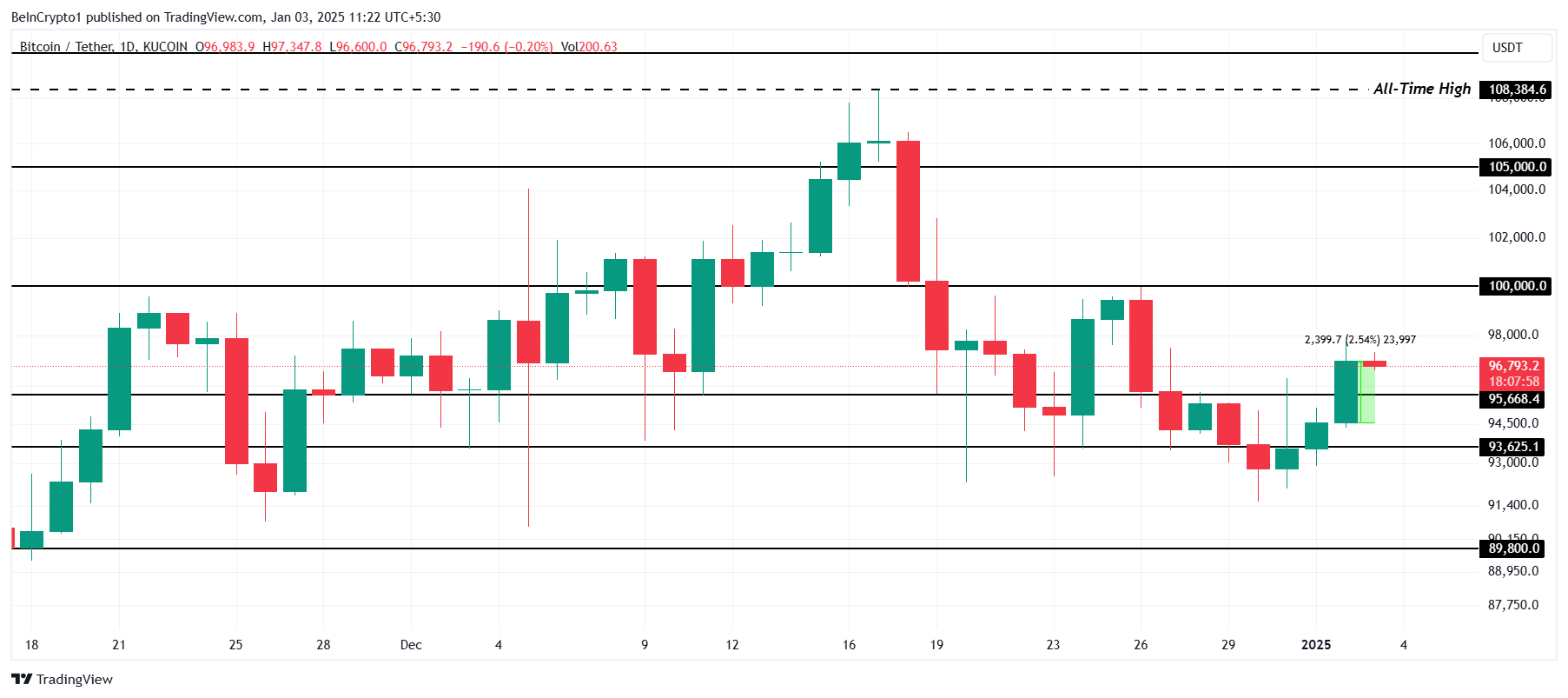

Bitcoin’s price stability is critical, as it sits at $96,793, needing to maintain a support level of $95,668 to avoid potential downturns.

Bitcoin’s recent performance reflects strong investor confidence and significant institutional interest, signaling potential price movements ahead.

Current Market Dynamics and Investor Sentiment

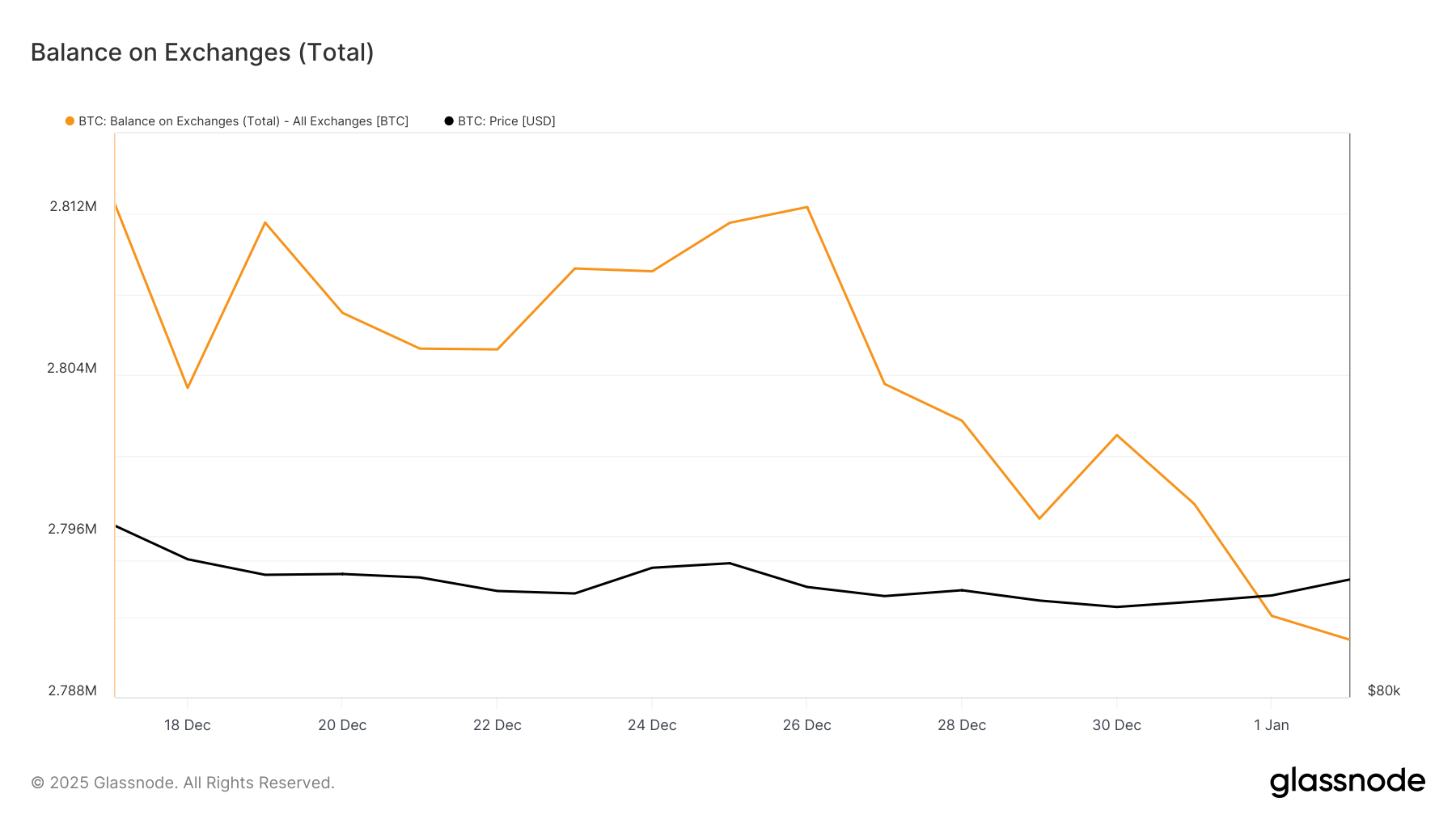

In a notable shift, the supply of Bitcoin on exchanges has decreased by 11,000 BTC within a short span, signifying a reduction in selling pressure and an increasing trend in accumulation by investors. As of late, total accumulation has soared to approximately $1 billion, reflecting a growing confidence among Bitcoin holders that the current price stagnation is temporary.

This substantial decrease in supply coincides with a marked increase in institutional investor interest. In December alone, Bitcoin ETFs attracted a near-record influx of $4.63 billion, well above the average monthly total for 2024, which was approximately $2.77 billion. Such inflows highlight a persistent optimism among institutions regarding Bitcoin’s long-term prospects, even during volatile market conditions.

Price Targets and Key Levels for BTC

The current price of Bitcoin is $96,793, which has been buoyed by the critical support level at $95,668. Maintaining this price floor is essential for targeting the psychologically significant mark of $100,000. Market indicators suggest that there is potential upward momentum if this threshold is maintained.

Flipping the $100,000 level to support could lead Bitcoin towards a target of $105,000, which would signify a major recovery milestone. However, should Bitcoin fail to hold above the $95,668 support, a drop to around $93,625 becomes plausible, with further declines to $89,800 looming as a serious concern.

Investors are advised to closely monitor these levels as they will serve as crucial indicators of Bitcoin’s market direction and overall health.

Conclusion

In summary, Bitcoin’s market appears to be navigating through critical support levels, backed by robust institutional interests and optimistic sentiment from retail investors. The ability to hold above the $95,668 threshold is vital for continuing its upward trajectory, while a breach could alter the current bullish outlook. Awareness of these dynamics will be essential for investors as they consider their next steps in the evolving cryptocurrency landscape.