Key Points

- New Hampshire is the latest state to introduce SBR bill.

- Meanwhile, Meta received a BTC Treasury shareholder proposal.

Today, Bitcoin’s price holds above $94,000, amidst huge optimism flooding the crypto industry 10 days before the Trump administration’s debut.

BTC Trades Above $94,000

At the moment of writing this article, BTC is trading above $94,000, following yesterday’s price dip to $92,000 levels.

BTC price in USD todayOn January 10, BTC’s price dropped below $93,000 following better-than-expected US unemployment data, before a rebound above $95,000.

The crypto market maintains optimism as the countdown for the new Trump administration debut in the US begins. Trump and his cabinet are expected to bring crypto-friendly policies and important names supporting the digital asset ecosystem.

Also, efforts for Bitcoin Reserves are intensifying in the US, with more states already introducing bills to establish Strategic Bitcoin Reserves (SBRs).

New Hampshire Introduces SBR Bill

According to the latest reports from Satoshi Act Fund founder and CEO, Dennis Porter, Rep. Keith Ammon introduced a bill to create an SBR in New Hampshire.

Dennis Porter via X

Dennis Porter via X The act reveals the intention to enable the state treasury to invest in precious metals and digital assets.

Also, North Dakota representatives and senators introduced a bill to invest state funds in digital assets as well.

Legislative Assembly in North Dakota

Legislative Assembly in North Dakota Porter also mentioned Pennsylvania, Texas, and Oklahoma which have already taken the same action.

Meanwhile, new reports reveal that Meta got a proposal from the shareholders to assess the addition of Bitcoin to its Treasury.

Meta Receives BTC Treasury Shareholder Proposal

Meta shareholders requested that the board conduct an assessment to determine if adding BTC to the company’s treasury is in their best interest.

The official notes mention that as of September 30, 2024, Meta has $256 billion in total assets of which $72 billion in cash, cash equivalents, and marketable securities, including US government bonds and corporate bonds.

As cash is consistently being debased and bond yields and lower than the true inflation rate, 28% of Meta’s total assets are consistently diminishing the shareholder value by sitting on the balance sheet, the argument says.

The proposal says that Meta should consider replacing some percentage of the assets with others that can appreciate more, despite their volatility in the short term, such as Bitcoin – the most inflation-resistant store of value available.

Reasons to Add BTC to Meta’s Treasury

1. BTC’s Impressive Price Trajectory Over Time

The notes also mention how as of December 20, 2024, BTC’s price increased by 124% YoY, outperforming bonds by 119% on average. Also, over the past 5 years, the price of BTC increased by 1,265%, outperforming bonds by 1,262%.

2. BlackRock’s Advice

The same notes state that Meta’s second-largest institutional shareholder, BlackRock, advised a 2% BTC allocation is reasonable, and the reasoning is applicable to Meta’s assets as well.

3. Rising Corporate and Institutional BTC Adoption

The report also brings up corporate and institutional BTC adoption, mentioning MicroStratgy’s success. As an argument, MicroStrategy’s stock outperformed Meta’s stock by over 2,100% over the past five years. Also, it became the first BTC-centric company to be added to the Nasdaq 100 Index.

4. BTC ETFs’ Impressive Performance

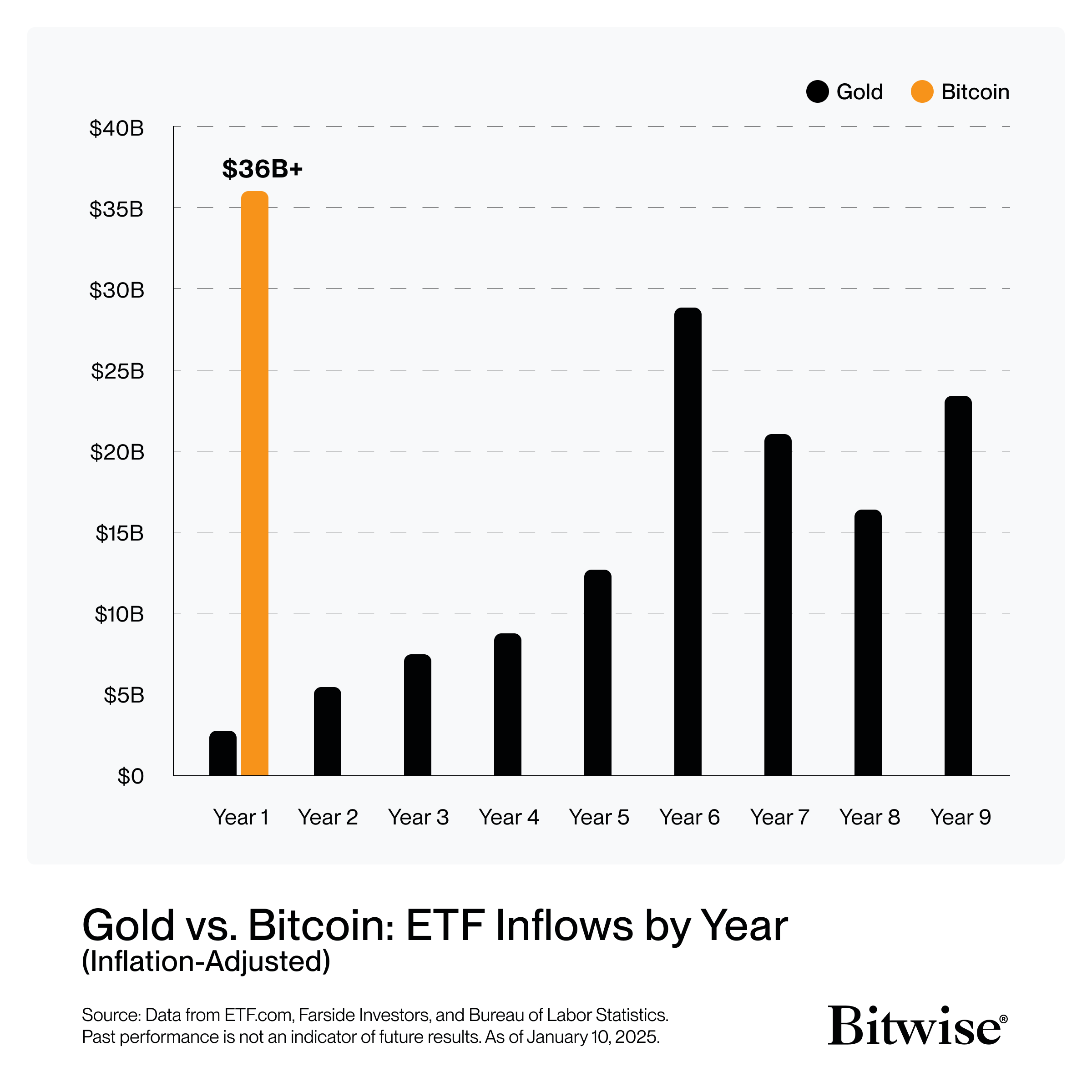

Also, BlackRock’s BTC ETF is the fastest growing in history as Larry Fink noted back in March 2024. Today marks exactly one year since BTC ETFs went live, recording over $36 billion in total flows in one year.

Also, BTC ETFs surpassed $20 billion in net flows much faster than gold. Btiwise recently shared a comparison between BTC ETFs and gold’s trajectory for the first year, showing the crypto products’ huge progress.

Bitwise via X

Bitwise via X The notes conclude that as Meta has always been a forward-thinking company, it should consider adding BTC to its reserves as well. Bitcoin has already surpassed Meta in terms of assets by market cap. While Meta is placed in the 10th position, BTC is sitting in the 7th spot on the list of top assets by market cap in the world.

Meta – BTC Treasury Assessment

Meta – BTC Treasury Assessment Amidst rising global adoption and multiple efforts to establish strategic reserves in the US, and considering the upcoming Trump administration, which will debut on January 20, there are plenty of reasons to remain optimistic about Bitcoin and the entire crypto industry.