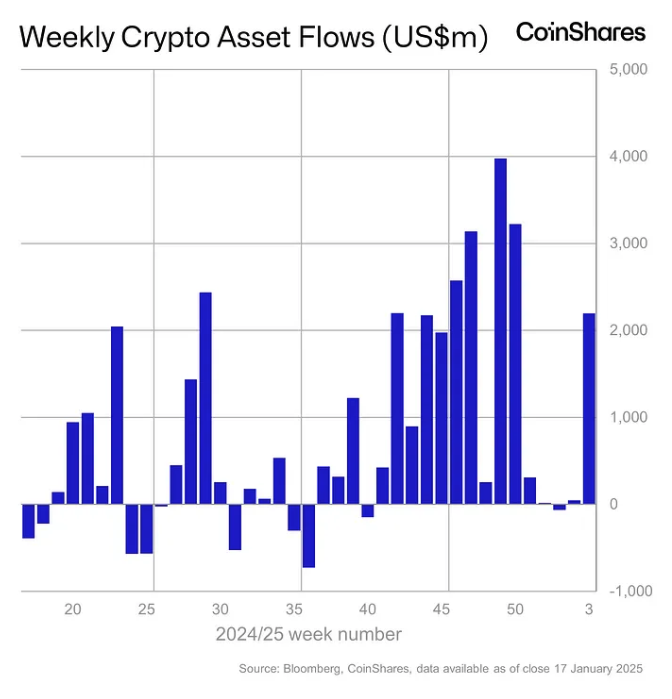

'Trump inauguration euphoria' prompts $2.2 billion in crypto fund flows and AUM all-time high: CoinShares

Global crypto funds run by asset managers such as BlackRock, Bitwise, Fidelity, Grayscale, ProShares and 21Shares registered net inflows of $2.2 billion last week, the largest of the year so far, according to CoinShares.

Prompted by “Trump euphoria” leading up to Inauguration Day and, combined with positive crypto price action over the past week, the inflows propelled assets under management at the funds to an all-time high of $171 billion, CoinShares Head of Research James Butterfill said in a Monday report.

Trading volumes for global exchange-traded products also remained high at $21 billion last week, representing 34% of total bitcoin trading on trusted exchanges, Butterfill noted.

Weekly crypto asset flows. Images: CoinShares .

U.S. and bitcoin-based funds lead

Unsurprisingly, U.S.-based crypto funds led regionally, generating $2.1 billion of the net weekly inflows. Digital asset investment products in Switzerland and Canada also witnessed net inflows of $88.9 million and $13.4 million, respectively. However, funds in Sweden and Germany saw net outflows of $14.5 million and $2.4 million, respectively.

Bitcoin-based investment products dominated last week’s net inflows globally, adding $1.9 billion. They remain the best-performing crypto funds this year so far, clocking $2.7 billion worth of net inflows. The U.S. spot Bitcoin exchange-traded funds represented $1.86 billion of the overall net inflows, according to data compiled by The Block, driven by a strong end to the week.

Ethereum-based funds also witnessed net inflows totaling $246 million, correcting the outflows it had seen year-to-date. U.S. spot Ethereum ETFs accounted for $212 million of those net inflows last week, according to The Block's data dashboard.

XRP investment products were another benefactor of the bullish sentiment, adding a further $31 million to an inflow streak that now totals $484 million since mid-November, Butterfill noted, amid the cryptocurrency’s surge to its first all-time high in seven years.