Key Points

- As of February 2, MicroStrategy holds $471,107 BTC, worth over $44.8 billion at current prices.

- BTC trades above $94,000, following an earlier dip to $92,000 levels.

Earlier, Michael Saylor announced that MicroStrategy has paused its Bitcoin buying spree, ending its 12-week buying streak. Bitcoin rebounded above $95,000 today, following an earlier dip to $92,000 levels.

MicroStrategy Pauses Bitcoin Buying Spree

Saylor announced in a post via X that last week, MicroStrategy didn’t sell any shares of class A common stock under its at-the-market equity offering program, and did not purchase any Bitcoin.

As of February 2, the company is holding 471,107 BTC acquired for $30.4 billion at $64,511 per coin. The current value of the company’s holdings is above $44.8 billion.

Michael Saylor via X

Michael Saylor via X Bloomberg highlighted that the company ended its Bitcoin buying spree that lasted for 12 consecutive weeks.

Since November 11, MicroStrategy bought BTC every Monday until January 27 when the company made its last purchase of 10,107 BTC.

The publication mentioned above also noted that these purchases have coincided with a record-breaking rally in Bitcoin’s price that had been driven by Trump’s embrace of crypto and the subsequent crypto-friendly agenda that the new administration brings.

During this period, MicroStrategy bought more than $20 billion in BTC, increasing its overall holdings to over 2% of BTC that will ever be minted.

Bloomberg also noted that The Tysons Corner, a Virginia-based enterprise software company turned leveraged Bitcoin proxy led by Michael Saylor aims to raise $42 billion of capital through 2027.

Today, Bitcoin’s price rebounded above $95,000 following an earlier dip to $92,000 levels triggered by multiple factors.

Bitcoin Trades Above $94,000

At the moment of writing this article, BTC is trading above $94,000, down by 4% today. Earlier, BTC reclaimed $95,000 after it dipped to $92,000 today.

BTC price in USD todayBitcoin’s price drop coincided with a wider crypto market sell-off, following massive liquidations after Trump imposed tariffs on Canada, Mexico, and China.

More Crypto Liquidations than Officially Reported

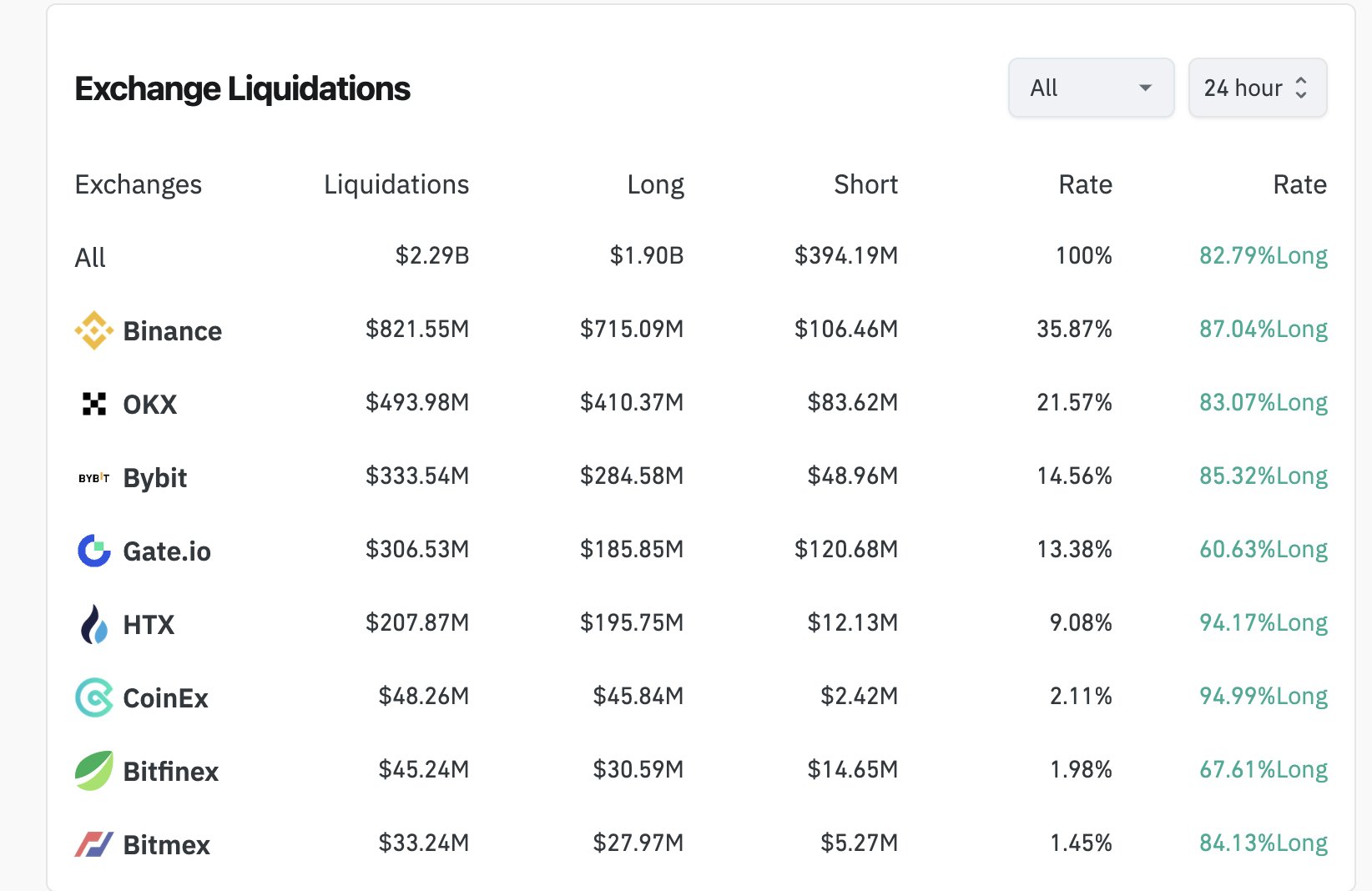

Earlier today, Bybit’s CEO, Ben Zhou said that the total real crypto liquidations are more than $2 billion, reaching between $8 and $10 billion.

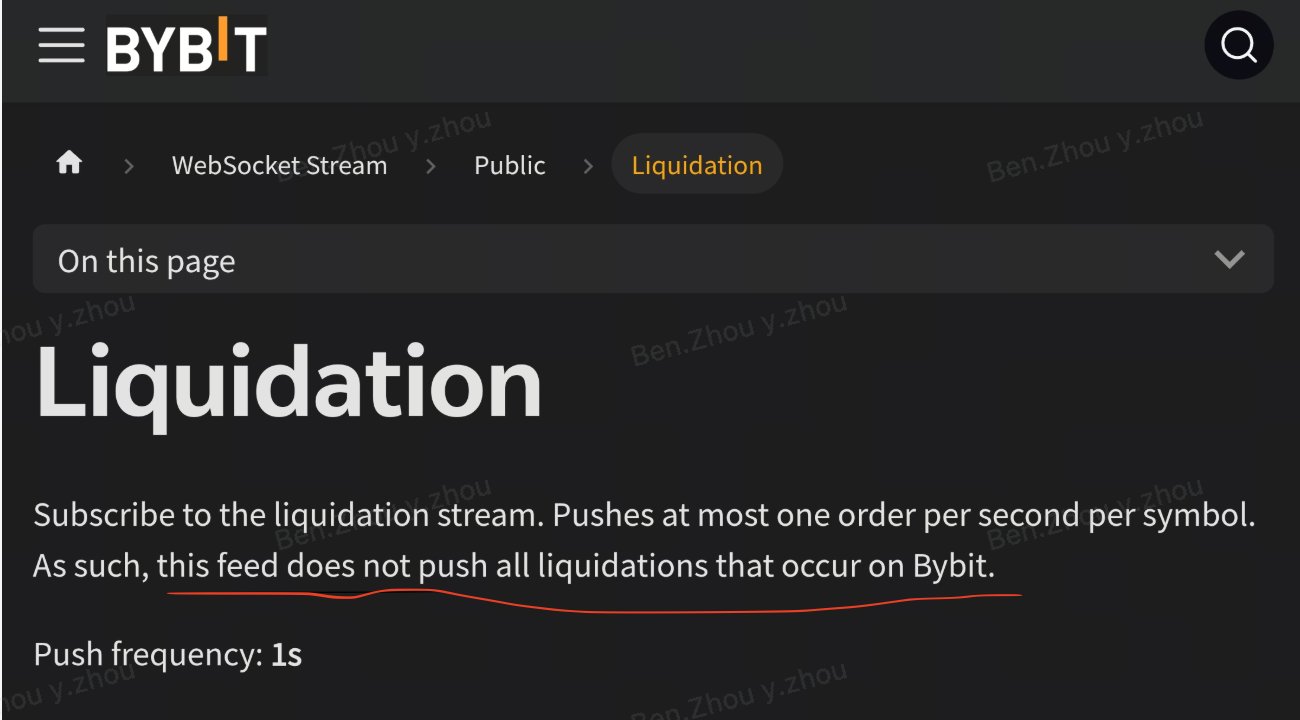

In a post via X, he noted that Bybit’s 24-hour liquidations recorded on CoinGlass were around $333 million, however, this is not the entire amount.

The exchange has an API limitation on how many feeds are pushed out per second, and other exchanges reportedly practice the same to limit liquidation data.

Ben Zhou via X – CoinGlass data

Ben Zhou via X – CoinGlass data He also said that Bybit will start to push all liquidation data as they believe in transparency.

Bybit official data

Bybit official data The overall crypto market is down by over 7% in the past 24 hours, having a market cap of $3.09 trillion.