Is Bitcoin price finally ready for a bullish comeback? The bears had a strong run last week, and managed to push price lower, and undoing a sizable chunk of the gains attained in November last year.

Despite the sell pressure, Bitcoin price has already bounced back significantly during the weekend, indicating that there was a significant amount of accumulation taking place.

For context, Bitcoin price fell as low as $78,197 on Friday and has since bounced back to $85,110 at press time. A 10% gain from its recent low. But could this signal the start of a bullish recovery?

Bitcoin price action | Source: TradingView

Bitcoin price action | Source: TradingView One of the main reasons for Bitcoin price snapping back as quickly as it did this weekend was the fact that it was oversold at its recent weekly low.

Can Bitcoin price yield a bullish week ahead?

Bitcoin Exchange flows confirm that demand was on the rise during the weekend. This could be a precursor for more bullish activity ahead but only if demand remains significantly stronger than sell pressure.

According to CryptoQuant, Exchange flows were at their lowest level observed in the last 6 weeks. The last time that exchange flows were this low was near mid-January.

More importantly, exchange outflows were significantly higher at 8,697 BTC compared to 7,417 BTC in exchange inflows at the time of observation. This confirmed that there was a significant gap between inflows and outflows, this time in favor of the bulls.

Bitcoin exchange flows | Source: TradingView

Bitcoin exchange flows | Source: TradingView This outcome was further confirmation that demand was ballooning during the weekend. There are a few other signs indicating that sentiment is shifting in favor of bullish expectations.

A prominent example is a report revealing that someone recently executed 2 long positions collectively totaling $195 million at 50X leverage. This comes at a time when demand in the derivatives segment was recently crushed by heavy liquidations.

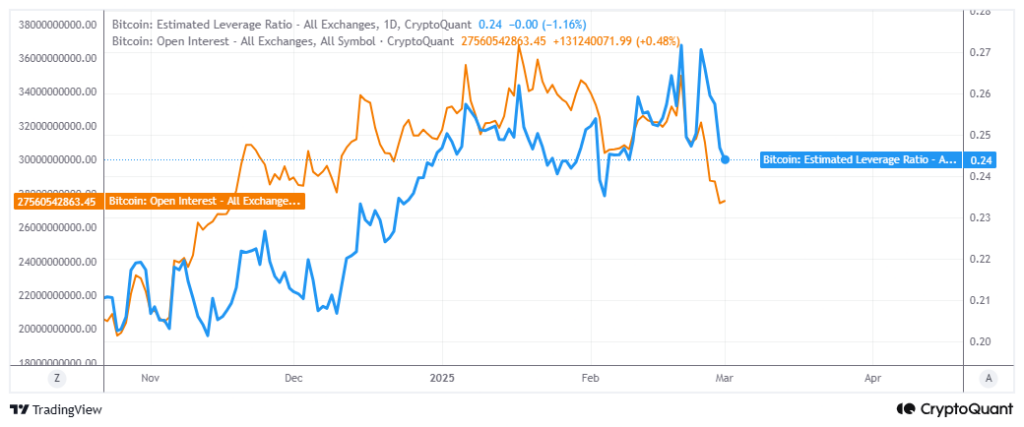

Both Bitcoin open interest and estimated leverage ratio tanked by a substantial margin since 20 February. A reflection of the shift from market confidence to uncertainty as price dipped lower.

Is the bearish wave over or will Bitcoin price slide lower?

This is the question that many traders probably have right now. Especially considering that previous bearish pauses have yielded more downside, leading to more losses for holders.

Some points to note include weak whale activity despite the recent pause. This may signal that whales are anticipating more downside. On the other hand, institutions pumped $94.3 million into BTC on Friday. This may have set the bullish mood during the weekend.

Meanwhile, Bitcoin dominance pushed back above 61% despite expectations that a slide below 60% would pave the way for altcoin season.

Bitcoin price action has a better chance at a bullish outcome this week. However, there is still considerable risk of more downside given weak demand from whales.

In case of more downside, BTC could encounter the next support levels near $76,000 and the 467,000 price level. The second support level means Bitcoin will have given up its November gains. Another major dip would allow buyers to get in at a more discounted price.