Newmarket Capital CEO suggests the U.S issue $2t ‘Bit Bonds’ to buy Bitcoin

Newmarket Capital CEO Andrew Hohns suggests incorporating Bitcoin into government bonds as a way to reduce national debt and purchase Bitcoin for the U.S. strategic reserve.

At the Bitcoin ( BTC ) Policy Institute’s Bitcoin for America on March 11, Hohns proposes the idea of “Bit Bonds,” a novel type of U.S. Treasury bond that incorporates Bitcoin into government financing. The idea is to use bond issuance to reduce government borrowing costs and build a strategic Bitcoin reserve , while offering American families a tax-free investment vehicle.

Hohn suggested the U.S. government issue around $2 trillion Bit Bonds, with 90% of the funds allocated for government purchase and 10% of the proceeds would be used to buy Bitcoin. This means that for every $100, around $10 would go to BTC.

“If it’s a $2 trillion issuance right off the bat, that would mean $200 billion worth of Bitcoin if purchased at $90,000 per BTC. That’s 2.22 million Bitcoin. Of course, the price will fluctuate and likely we’ll acquire a different amount than that,” said Hahn during his presentation.

According to the Newmarket Capital CEO, the bonds would enable the United States federal government would be able to acquire $200 billion worth of Bitcoin while saving the government $554 billion in 10-year interest rates at the same time.

This is because Bit Bonds offer a much lower rate of 1% per year compared to the 4.5% interest rate of U.S. Treasuries. Thus, it could significantly cut interest expenses.

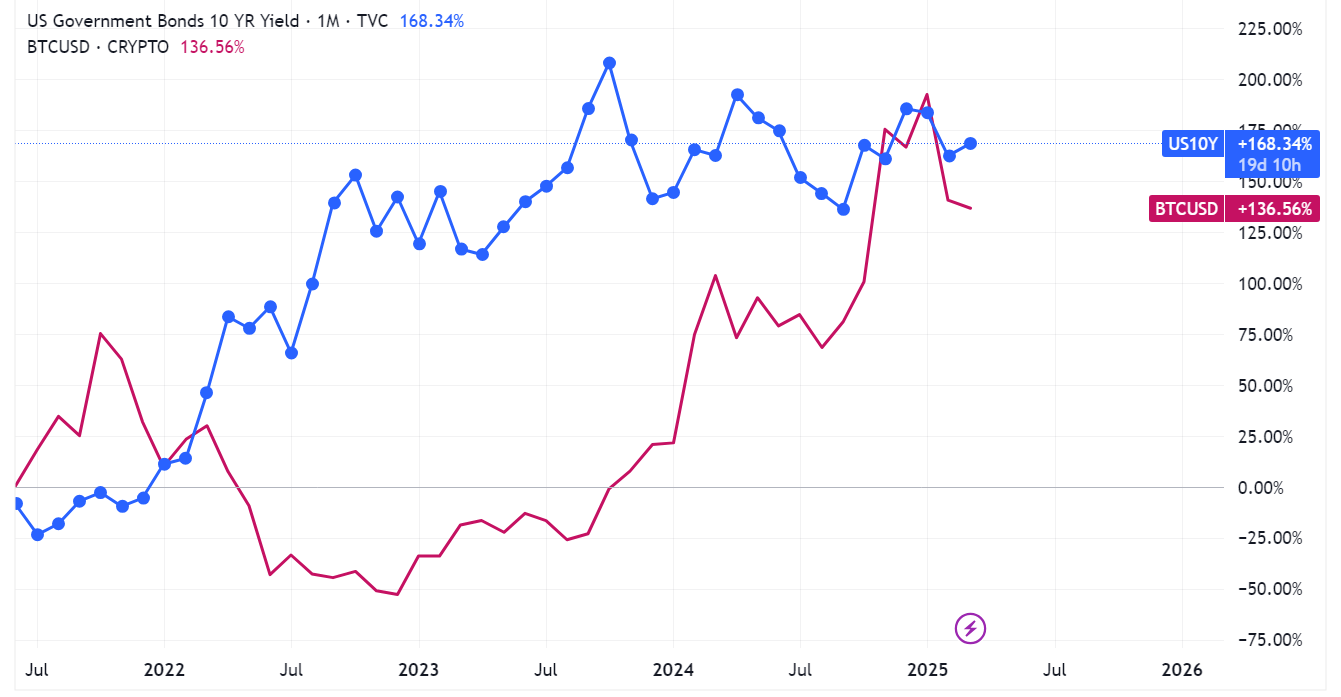

A chart comparing Bitcoin’s growth to the U.S. Treasuries 10-year yields, March 12, 2025 | Source: TradingView

A chart comparing Bitcoin’s growth to the U.S. Treasuries 10-year yields, March 12, 2025 | Source: TradingView Moreover, he said Bit Bonds would become an attractive investment for foreign investors, because they can serve as eligible collateral for range of different swap and derivative arrangements. According to Hahn, investors stand a chance to receive a 4.5% compound annual growth rate on a senior basis, which aligns with the current Treasury yields.

After earning this fixed return, investors receive a 50% share from the upside of the Bitcoin purchase, while the U.S. government receives the remaining 50%. Depending on Bitcoin’s performance, the total returns for investors can be quite attractive, ranging from nearly 7% to as high as 17% annually on a tax-free basis.

“It produces a government entitlement of Bitcoin that is slightly greater than $50.8 trillion which is the expected size of the funded federal debt in the year 2045. In other words, with this plan, we’re in a position to defease the federal debt,” explained Hahn.

In addition, he also suggested Bit Bonds become available for American citizens as it is a ” powerful tool to defend against inflation.” As a savings instrument, Hahn said the bonds should be free of income tax and capital gains tax for the American people.

He claimed a family could invest $2,900 and receive a yield of 7% to 17% over a 10-year period, depending on Bitcoin’s performance throughout the years.