-

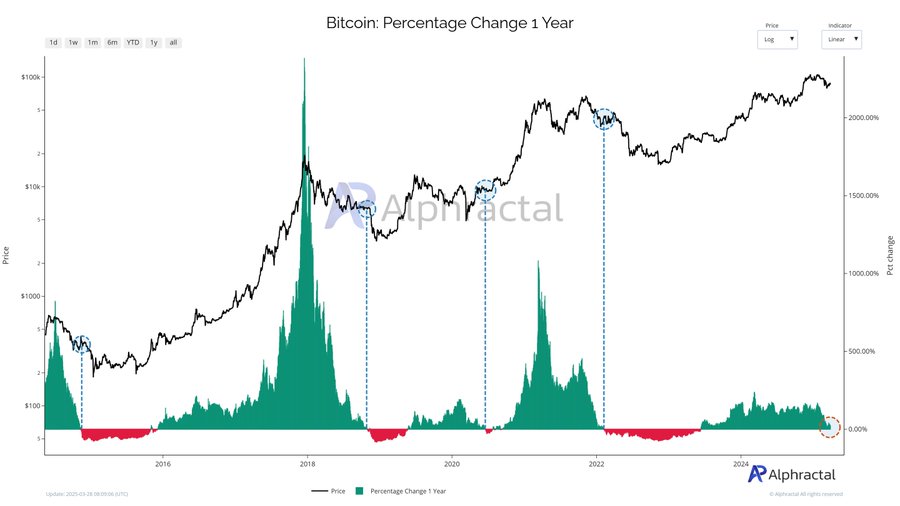

Bitcoin is at a critical juncture as its 1-year percentage change approaches the negative zone, raising concerns among investors about a potential downturn.

-

While historical data indicates that such movements often precede bearish trends, this time could draw parallels to 2020, suggesting a potential opportunity for recovery.

-

As noted by Alphractal, “Analysts are divided on whether this indicates a consolidation phase or the risk of a new bearish cycle,” highlighting the uncertainty in market sentiment.

This article explores Bitcoin’s current market situation as its 1-year percentage change nears negative territory, assessing implications and potential outcomes.

Understanding Bitcoin’s 1-Year Percentage Change and Its Implications

The 1-year percentage change of Bitcoin measures its price fluctuations over the past twelve months, acting as a crucial indicator of market performance. When the change drifts into the negative zone, it signifies that Bitcoin’s current price is lower than it was a year prior, which can heavily influence investor sentiment.

This negative shift is often linked to a **decrease in buying interest** and an increase in selling pressure. Historically, of the past instances where the percentage entered the negative, three out of four led to prolonged downturns. However, **external factors** and market conditions can create exceptions, making it imperative to analyze current contexts before drawing conclusions.

Past Market Patterns: Lessons Learned

An analytical review of Bitcoin’s price trends indicates that the 1-year percentage change dipped below zero during critical phases in its history. Notably, in 2015, the dip occurred while recovering from the 2014 bear market, presenting a brief fluctuation. Conversely, the longest stretch of negative change emerged between 2018 and 2019, when Bitcoin plummeted from $20,000 to around $3,200.

Source: Alphractal

Currently, as of March 2025, Bitcoin’s percentage change is nearing zero. Analysts express differing opinions on what this signifies—whether it foreshadows another downturn akin to previous bear cycles, or it marks a solid foundation for future growth, reminiscent of 2020’s market dynamics.

Analyzing the Potential for Market Consolidation

Despite fears of Bitcoin entering a negative phase, historical cases like that of 2020 offer a glimmer of hope. During that time, the 1-year change dipped into the negative, yet it did not lead to a protracted downturn. Instead, that phase functioned as a consolidation before an eventual bullish breakout that spurred further price appreciation.

Today, Bitcoin’s stability near the negative zone could suggest a similar scenario. If the market echoes past patterns, we might witness a temporary period of stagnation, then a renewed drive upward as bullish forces gather strength once again.

Risks Inherent to Continued Negative Movements

A sustained negative movement in Bitcoin’s 1-year percentage change could foretell a deeper decline. Historical trends indicate that negative metrics typically accompany bearish cycles, signaling lost market momentum and potentially pushing investors toward a **risk-off** stance.

If Bitcoin’s price drops further, it could spell trouble, compelling a reassessment of support levels and possibly prompting panic selling. This could deepen an ongoing bear cycle, resulting in significant implications for market participants.

Conclusion

In summary, Bitcoin’s approach towards the negative zone in its 1-year percentage change presents a pivotal moment for investors to watch. While historical trends suggest potential for downturns, there are pathways that could lead to consolidation or eventual recovery, mirroring past performances. Staying informed and vigilant will be essential as the crypto markets navigate this uncertain landscape.