-

Bitcoin approaches the critical $80,000 support with a looming Death Cross, raising concerns over potential bearish trends and investor sentiment.

-

Many short-term holders are realizing losses, putting extra pressure on Bitcoin’s price as long-term holders struggle to stimulate demand.

-

Failure to retain the $80,000 support could lead Bitcoin towards $76,741, while breaking above $85,000 may ignite bullish sentiment.

Bitcoin faces critical market challenges as the $80,000 support is tested amid growing bearish sentiment, particularly from short-term holders.

Bitcoin Investors Are Skeptical Amid Market Challenges

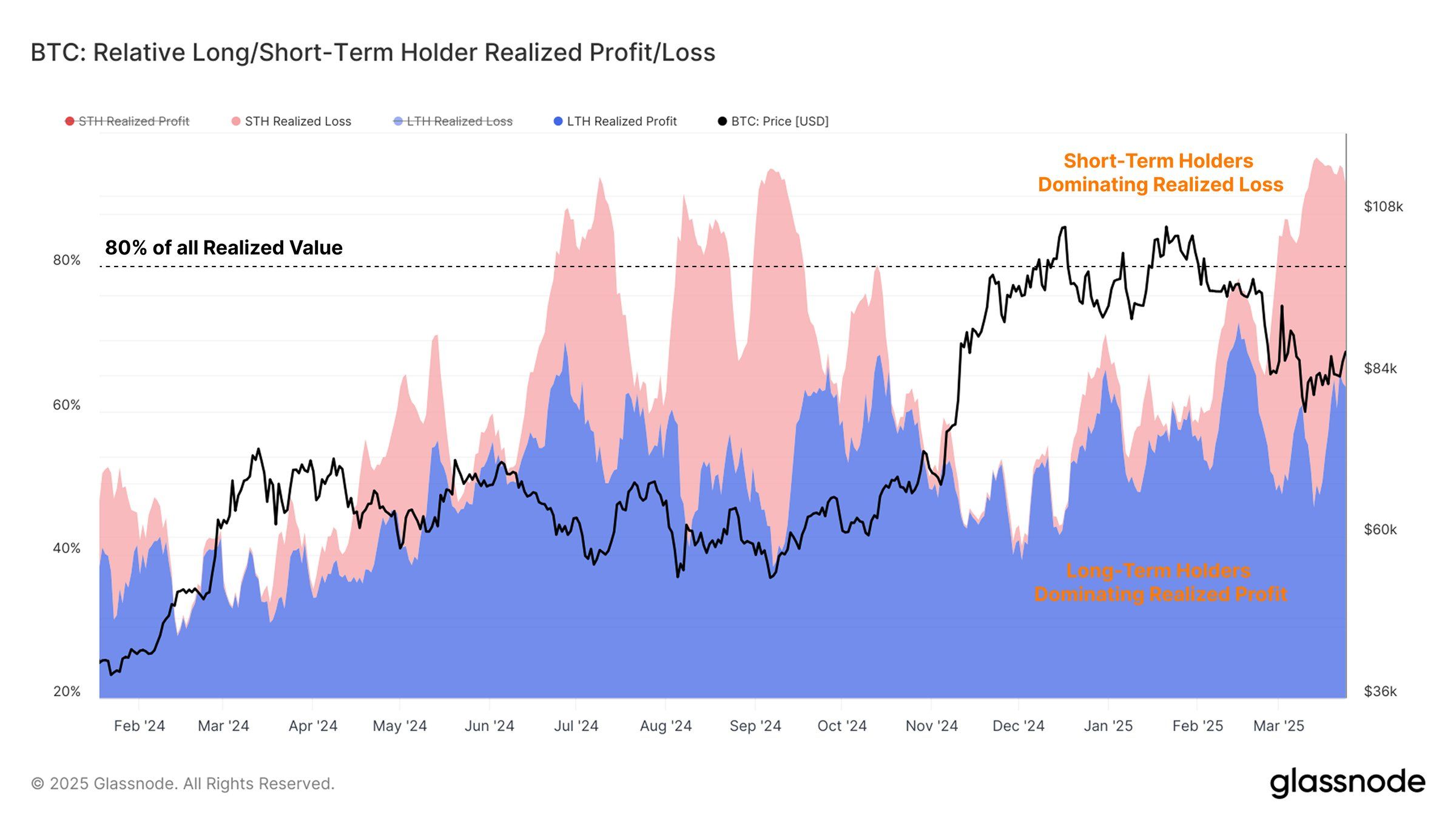

Short-Term Holders (STHs) of Bitcoin, who entered the market at higher price points, are a significant factor in the ongoing downward pressure on Bitcoin’s value. As market volatility persists, many of these investors are reporting losses, which exacerbates the instability in price movements. This trend indicates a turbulent environment that poses challenges for new investors seeking to navigate the crypto market effectively.

In contrast, Long-Term Holders (LTHs) are generally realizing profits due to their prolonged market presence. However, the current trend is characterized by a stagnation of new capital inflows. STH losses are not being counterbalanced by LTH profits, leading to weakened overall demand. The consequences of this situation reflect a neutral market sentiment where ongoing profit-taking and loss realization neutralize each other.

Bitcoin Realized Profit/Loss. Source: Glassnode

Further compounding these concerns is Bitcoin’s macro momentum, which signals additional bearish pressure. The Exponential Moving Averages (EMAs) indicate that the 200-day EMA is within 3% of crossing below the 50-day EMA, an occurrence known as a Death Cross. Such a pattern has historically led to substantial price corrections, potentially marking the end of Bitcoin’s 18-month-long Golden Cross period.

As traders and investors keep a vigilant watch on the EMAs, any indication of a retracement can escalate market fears. If the 50-day EMA does cross below the 200-day EMA, heightened sell-offs could follow, further exacerbating the bearish market sentiment.

Bitcoin Death Cross Nears. Source: TradingView

Is BTC Price Primed For Further Decline?

Currently trading at $82,248, Bitcoin nears the psychological support at $80,000. Despite numerous attempts at breakout, Bitcoin has consistently failed to surpass key resistance levels defined by a two-month-long broadening descending wedge pattern. This technical formation signals that Bitcoin may face further declines.

Should the downward trend continue, breaching the $80,000 support level could propel Bitcoin toward $76,741. Such a decline reinforces a bearish perspective, especially given the current lack of robust buying support alongside negative technical indicators. A breakdown below these levels could suggest a more pronounced price correction.

Bitcoin Price Analysis. Source: TradingView

Conversely, if Bitcoin manages to reclaim $82,761 as a support level, the short-term bearish outlook might be invalidated. A significant move past the $85,000 resistance could indicate a breakout from the existing pattern, uplifting market sentiment and potentially signaling a bullish reversal. A rally surpassing $86,822 would be necessary to indicate a resumption of the bullish trend previously observed, effectively negating the prevailing bearish outlook.

Conclusion

In summary, Bitcoin’s current market position underscores a critical juncture, with the possibility of a Death Cross raising alarms among traders. The balance between short-term realizations and long-term holding profits creates a complex investor landscape. With the critical support levels being tested, many are left contemplating whether Bitcoin will stabilize or face further declines. The coming days will be crucial in determining the direction of Bitcoin’s price and the broader market mood.