Bitcoin Flashes Bullish Divergence: Are We Headed for a Trend Reversal?

Bitcoin Price Prediction

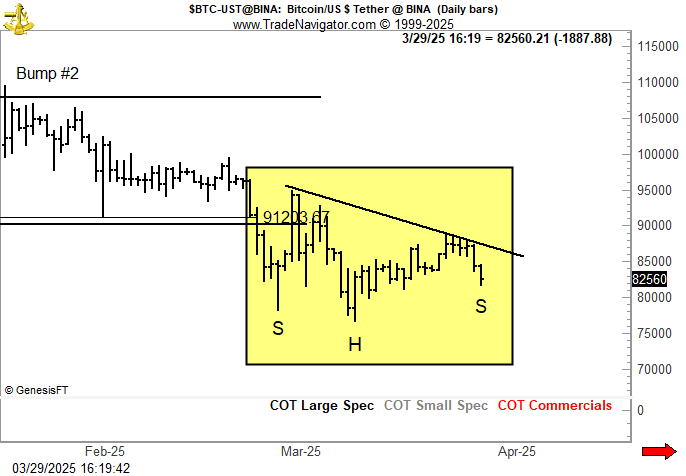

Bitcoin Price Prediction Bitcoin (BTC) is showing early signs of a bullish reversal, but not everyone is convinced. A classic inverse head-and-shoulders (H&S) formation has emerged on the daily chart—typically a strong signal of upside potential. However, veteran chartist Peter Brandt is urging caution.

Brandt, a seasoned commodity trader with over four decades of experience, points to a downward-sloping neckline, which could undermine the reliability of the pattern.

“I prefer H&S patterns with horizontal necklines,” he noted, adding that sloped necklines often suggest weakened buying pressure and a higher likelihood of false breakouts.

This aligns with the broader market narrative: while Bitcoin is attempting to find its footing, momentum remains fragile amid macro uncertainty and mixed technical signals.

Bitcoin Price Analysis – March 30, 2025

As of writing, Bitcoin trades at $83,098, recovering slightly from a session low of $82,978. The price remains compressed within a broad symmetrical triangle, reflecting the market’s indecision heading into month-end.

The key pivot level at $83,662—which has acted as both support and resistance in recent sessions—remains under pressure but hasn’t yet been reclaimed. A strong close above this level would signal a potential shift in momentum.

Bullish Divergence in Focus

On the 2-hour timeframe, the Relative Strength Index (RSI) presents a bullish divergence: price made a lower low, while RSI made a higher low, now reading 41.94.

This often hints at waning bearish momentum and sets the stage for a short-term bounce—if bulls can break above resistance.

The immediate hurdle lies at the 50-period EMA ($84,538). A clean break above it could pave the way toward:

- $85,551 – short-term breakout target

- $86,927 – triangle resistance and potential upside cap

Conversely, failure to hold $81,278 support would invalidate the bullish setup, exposing BTC to further downside toward $79,990 or even $78,319.

Chart Overview: Inverse H&S with a Twist

Brandt’s caution is visually evident. The inverse H&S pattern forming since early March features a clearly sloped neckline, diverging from traditional bullish structures. As shown in the highlighted yellow zone:

- Left Shoulder (S) formed mid-March

- Head (H) bottomed on March 20

- Right Shoulder (S) is developing with lower highs

- Neckline resistance coincides with ~$91,200, trending downward

This structure may still break to the upside—but traders should watch for a volume-supported breakout to validate any move.

Conclusion

Bitcoin is showing early signs of a bullish reversal, supported by RSI divergence and a potential inverse H&S formation. However, Peter Brandt’s warning about the sloping neckline shouldn’t be ignored—especially in a market lacking strong volume confirmation.

A break above $84,538, accompanied by rising volume, would strengthen the bullish case. Until then, traders should tread carefully. Fakeouts are common in this kind of setup, and the current macro environment only adds to the uncertainty.

BTC Bull: Earn Bitcoin Rewards with the Hottest Crypto Presale

BTC Bull ($BTCBULL) is making waves as a community-driven token that automatically rewards holders with real Bitcoin when BTC hits key price milestones. Unlike traditional meme tokens, BTCBULL is built for long-term investors, offering real incentives through airdropped BTC rewards and staking opportunities.

Staking & Passive Income Opportunities

BTC Bull offers a high-yield staking program with an impressive 119% APY, allowing users to generate passive income. The staking pool has already attracted 882.5 million BTCBULL tokens, highlighting strong community participation.

Latest Presale Updates:

- Current Presale Price: $0.002425 per BTCBULL

- Total Raised: $4M / $4.5M target

With demand surging, this presale provides an opportunity to acquire BTCBULL at early-stage pricing before the next price increase.