Date: Mon, March 31, 2025 | 03:30 PM GMT

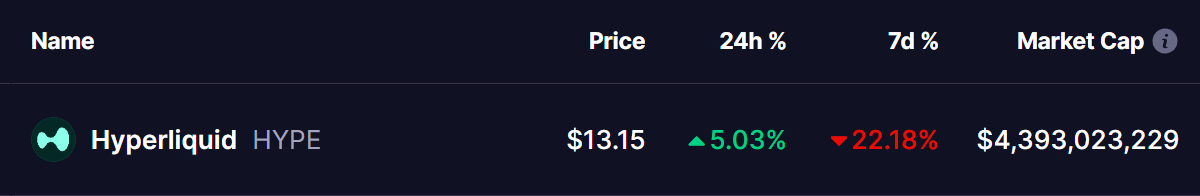

The cryptocurrency market has faced significant selling pressure, with Ethereum (ETH) dropping over 11% in the past week. This decline has been driven by escalating global tariff tensions, creating a ripple effect across the altcoin sector. One of the hardest-hit tokens was Hyperliquid (HYPE), a decentralized derivatives exchange token, which fell over 22% due to whales exploiting its liquidation system.

To address this, Hyperliquid introduced key risk management updates, which have brought some relief to investors. The market has shown a slight recovery in the last few hours, with HYPE bouncing back into the green with a 5% surge, thanks to its successful defense of a critical support level.

Source: Coinmarketcap

Source: Coinmarketcap HYPE Defends Key Support

On the daily chart, HYPE has been forming a symmetrical triangle pattern since its rejection from its all-time high of $35.29 on December 21. This rejection triggered a steep correction, leading to a 65% decline and pushing the token down to its crucial ascending support level of $12.19.

Hyperliquid (HYPE) Daily Chart/Coinsprobe (Source: Tradingview)

Hyperliquid (HYPE) Daily Chart/Coinsprobe (Source: Tradingview) After testing this level, HYPE has managed to defend the support and bounce back to $13.15, showing resilience. The chart indicates that if this pattern holds, a potential breakout could be on the horizon. A move above the next resistance at $17.34, followed by the 50-day moving average (50 MA), could confirm an uptrend, setting the stage for a bullish reversal.

However, if HYPE fails to hold the $12.00 support range, it will invalidate the pattern, potentially inviting further downside toward the $10.50 support zone.

Looking at the MACD indicator on the daily timeframe, a bullish crossover appears to be forming. This suggests that momentum might shift in favor of buyers, increasing the likelihood of an upward breakout from the symmetrical triangle.

Can This Pattern Spark a Rebound?

The symmetrical triangle pattern is often a sign of consolidation before a breakout. If HYPE can maintain its ascending support and break above key resistance levels, a bullish reversal could take shape. The next few days will be critical in determining whether the price can push higher.

As always, traders should keep an eye on key resistance and support levels while considering broader market trends before making any investment decisions.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always conduct your own research before investing in cryptocurrencies.