- Crypto market cautious awaiting Apr 2 Trump tariff details (“Liberation Day”)

- ETH (~$1860) tests support near $1854; $1920 resistance key pre-announcement

- Other news: VanEck files BNB ETF, Eric Trump backs miner, NFT platforms close

Ethereum (ETH) and Bitcoin (BTC) experienced slight gains Tuesday as traders speculated President Donald Trump’s proposed tariffs might be less restrictive than initially anticipated.

However, further details on these trade policies are expected later today (20:00 UTC, April 2). This announcement could significantly impact overall market sentiment.

The total crypto market cap stands near $2.85 trillion currently, with Bitcoin dominance holding at 58.59%, as investors closely monitor developments. The Fear Greed Index sits at 44, indicating a state of “Fear” still prevails in the market.

How is the Market Reacting Pre-Announcement?

The crypto market reacted somewhat positively earlier to expectations of potentially lenient tariffs. ETH, for example, climbed 0.31% over the past day to reach $1,860.41 .

However, recent price action suggests ETH remains in a consolidation phase. It struggles to sustain moves towards higher levels at present.

Related: “YOLO”: Ripple CTO Reacts as Analyst Swaps BTC, ETH, XRP, SOL for DOGE/BONK

If today’s tariff-related announcement proves more aggressive than expected, market confidence could shift rapidly, potentially leading to increased volatility. Conversely, any official indication of relative leniency could help drive further modest gains for ETH and the broader crypto market.

Market trading activity shows a moderate uptick recently, with 24-hour trading volume increasing by 1.57% across the board. This suggests a cautious yet slightly hopeful approach among traders while awaiting the policy updates from the Trump administration.

What Are Ethereum’s Key Levels to Watch?

The latest technical indicators highlight key price levels that could determine ETH’s immediate short-term trajectory following the tariff news.

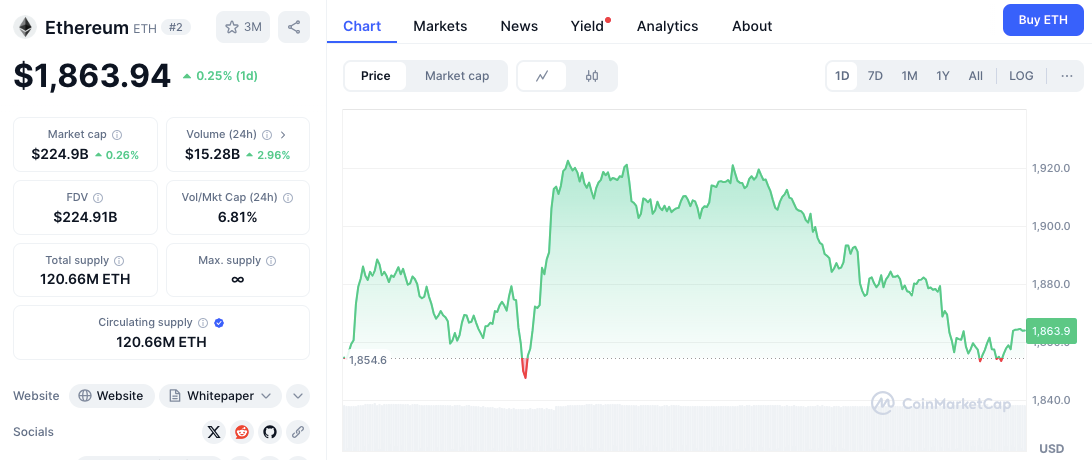

ETH found short-term support near $1,854 on Tuesday, rebounding from this level multiple times during intraday trading. If ETH fails to hold above this immediate support following the announcement, the next critical support zone could emerge down near $1,840.

Source: CoinMarketCap

Source: CoinMarketCap On the upside, resistance for ETH remains near $1,920. This is a level where the price faced rejection before its recent pullback. A successful breakout above this $1,920 threshold could push prices toward the $1,950 area, potentially signaling renewed bullish momentum.

However, failure to break past resistance soon may simply result in further sideways consolidation or potential price declines toward the supports mentioned.

Other Developing Pre-Tariff Crypto News

Beyond near-term market fluctuations tied to tariffs, other notable events continue unfolding across the cryptocurrency industry. Asset manager VanEck officially filed paperwork to launch the first spot BNB exchange-traded fund (ETF) in the US (specifically filed in Delaware).

This move, if eventually approved by the SEC, could broaden institutional investor exposure to Binance Coin (BNB).

Separately, Eric Trump threw his weight behind the new Bitcoin mining venture ‘American Bitcoin,’ launched in collaboration with Hut 8 Corp. Also, declining trading volumes reportedly forced NFT marketplaces X2Y2 and Bybit to shut down operations recently. This reflects an ongoing slowdown and consolidation within parts of the NFT sector.

Related: Four Altcoins, Four Stories: XRP, TAO, ETH, HBAR Set for Critical April?

Which Small Caps Are Gaining Attention?

Smaller cryptocurrencies also showed significant, often uncorrelated, price movements Tuesday. Titcoin (TIT) reportedly surged 99.7% to trade near $0.030383 , registering $16.85 million in 24-hour volume.

Ghiblification (GHIBLI) saw an 82.23% price increase, reaching $0.013277 . Aki Network (AK) rose 31.11% to $0.015774 while Loom Network (LOOM) declined 46.80%, trading at $0.012506 . LUCE, another rising token, climbed 27.57% to $0.012250 .

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.