-

Solana has faced significant trading challenges, having been trapped in a narrow price range while key indicators hint at potential downward pressure.

-

The ongoing market dynamics suggest that sellers are increasingly in control, raising alarms among traders and investors regarding a possible decline.

-

As noted by COINOTAG, “The failure to maintain above key support levels could lead to further market turmoil.”

Solana shows increased bearish pressure as it struggles to maintain price stability, with key indicators pointing towards potential declines.

Technical Indicators Suggest Bearish Sentiment for Solana

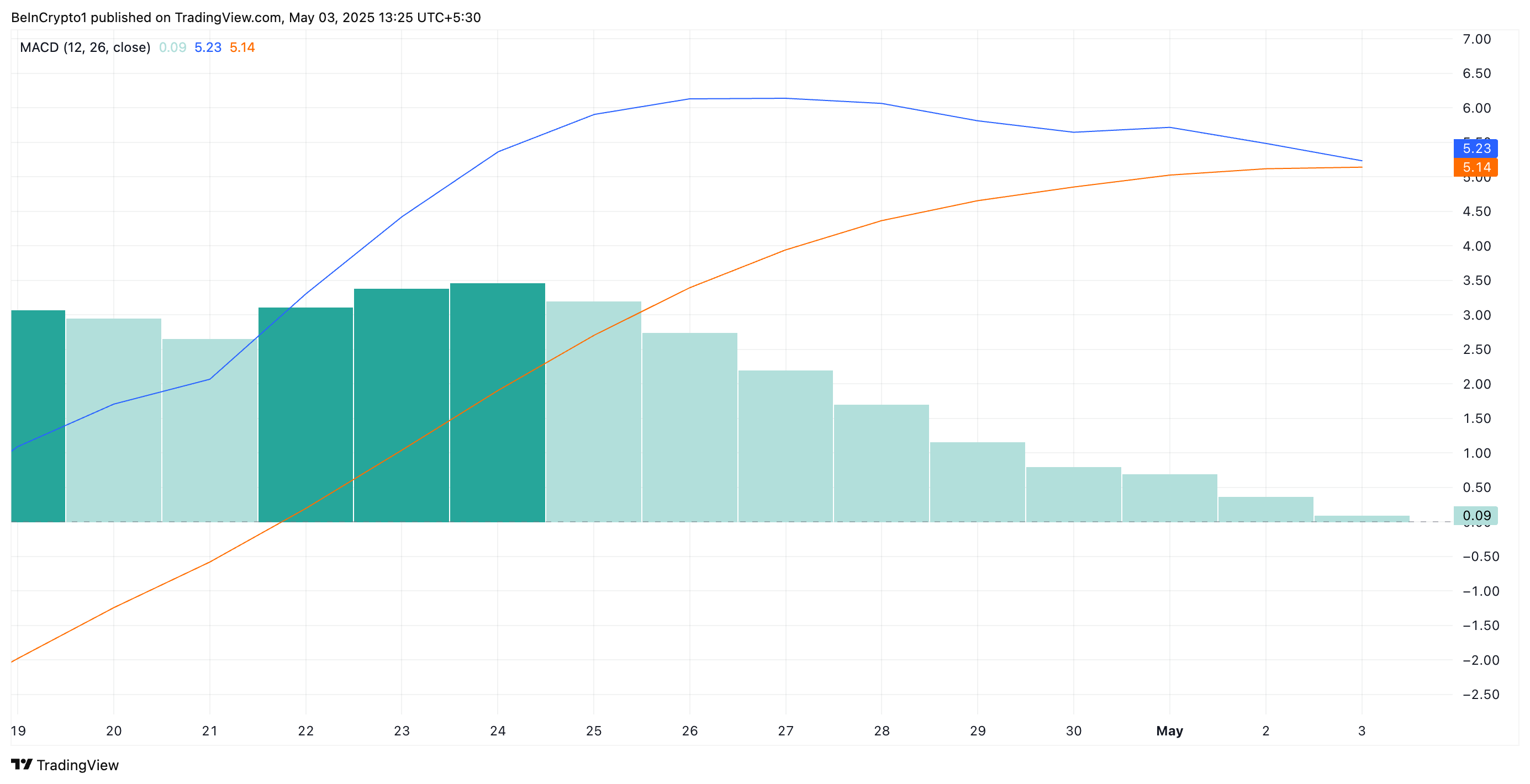

The current trend in Solana (SOL) indicates a potential breakdown as key technical indicators point towards a bearish sentiment in the market. The Moving Average Convergence Divergence (MACD) indicator is nearing a critical death cross, suggesting an increased likelihood of a downtrend.

Understanding the MACD Signal and Market Implications

The MACD indicator’s significance lies in its ability to signal shifts in momentum. When the MACD line crosses below the signal line, it typically indicates a weakening price action. Recent readings show that SOL’s MACD line (in blue) is closely approaching the signal line (in orange), suggesting traders should watch for a potential validation of this bearish crossover.

SOL MACD. Source: TradingView

Moreover, the Balance of Power (BoP) indicator confirms the challenging outlook for SOL. With the BoP currently standing at -0.12, this further cements the viewpoint that sellers have taken the upper hand in the market.

Support Levels Under Threat as Market Dynamics Shift

The recent bearish momentum places SOL on shaky grounds as it approaches critical support at $145.68. A decisive break below this threshold could catalyze a downward trend, potentially leading prices toward $142.32.

If support holds at this level, there may be a temporary respite for buyers; however, failure to reclaim this ground could subsequently push SOL to lower levels, including a further plunge towards $133.94.

SOL Price Analysis. Source: TradingView

Conversely, should market conditions shift favorably, and buying interest resurges, Solana could clear the critical resistance at $153.67. Such a development might pave the way for a rally towards $171.50, reaffirming bullish momentum.

Conclusion

In summary, Solana is under significant pressure as bearish indicators mount, suggesting a critical juncture ahead. Traders should remain vigilant, monitoring both resistance and support levels closely. The outcome in the coming weeks will be vital in determining whether Solana can stabilize or if further declines are imminent. As always, prudent risk management continues to be essential for participants in this volatile space.