Bitcoin faces significant resistance near $98K as whale demand fades and profit-taking accelerates, signaling potential market volatility.

-

Whale accumulation has dropped sharply, while exchange outflows continue without institutional backing.

-

Profit-taking is rising and resistance holds firm, casting doubt on Bitcoin’s breakout potential.

Bitcoin [BTC]’s network activity has dropped sharply since December 2024, with both transaction volume and active addresses in decline. The Coinbase Premium Gap currently sits at -5.07, suggesting sustained selling pressure from U.S.-based traders.

These metrics signal weakened on-chain demand, despite Bitcoin’s relatively strong price performance in recent weeks. At the time of writing, Bitcoin was trading at $94,446.17, reflecting a 0.28% decline in the past 24 hours.

These signals raise a critical question: Will Bitcoin break through resistance, or is a deeper correction on the horizon?

Are BTC outflows misleading without whale accumulation to back the trend?

Large holder netflows have nearly collapsed, showing a staggering 90-day drop of -99.86%. This sharp decline highlights a sudden pause in whale accumulation, even as Bitcoin maintained momentum above $94K.

Despite broader exchange outflows, the lack of buying from large entities raises doubts about strong institutional conviction. Historically, aggressive accumulation from whales has preceded major price rallies.

Source: IntoTheBlock

Bitcoin continues to see net outflows from exchanges, with the total netflow reaching -7.16K BTC — a 15.53% decrease. Typically, this trend implies accumulation and reduced sell-side pressure. However, the absence of matching whale activity makes the case less convincing.

While retail and smaller holders may be moving coins off exchanges, institutional-grade support seems to be missing. Therefore, the current exchange activity appears hollow and may not translate into strong upward momentum unless large players re-engage.

Are profit-rich holders preparing to exit as selling pressure quietly builds?

According to on-chain data, 82.09% of Bitcoin addresses are currently “in the money.” This means most holders are sitting on unrealized profits. In such scenarios, the desire to accumulate more diminishes, especially when the market appears uncertain.

Moreover, if Bitcoin faces any downward pressure, these holders could rush to secure profits, intensifying the decline. While it reflects a healthy market structure, high profitability often limits immediate upside unless new capital enters the space.

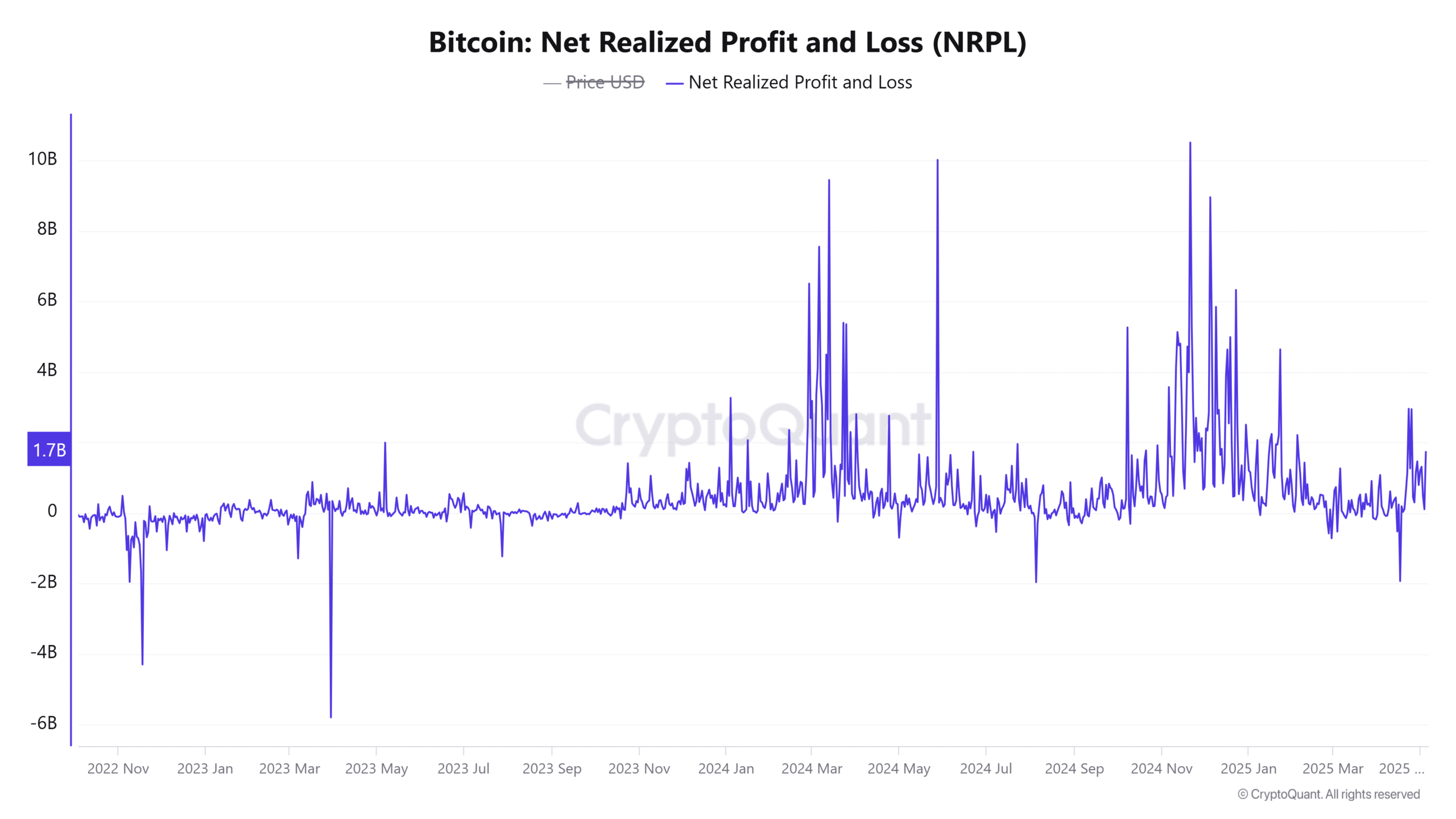

The Net Realized Profit/Loss (NRPL) has surged by 21.88%, alongside a 13.19% rise in Supply-Adjusted Coin Days Destroyed (CDD).

Source: CryptoQuant

These increases suggest that long-held coins are being spent, often a sign of profit-taking by long-term investors. Historically, spikes in these metrics have aligned with local tops or periods of price stagnation.

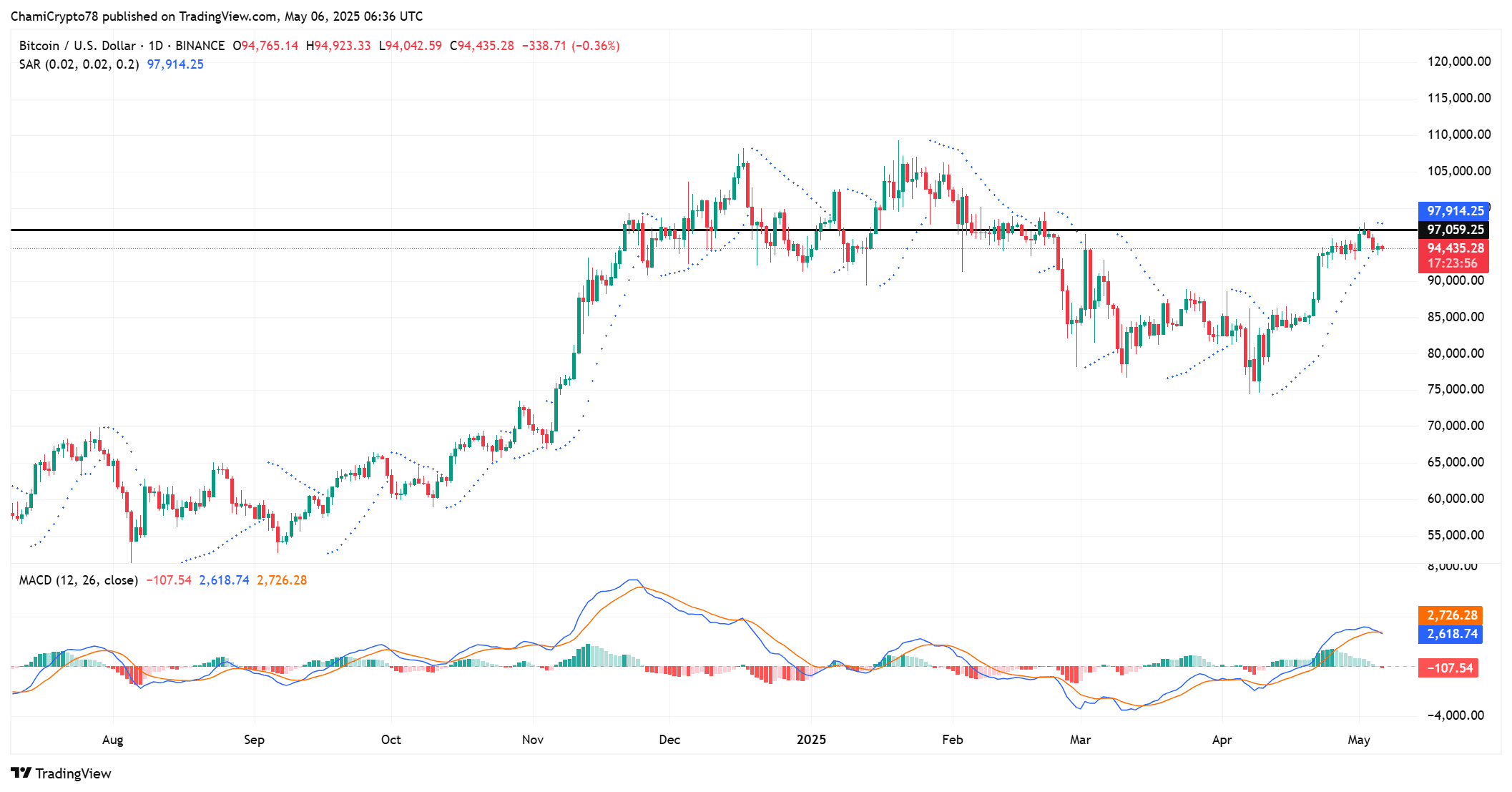

Bitcoin faces resistance at $97.9K with mixed technical signals

Bitcoin has struggled to breach the $97,914 resistance level, with repeated rejections evident in the chart.

Parabolic SAR dots continue to hover above the candles, signaling active bearish pressure. Meanwhile, the MACD is flattening, hinting at weakening momentum and a potential crossover.

This technical setup indicates indecision, and without renewed buyer strength, Bitcoin may be unable to sustain its current levels. Price compression near resistance often precedes breakout or breakdown, and current signals lean slightly bearish.

Source: TradingView

While on-chain outflows persist and BTC remains near key resistance, weak whale activity, high profitability, and increased profit-taking raise downside risks. Bitcoin’s ability to push higher will depend heavily on fresh inflows and renewed large holder conviction. Without that, price may fail to break above $98K and could revisit lower support zones.