-

As Bitcoin (BTC) navigates over $100K, contrasting strategies emerge between long-term holders (LTHs) and short-term traders (STHs), shaping market dynamics.

-

Despite recent profit-taking by LTHs, short-term traders capitalize on momentum, reflecting a vibrant market sentiment.

-

“These changes in holder behavior often precede significant price movements,” notes a recent report from COINOTAG.

This article explores the shifting strategies of Bitcoin holders, focusing on the implications for market momentum and future trends.

Early signs of distribution among long-term holders

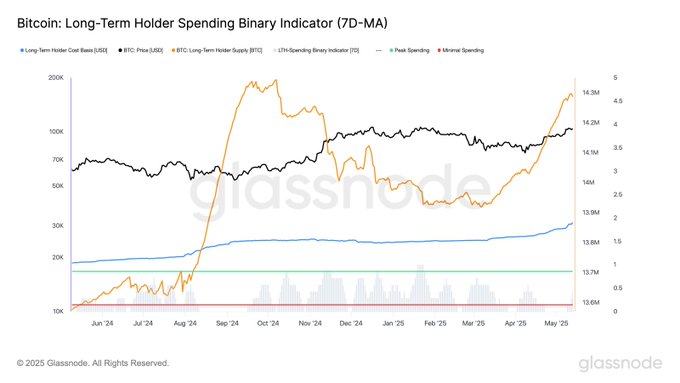

As Bitcoin’s price ascended from $100K, the dynamics between long-term holders (LTHs) and short-term traders (STHs) have shifted significantly. After a steady accumulation phase that saw LTH supply climb from 13.66 million BTC in mid-March to a peak of 14.29 million BTC, the trend has now quietly reversed.

Source: Glassnode

May has already recorded two consecutive declines in LTH supply, while LTH spending has surged to 0.43, marking a noteworthy increase. These subtle shifts often signal approaching local tops, as seasoned holders begin to take profits before broader market fluctuations. With Bitcoin trading above the $100K threshold, these pivotal moments warrant close attention from market participants.

Short-term traders riding the momentum

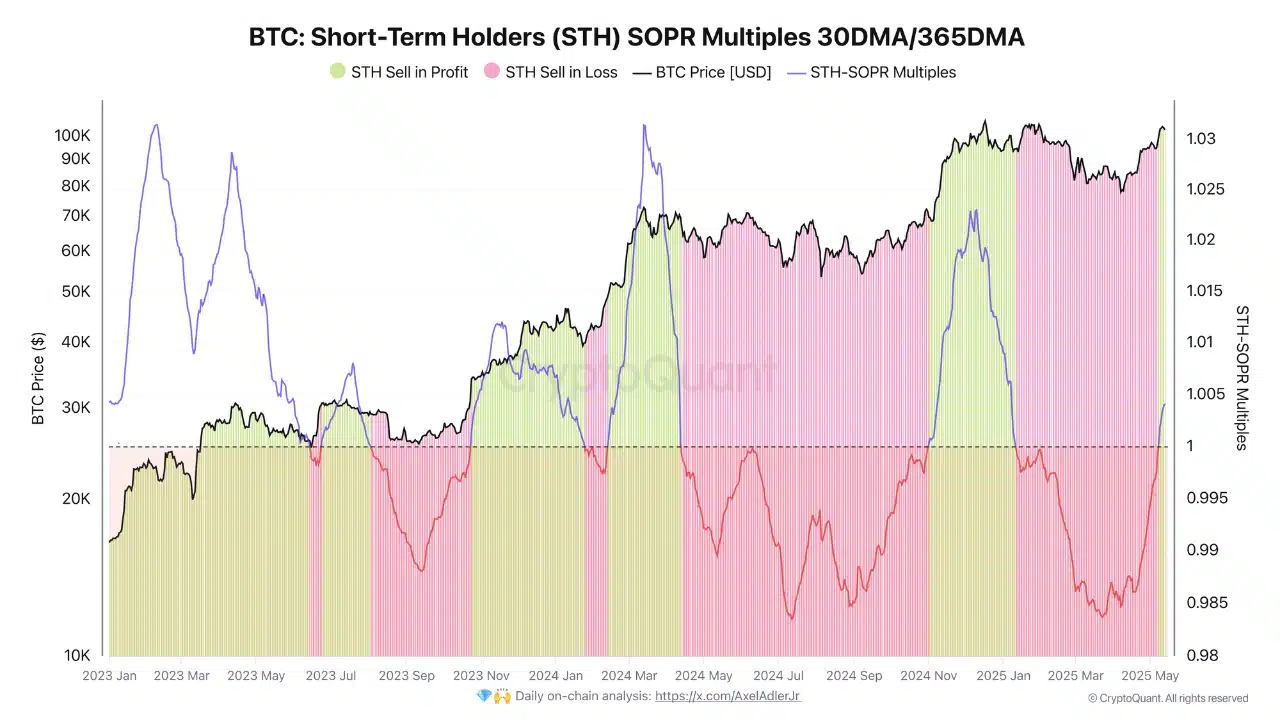

Since May 8th, short-term holders have re-entered profit territory as Bitcoin surged past $99K. Their SOPR (Spent Output Profit Ratio) has consistently held above 1, indicating that recent sellers are locking in gains.

This metric is a crucial indicator of bullish momentum: when STHs are in profit, they’re less likely to panic sell and more inclined to follow the uptrend.

Source: CryptoQuant

As SOPR climbs toward 1.03, potential sell pressure builds; however, current market sentiment suggests ongoing bullish traction, with little evidence of aggressive distribution.

Price fluctuations maintain bullish sentiment

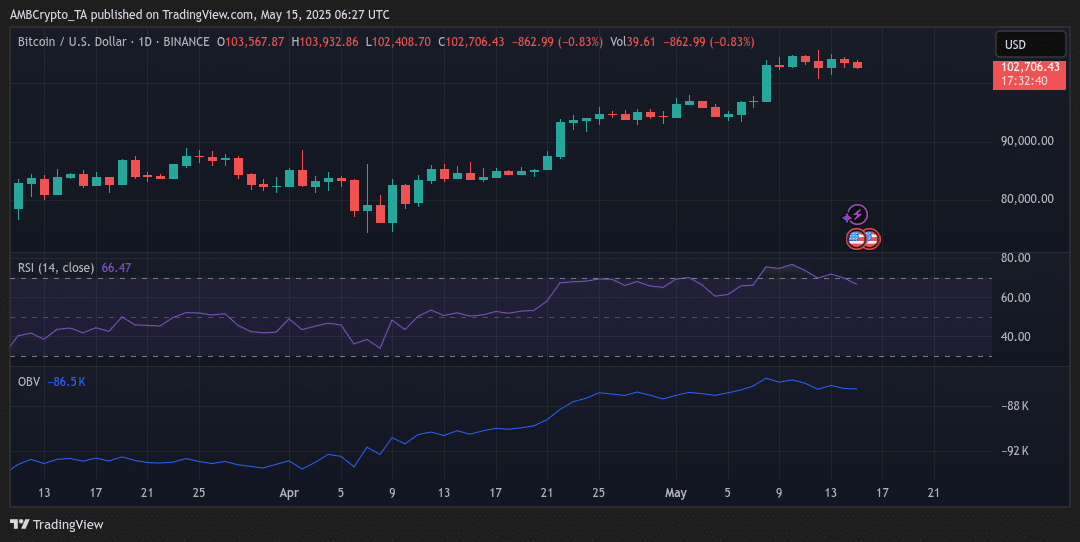

Bitcoin traded at $102,706 at press time, a modest decline of 0.83% on the day – a slight cooldown after its recent ascent above $103K. The relative strength index (RSI) stood at 66.47, on the brink of overbought territory but not yet signaling an impending reversal.

Meanwhile, the on-balance volume (OBV) has plateaued following a robust April, hinting at declining conviction among buyers but not outright weakness.

Source: TradingView

While daily candles indicate a period of consolidation, the overall market structure remains bullish. As long as BTC remains above the pivotal $100K support level, the path of least resistance appears upward, although further gains may hinge on fresh buying volume.

Conclusion

The contrasting behaviors of LTHs and STHs underscore the multifaceted nature of the current Bitcoin market. While LTHs trim positions, STHs embrace the prevailing bullish trend. Monitoring these shifts is critical, especially as price action continues to fluctuate around the $100K mark, providing insights into future market trajectories.