-

Fred Krueger forecasts Bitcoin (BTC) could surge to $600,000 by October 2025, driven by geopolitical and economic shifts.

-

His prediction hinges on a dollar and US Treasury collapse, BRICS nations adopting Bitcoin, and a dollar backed by BTC and gold.

-

Bitcoin’s growing appeal as a hedge against fiat risk, supported by rising institutional interest, is fueling long-term market optimism.

Mathematician Fred Krueger predicts Bitcoin may reach $600,000 by October 2025, driven by key global economic shifts and a potential dollar collapse.

The Path to $600,000: Krueger’s Bold Bitcoin Price Prediction

His forecast, “The Final Run,” envisions a multi-phase cascade of events. The analyst presents a highly speculative view of what could happen if traditional financial systems break down and alternative assets like Bitcoin and gold take center stage.

It begins with a $200 billion US Treasury auction failing to attract buyers on July 21, 2025, triggering a crisis of confidence in the dollar. He predicts that the BRICS nations will launch a gold- and Bitcoin-settled payment system after this.

Countries like Venezuela, Turkey, and Nigeria supposedly shift foreign exchange reserves to BTC by August. Krueger also forecasts that Treasury yields will spike above 8.5% in September.

In parallel, he expects US real estate prices to collapse by 35% within three weeks, exacerbating financial instability. Meanwhile, major tech companies are projected to adopt Bitcoin.

All these envisioned scenarios culminate in October with a “New Bretton Woods” summit. In the summit, the US will supposedly restructure the dollar to be 25% backed by Bitcoin and 25% by gold.

“BTC touches $600,000, Gold at $10,400, Oil at $180/barrel, DXY: 68,” Krueger stated.

He also anticipates a severe downturn in the stock market, with the S&P 500 crashing by 50%. Krueger’s forecast follows an earlier BTC prediction.

Last month, he estimated a 77% probability of Bitcoin reaching an all-time high (ATH) in 2025. Notably, this already appears to be materializing.

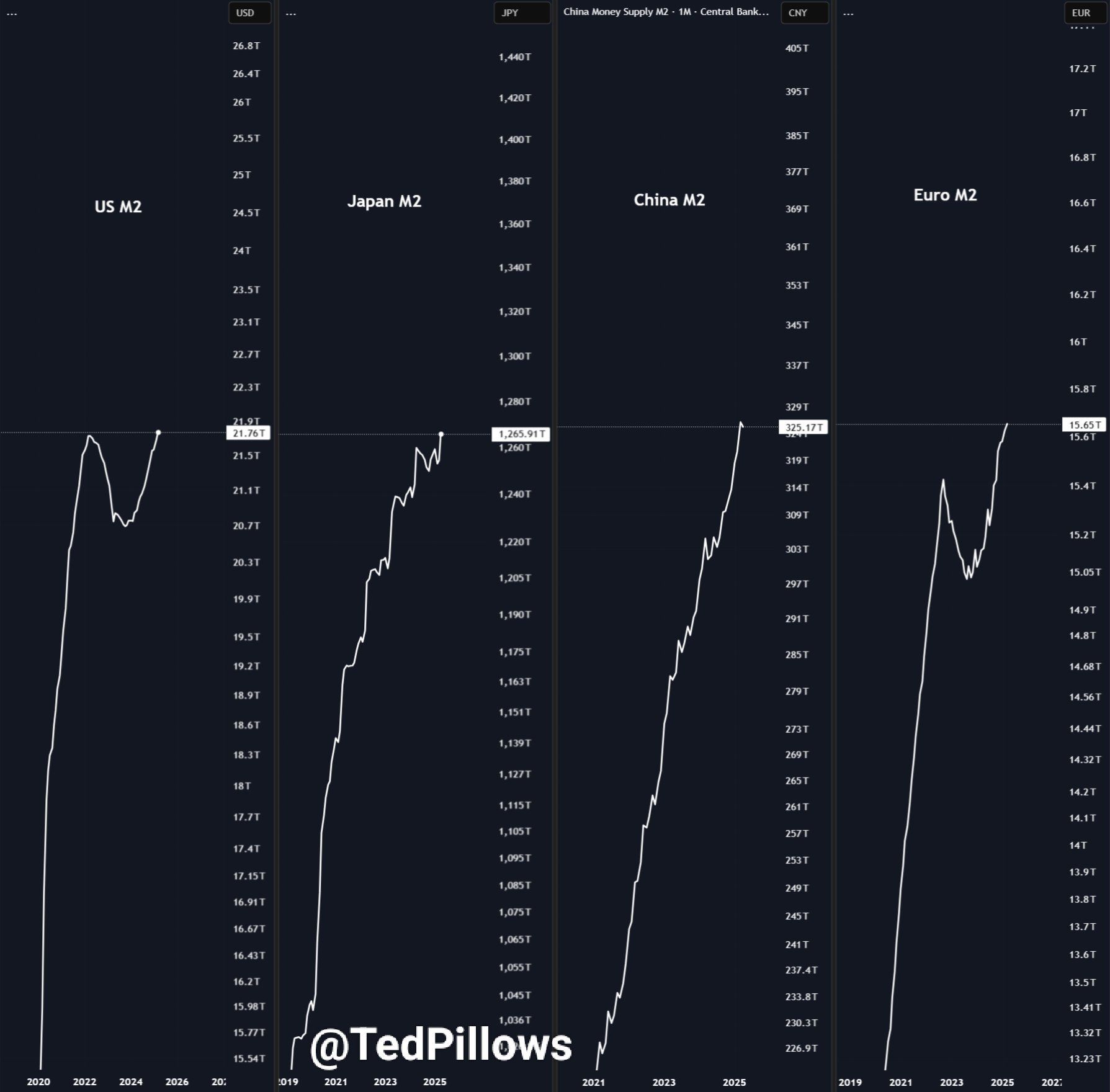

In a recent post, Analyst Ted Pillows revealed that the M2 money supply in major economies has reached record highs. He noted that the US dollar could follow suit. Due to the significant correlation between M2 and BTC, the coin might also reclaim its ATH soon.

Meanwhile, Bitcoin has already notched new all-time highs in high-inflation countries such as Argentina and Turkey, raising hopes that the US might be next.

Market conditions further bolster this outlook. According to CryptoQuant data, Bitcoin’s Realized Capitalization surged by $3.0 billion in a single day. Analysts view this as a strong indicator of market accumulation, often a precursor to significant price surges.

“This behavior suggests that capital is not only flowing into Bitcoin but doing so with a long-term view. In the current context, this increase reinforces the thesis that the market is positioning for a potential breakout, as accumulation intensifies near key psychological levels,” Carmelo Alemán wrote.

Bitcoin’s price performance is equally encouraging. Over the past month, the price has appreciated by 21.5%. At press time, BTC was trading at $106,339, just 2.3% below its record high.

MEXC’s COO, Tracy Jin, believes that BTC has the potential to close this gap and even surge as high as $150,000 by the end of 2025.

“The asset has posted six consecutive weeks of growth, closing near $106,500. The $105,800 level is a key resistance zone: a confirmed breakout could open the way toward $109,000, with optimistic projections reaching $130,000 in Q3 and potentially $150,000 by year-end,” Jin told COINOTAG.

She emphasized that Bitcoin’s appeal is growing as a long-term hedge against fiat risk and sovereign debt, especially amid global economic imbalances. Jin added that with increasing institutional interest, Bitcoin is shaping modern portfolio strategies, not just the crypto ecosystem. According to her, Bitcoin’s role as a strategic macro asset is clear, regardless of short-term price fluctuations.

Conclusion

This multifaceted approach to forecasting Bitcoin’s potential future price highlights a critical intersection of economic factors and market psychology. As geopolitical uncertainties and economic shifts potentially reshape the landscape, investors are urged to stay vigilant and informed about these emerging trends that could redefine the trajectories of Bitcoin and traditional assets.