Worldcoin Sells $135 Million in WLD Tokens to a16z and Bain Capital Crypto

Worldcoin raised $135 million from a16z and Bain Capital Crypto by means of a direct purchase of WLD tokens. This led to a corresponding jump in WLD’s total circulating supply.

The company will use these funds to continue its biometric data collection operations in the US. It recently opened eye-scanning physical infrastructure in six US cities and plans to expand to many more locations.

Worldcoin Fundraises with WLD Tokens

Worldcoin, OpenAI founder Sam Altman’s iris-scanning identity verification project, announced this WLD sale over social media.

In an accompanying press release, the company claimed that the $135 million in investment will primarily go to biometric identity verification in the US, as Worldcoin expanded these operations in May.

“World Foundation raised $135 million from a16z and Bain Capital Crypto. Funding was through a recent direct purchase of liquid, market-priced WLD. The funding comes from two of World’s earliest backers and long-term holders — a16z and Bain Capital Crypto. This wasn’t a venture round. It was a direct purchase of non-discounted liquid tokens,” the firm stated.

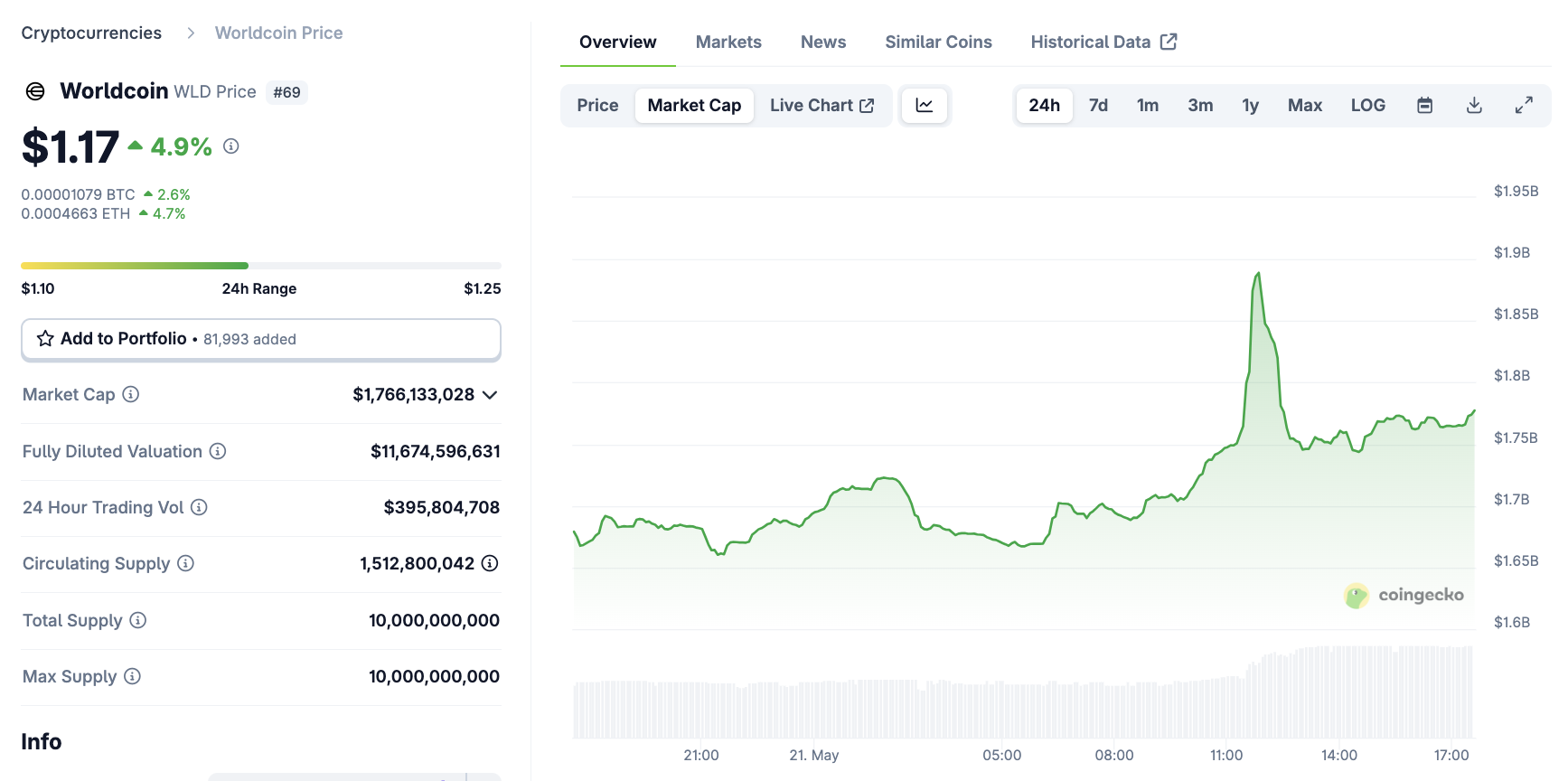

Because this Worldcoin investment deal substantially increased the number of WLD tokens, it’s actually somewhat visible in publicly-available price data.

Less than an hour before the public announcement, WLD’s market cap quickly spiked by $135 million. If this is unrelated to the investment deal, then it’s an extremely remarkable coincidence.

Worldcoin (WLD) Market Cap. Source: CoinGecko

Worldcoin (WLD) Market Cap. Source: CoinGecko In any event, this major WLD investment could be a much-needed win for Worldcoin. Last December, German regulators ruled against the company’s data collection, and both Kenya and Indonesia reached similar conclusions this month.

WLD recently spiked on rumors of OpenAI social media integration, but nothing ever materialized.

In addition to a16z and Bain Capital Crypto, both of which have been substantial crypto investors in the last few months, Worldcoin also mentioned a few other funders.

Selini Capital, Mirana Ventures, and Arctic Digital participated in a traditional funding round for Worldcoin, one which apparently did not involve WLD tokens.

Thanks to this major investment, Worldcoin can continue ramping up its US operations while boosting WLD circulation and prominence.

The company didn’t make any other specific commitments regarding the $135 million, but discussed the growth of its user network, physical infrastructure, and the possibilities of AI tech more broadly.