AAVE is nearing a critical breakout point, energized by whale accumulation amidst short liquidation clusters, creating a potential shift in market dynamics.

-

Whale accumulation and address growth have highlighted renewed interest; however, active participation remains relatively low.

-

AAVE appears to be approaching crucial resistance at $280, with rising trading flows and increasing liquidation pressure suggesting heightened market activity.

A significant whale has aggressively accumulated over 118,000 AAVE since May 1, with a notable purchase of $4.96 million made just hours ago, amplifying its total holdings to over 261,000 AAVE, valued at approximately $69.8 million.

This accumulation, primarily from centralized exchanges such as Kraken and Wintermute, has yet to trigger noteworthy resistance. However, this trend coincides with AAVE’s testing of pivotal resistance levels on the price charts.

Consequently, this aggressive accumulation suggests two possibilities: either the whale anticipates a sustained rally or is building liquidity for potential distribution.

Is rising AAVE network activity a signal of strength or just noise?

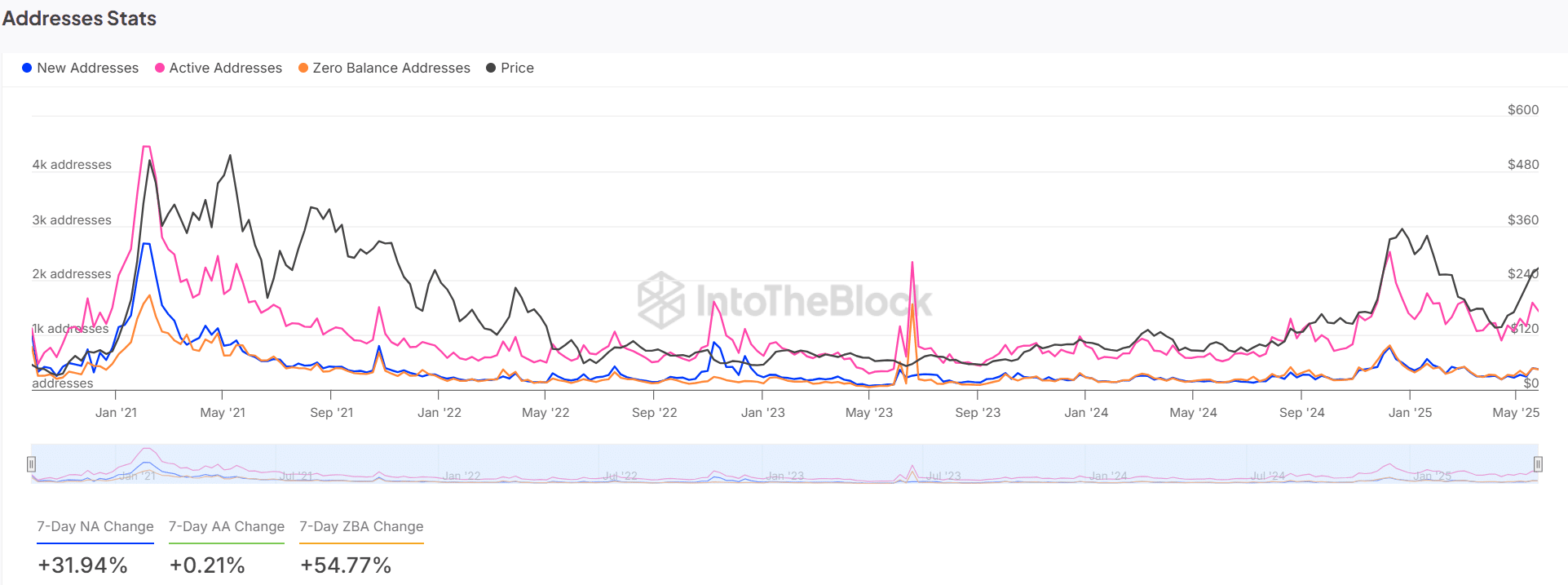

As of now, AAVE’s address metrics present a nuanced view. New wallet creations surged by 31.94% over the past week, indicating a short-term uptick in interest.

In contrast, active addresses have seen minimal change, increasing only 0.21%, suggesting a lack of sustained engagement.

More concerning is the 54.77% increase in zero-balance addresses, which might indicate user exits or the recycling of wallets.

Source: IntoTheBlock

Concentration trends over the last month revealed that whale holdings increased by 3.32%, while mid-tier investors’ addresses dropped by 6.13%. Retail participation climbed marginally by 1.27%, underscoring minimal excitement from retail investors. This shift towards whale dominance could either suggest market stability or raise alarms regarding potential reversals.

Additionally, the exit of investor-tier holders, who are typically more stable than retail, diminishes a critical support layer.

Do rising exchange flows reflect confidence or caution?

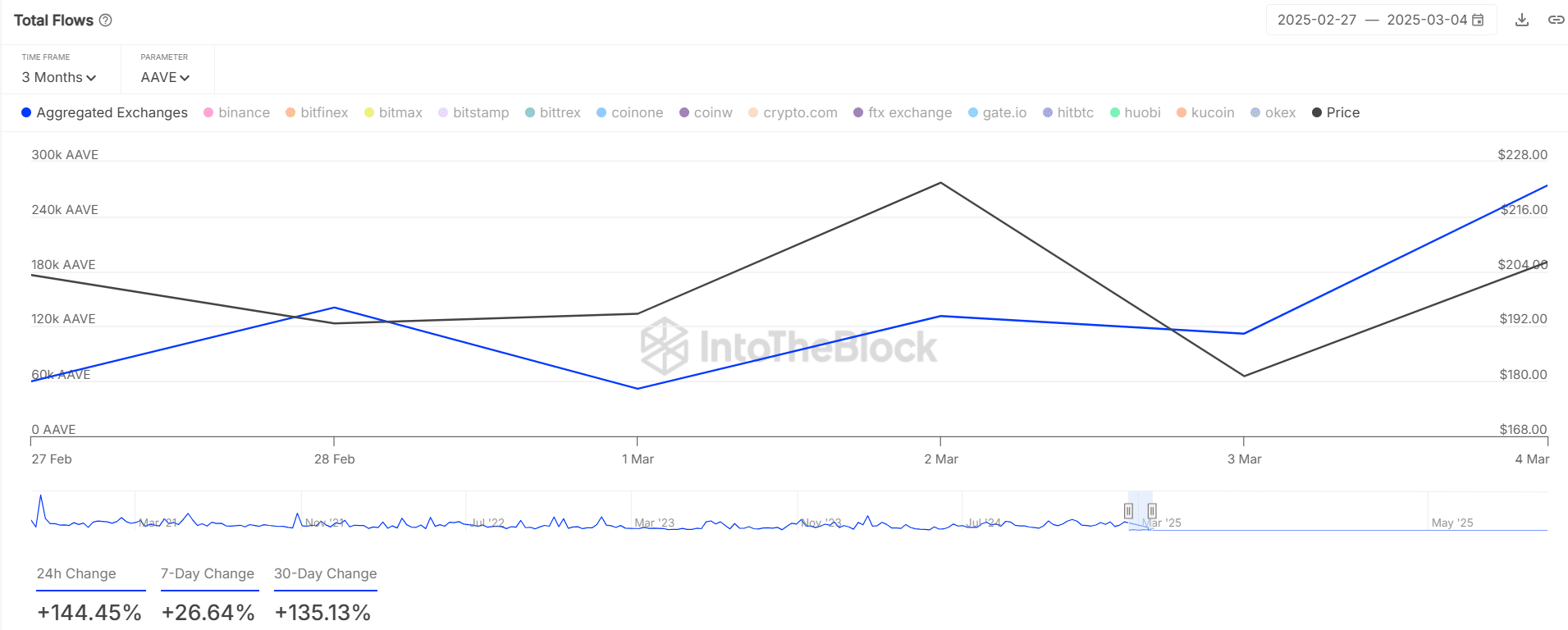

Exchange flows surged by 135.13% in the last 30 days, with a notable 26.64% increase over the past week and a striking 144.45% daily spike.

These rising flows coincided with an uptick in price from $180 to $271.85, highlighting pronounced capital movement across key levels.

While this surge could reflect bullish momentum, such spikes also carry the risk of corresponding distribution zones observed in prior cycles, suggesting profit-taking may be misidentified as accumulation.

If inflows continue while prices stagnate below the resistance level, selling pressure might soon overshadow bullish intent.

Source: IntoTheBlock

Will short squeezes fuel a breakout above $275?

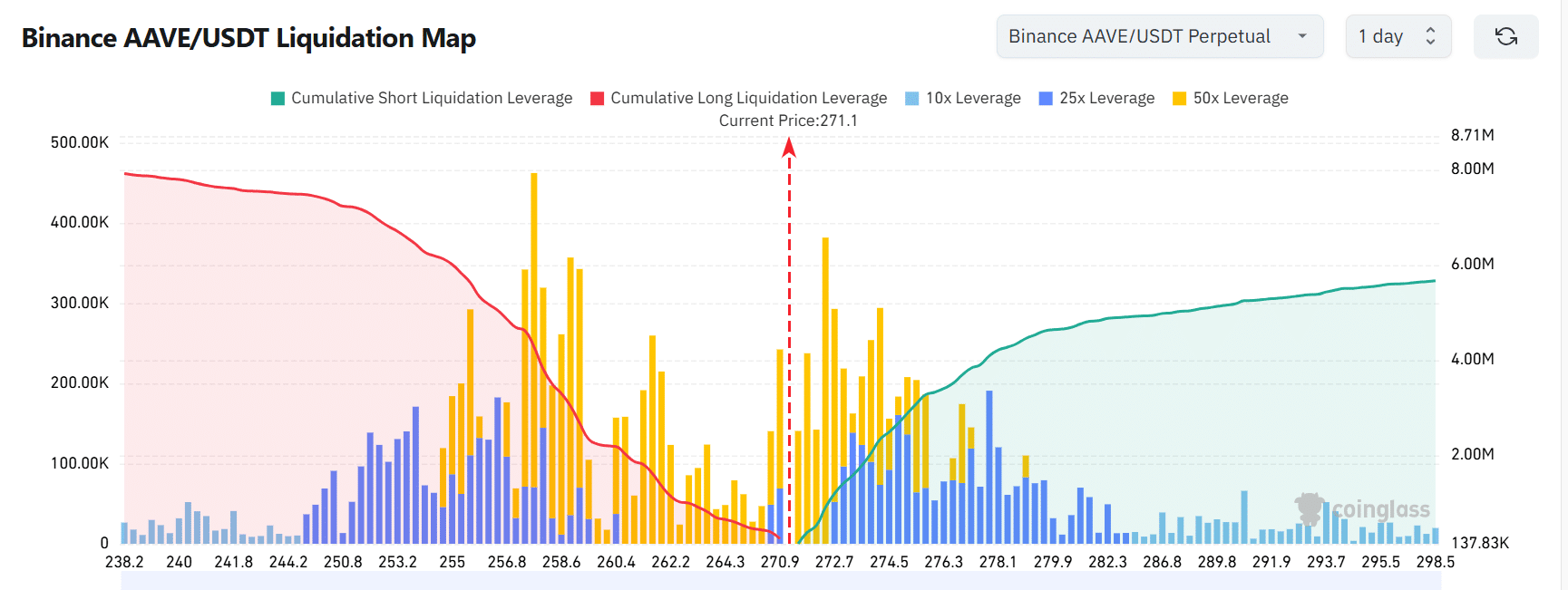

The liquidation heatmap indicated substantial short pressure above $275, establishing a potential squeeze zone.

Simultaneously, long positions appeared vulnerable beneath $260, setting a lower boundary. With AAVE priced around $271, it is at the epicenter of this liquidity struggle.

A decisive breakout above $275 could trigger a cascade of short liquidations, propelling the rally further. Conversely, if the price fails to maintain this level, long positions may begin to unwind aggressively.

Source: Coinglass

Is AAVE ready to push through resistance?

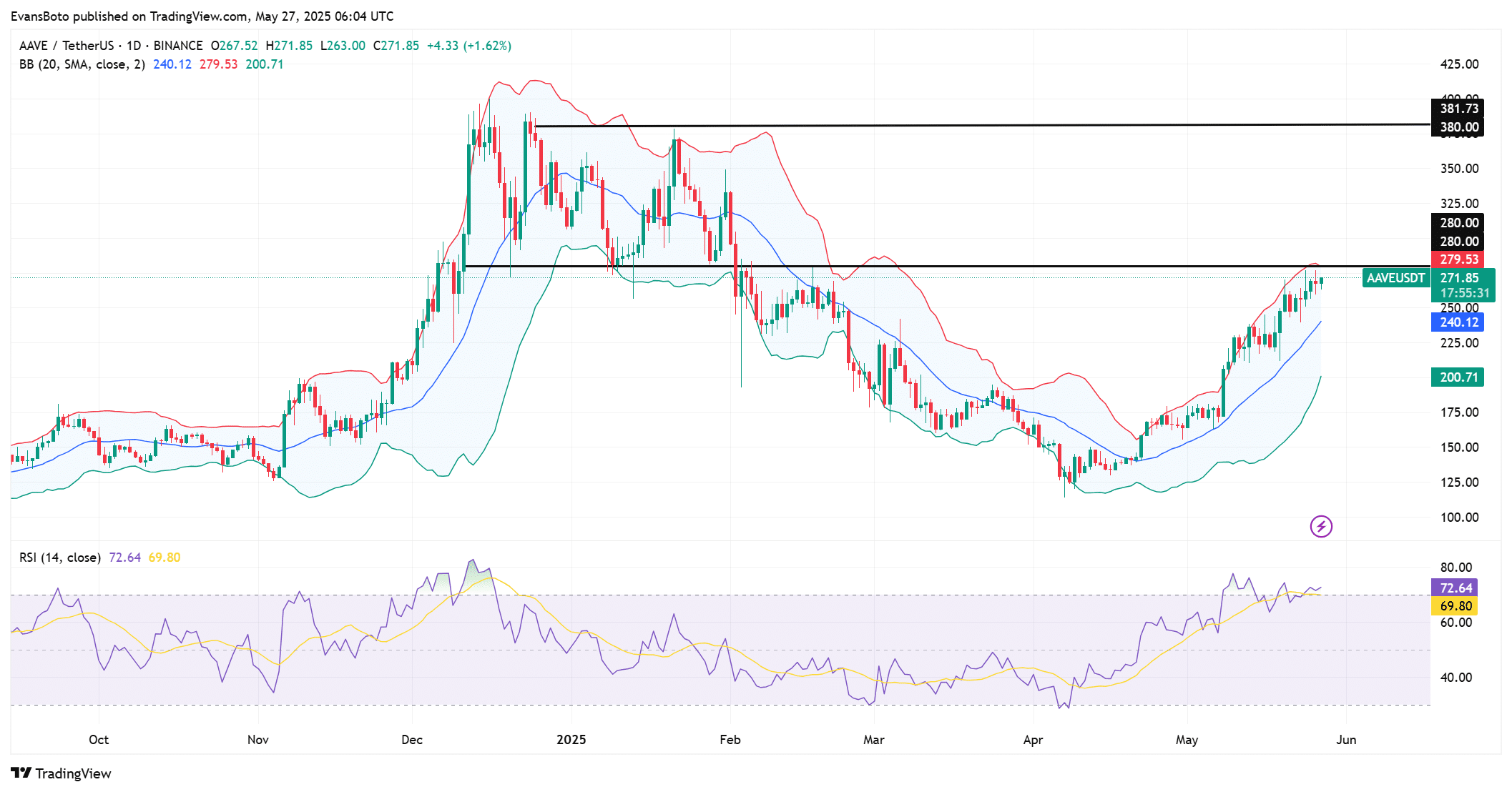

As of this writing, AAVE is challenging its key resistance at $279.53, in alignment with its upper Bollinger Band.

The Relative Strength Index (RSI) currently sits at 72.64, indicating overbought conditions, which may suggest a possible price pullback. The 20-day moving average at $250 serves as a support level should a retracement occur.

A breakout beyond $280 could pave the way toward $380, the next significant resistance. However, without a robust catalyst, the overheated RSI might result in a market cooldown.

Source: TradingView

Conclusion

Whale accumulation combined with short liquidation pressure indicates a potential breakout, particularly if AAVE surmounts the $280 barrier with considerable volume. However, an overheated RSI alongside rising exchange flows suggests a pattern of profit-taking.

While AAVE is poised to test and possibly pierce the $280 mark, the sustainability of these gains will hinge on further engagement from retail investors and institutional support.