Bitcoin Targets $500,000 Amid Rising Bond Yields, Says Max Keiser | US Crypto News

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee to read what experts say about Bitcoin (BTC) price implications amid rising sovereign bond yields. Bitcoin’s status as a hedge against economic uncertainty is progressively going mainstream as global inflation presents a formidable challenge for governments.

Crypto News of the Day: Max Keiser Sees Bitcoin at $500,000

A recent US Crypto News publication indicated that Japan bond yields are surging to multi-decade highs. However, the trend goes beyond the island country in East Asia, with global concerns of possible fiat collapse.

Veteran investor and Bitcoin advocate Max Keiser believes surging global bond yields signal a looming collapse in fiat confidence. He says this could result in a flood of institutional money into Bitcoin.

“Rising yields in sovereign bonds show a collapse in confidence that governments can stop the global inflation tsunami,” Keiser told BeInCrypto in an exclusive statement.

Based on this outlook, Keiser says Bitcoin is the ultimate inflation hedge. He anticipates up to $5 trillion in institutional capital flowing into Bitcoin in the short term, prompting him to revise his BTC price target to $500,000.

“Bitcoin is the ultimate inflation hedge so expect another $5 trillion to flow into Bitcoin in the short term, and this implies a short term target of over $200,000 to $500,000,” Keiser added.

In a recent US Crypto News publication, BeInCrypto reported Keiser’s initial Bitcoin price target at $200,000. At the time, he cited stablecoin issuers’ using Treasury yields to buy Bitcoin.

With his latest target, the $500,000 Bitcoin price forecast aligns with Standard Chartered’s, also reported in a recent US Crypto News publication.

Keiser’s explosive prediction comes as bond markets across the US and Japan show signs of stress, amplifying fears of a macroeconomic reset.

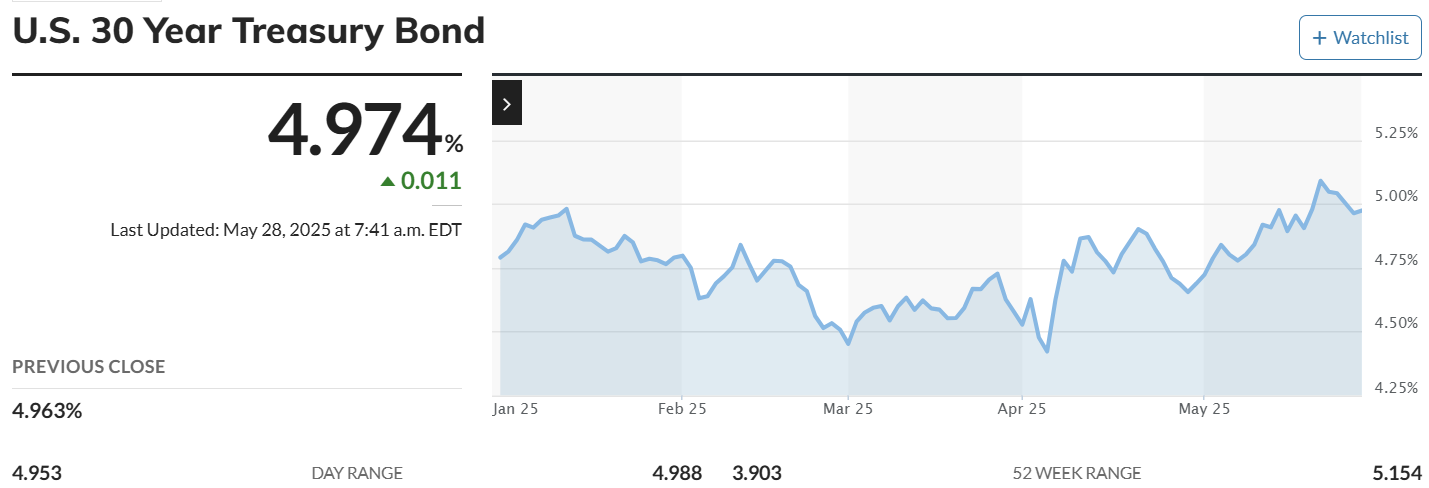

The 30-year Treasury yield in the US closed Friday at 5.04%, after briefly touching 5.15%, a level not seen since the October 2023 debt scare. The 20-year yield also hovered above 5% for three consecutive sessions, raising alarm about deepening dislocations in long-duration debt.

The resurgence in yields was triggered midweek by weak demand for Japanese 40-year government bonds, which recorded their lowest take-up since July 2023.

This raised concerns over a potential unwinding of the global carry trade—where investors borrow cheaply in Japan to buy higher-yielding US assets—and a possible wave of capital flight from the U.S.

Japan’s bond market is under similar pressure and facing a liquidity crisis. The 40-year bond yield spiked to a record 3.689% before easing slightly to 3.318%. However, it is still up nearly 70 basis points (9bps) year-to-date.

Japan’s 30-year and 20-year yields have also risen over 60 and 50 bps, respectively, and are nearing historic highs.

Some investors interpret such cross-market volatility as a breakdown in the traditional bond safety net, which was once considered the final refuge in uncertain times.

According to Keiser, Bitcoin’s fixed supply and independence from central bank policy make it increasingly attractive in this climate.

Japan’s Metaplanet and FOMC Signals Add Fuel to Bitcoin’s Ascent

Adding context, Agne Linge, Head of Growth at decentralized on-chain bank WeFi, told BeInCrypto that today’s FOMC Minutes could offer further clarity. However, the DeFi expert does not expect a dovish pivot.

“The US May 28 FOMC meeting will reveal where the attention is. It is unlikely that the FED will cut interest rates in June. The global economy and the markets feel too uncertain,” Linge said.

Linge also spotlighted Japan’s rising role in the Bitcoin narrative, citing Metaplanet, which continues to Saylorize.

BeInCrypto reported how Metaplanet’s Bitcoin holdings have attracted both support and skepticism, as institutional traders exploit valuation gaps, betting against its stock while favoring Bitcoin.

“What else is interesting to watch is Japan’s economy and Metaplanet — which became the most traded stock in one day in Japan. Metaplanet has shifted from the hotel business to being one of the largest buyers of Bitcoin. With the stock being actively traded, it has also become a popular stock to short,” she said.

As sovereign debt markets reel and global monetary policy remains hawkish, Bitcoin re-emerges as a macro hedge.

Interestingly, this allure goes beyond institutions, extending to nation-states and corporate treasuries.

Chart of the Day

US 30-year Treasury Bond yield. Source: MarketWatch

US 30-year Treasury Bond yield. Source: MarketWatch The chart displays the US 30-Year Treasury Bond yield from January to May 2025. It peaked around late April before slightly declining, reflecting market volatility and interest rate trends.

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- GameStop has purchased 4,710 Bitcoin, worth approximately $512 million, marking a major step toward digital assets.

- Michael Saylor refuses to disclose MicroStrategy’s Bitcoin wallet, citing security risks and calling proof-of-reserves a “crypto parlor trick.”

- Coinbase helped US authorities arrest Chirag Tomar for a $20 million crypto theft via fake Coinbase websites using blockchain forensics.

- Gemini’s 2025 report finds 30%+ of new crypto users start with meme coins, which serve as key gateways to Bitcoin, Ethereum, and ETFs.

- Cetus Protocol promises 100% reimbursement for over $220 million lost in the May 22 exploit caused by a code bug.

- Grayscale launches an Artificial Intelligence Crypto Sector with 20 altcoins focused on AI development and usage.

- Ethereum struggles below $2,700 due to a $4.4 billion supply zone of 1.67 million ETH, which creates strong selling pressure.

- HBAR faces a bearish MACD crossover after seven weeks, signaling growing selling pressure and waning bullish momentum.

Crypto Equities Pre-Market Overview

| Company | At the Close of May 27 | Pre-Market Overview |

| Strategy (MSTR) | $372.20 | $365.50 (-1.80%) |

| Coinbase Global (COIN) | $266.40 | $265,57 (-0.31%) |

| Galaxy Digital Holdings (GLXY.TO) | $29.97 | $29.48 (-1.63%) |

| MARA Holdings (MARA) | $16.44 | $16.22 (-1.34%) |

| Riot Platforms (RIOT) | $9.14 | $9.07 (-0.78%) |

| Core Scientific (CORZ) | $11.28 | $11.23 (-0.44%) |