Key Notes

- The $2.4 billion options expiry on May 30 is expected to influence market momentum, with bulls aiming to keep ETH above $2,600.

- Ethereum’s options trading volume has risen by 18.95%, with open interest nearing $9 billion.

- A significant call advantage exists across price ranges, including a $770 million edge between $2,700 and $2,900, highlighting strong bullish sentiment.

While the broader crypto market has entered a consolidation phase, Ethereum ETH $1 845 24h volatility: 2.6% Market cap: $222.72 B Vol. 24h: $14.22 B price is up 5%, regaining above the critical resistance as bulls drive the upside ahead of the $42.4 billion options expiry on May 30. As a result, the daily ETH trading volume has also shot up 12.46% to $26.15 billion.

Ethereum Price Rallies Before Options Expiry

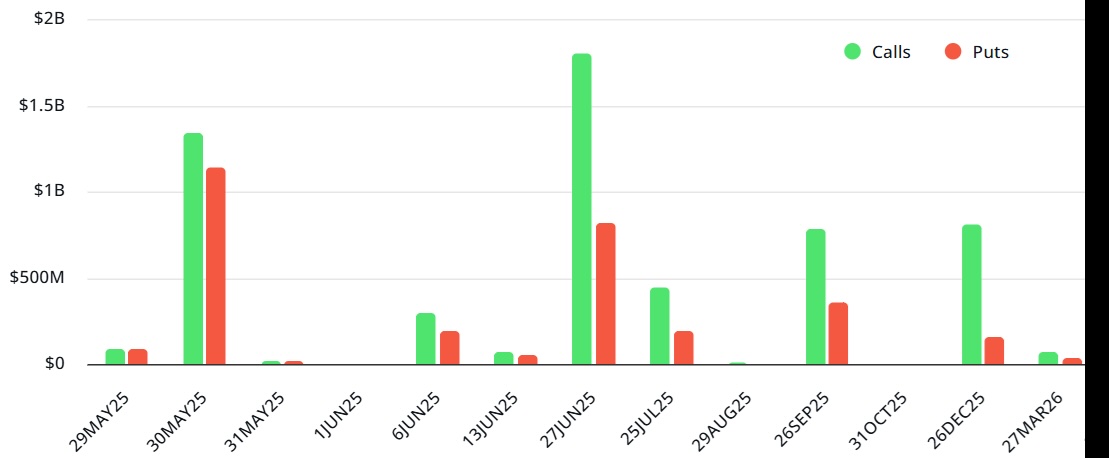

As per the CoinGlass data, the Ethereum options trading volume is up 18.95% to over $1 billion, while the options open interest volume is up to nearly $9 billion. On May 30, Ether (ETH) faces a significant milestone as $2.4 billion worth of options contracts are set to expire. This event could provide the momentum ETH needs to surpass the $2,700 mark for the first time in over three months.

EthereumOptions Open Interest – Source: Leavitas

Bulls are focused on maintaining ETH price above $2,600 ahead of the expiration, creating pressure on bearish positions. Notably, $1.1 billion in put (sell) options are positioned at $2,600 or lower, meaning 97% of these contracts will expire worthless if ETH remains above this threshold by 8:00 am UTC on May 30.

Furthermore, the put-call ratio has dropped to 0.53, showing that bulls are once again in the dominating position at this point. Although the max pain point for ETH options is currently placed at $2,300, the calls are dominating the puts at every price range as shown below.

ETH price at $2,300–$2,500: $420 million in call (buy) options vs. $220 million in put (sell) options, with a net $200 million advantage for calls.

ETH price at $2,500–$2,600: $500 million in calls vs. $130 million in puts, favoring calls by $370 million.

ETH price at $2,600–$2,700: $590 million in calls vs. $35 million in puts, resulting in a $555 million call advantage.

ETH price at $2,700–$2,900: $780 million in calls vs. $10 million in puts, creating a dominant $770 million edge for calls.

Ethereum ETF Inflows on Rise

On the other hand, inflows into spot Ethereum ETFs have gathered pace recently. On Wednesday, the total inflows stood at $84.6 million, with BlackRock’s iShares Ethereum Trust (ETHA) alone scooping $52.7 million in inflows, followed by Fidelity’s FETH seeing $25.7 million in inflows, according to data from Farside Investors.

ETHEREUM IS TRYING TO BREAKOUT NOW! pic.twitter.com/TdYmqUxyhj

— Merlijn The Trader (@MerlijnTrader) May 29, 2025

On the technical chart, Ethereum price is also staging a breakout from the flag-and-pole pattern. If the bulls sustain the momentum, we could quickly see a run up to $3,300.

nextDisclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.