Portal Price Prediction 2025-35: Will It Hit $50 by 2035?

- PORTAL trades near the top of its channel—a bullish breakout could spark a sharp move.

- The token’s funding rate at 0.0126% signals traders are confident in a likely price reversal.

- CryptoTale forecasts a $3.00 surge for PORTAL with the 2025 post-halving rally.

Portal (PORTAL) Overview

| Cryptocurrency | Portal |

| Ticker | PORTAL |

| Current Price | $0.05885 |

| Price Change (30D) | -34.11% |

| Price Change (1Y) | -93.18% |

| Market Cap | $31.35 Million |

| Circulating Supply | 522.68 Million |

| All-Time High | $4.41 |

| All-Time Low | $0.05404 |

| Total Supply | 1 Billion |

What is Portal (PORTAL)?

Imagine playing your favorite games, regardless of which blockchain they’re built on—all from one unified platform. That’s Portal. Powered by the next-gen interoperability protocol LayerZero, Portal connects games from over 40 blockchains like Ethereum, Solana, and Polygon into a seamless ecosystem.

At its core is the PORTAL token, an omni-chain currency that fuels transactions, rewards, governance, and game discovery. But Portal is more than tech—it’s a movement to simplify Web3 gaming, offering Web2-style logins, effortless onboarding, and real ownership of in-game assets.

Whether you’re a developer seeking users, a gamer looking for freedom, or a Web3 explorer chasing the future, Portal is where it all connects.

How the Portal Ecosystem Works

Portal is more than just a token — it’s a complete ecosystem designed to onboard traditional gamers into Web3 and support developers building the next generation of games. Here’s how it all fits together:

- Portal Wallet: Designed with simplicity, the Portal Wallet lets users log in using Web2 methods like Apple, Google, or Discord — there is no need for seed phrases or private keys. It’s the easiest way to jump into Web3 gaming.

- Companion App: Discover new games, stake tokens, trade in-game assets, and connect with other gamers — all in one app. It’s not just a tool; it’s the social hub of the Portal universe.

- Portal Nodes: The backbone of the platform, these nodes validate cross-chain transactions by syncing LayerZero’s oracle-relayer network with Portal’s Web3 layer. Node operators earn PORTAL tokens and help secure the network.

- Game Integration: Portal has already brought over 200 games onto its platform, from titles like Star Atlas and Sipher Odyssey to DeFi Kingdoms, creating one of the largest multi-chain gaming libraries.

Why PORTAL Token Matters: Utility, Governance, and Growth

The PORTAL token is the lifeblood of the entire ecosystem—multi-functional, interoperable, and incentive-driven. Here’s how it works:

- Omni-Chain Utility: PORTAL is designed to be chain-agnostic. It can move freely across supported blockchains, making it a unified currency across all connected games and services.

- Transaction Fuel & Node Rewards: Every transaction on the Portal platform is paid in PORTAL, and node operators earn these tokens as rewards for maintaining the system’s integrity.

- Governance Power: PORTAL holders help steer the future of the platform. Users vote on key decisions through decentralized governance, from token distribution to game visibility.

- Stake-to-Scale Mechanism: Staking PORTAL gives users yield and boosts partner games. Developers can stake tokens to gain spotlight placement for their games, driving adoption through a community-powered curation model.

- Exclusive Access & NFTs: Token holders get early or exclusive access to NFTs from the Portal’s gaming partners, offering tangible value and unique digital assets.

- Node Purchases: PORTAL tokens are required to buy and run nodes, allowing users to actively support and profit from the network’s infrastructure.

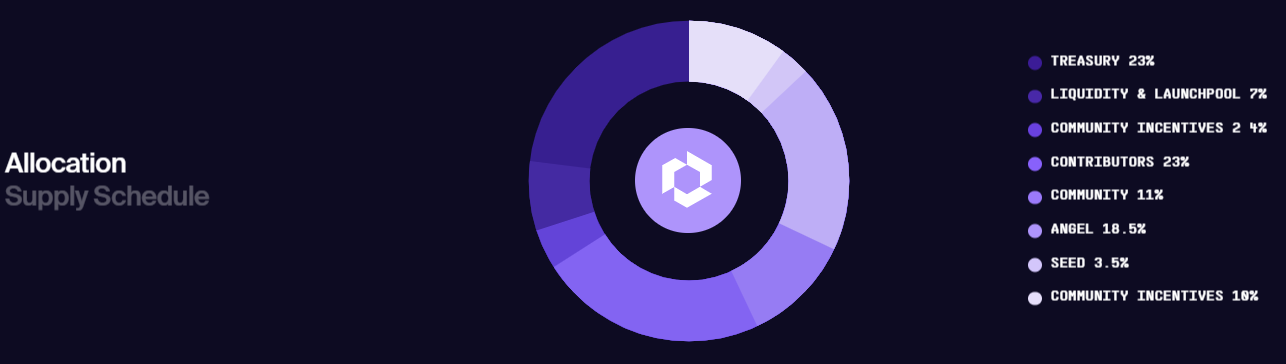

PORTAL Tokenomics Overview

The total supply of the PORTAL token is strategically allocated to fuel growth, reward early supporters, and secure long-term sustainability. Here’s how the 1 billion tokens are distributed:

Source: Portal

Source: Portal - Treasury – 23%: Reserved to support the long-term development of the Portal ecosystem, including rewards, grants, and partnerships.

- Contributors – 23%: Allocated to core team members and advisors, building and maintaining the Portal infrastructure.

- Angel – 18.5%: Provided to early-stage investors backing the project before wider funding rounds.

- Community – 11%: Directed towards initiatives that promote community growth, engagement, and retention.

- Community Incentives 1 – 10%: Users and developers use to incentivize participation, gameplay, and ecosystem contributions.

- Liquidity & Launchpool – 7%: Ensures healthy liquidity across decentralized exchanges and supports yield farming initiatives.

- Community Incentives 2 – 4%: Additional community engagement rewards, such as promotions or special events.

- Seed – 3.5%: Allocated to initial seed investors during the earliest funding phase.

This well-balanced token distribution reflects Portal’s commitment to ecosystem sustainability, community empowerment, and long-term decentralization.

The Vision: A Decentralized, Player-Powered Future

Portal is reimagining the way we think about blockchain gaming. By integrating over 200 games, leveraging the LayerZero protocol, and introducing an ecosystem powered by community-operated nodes, it creates a future where games don’t just exist in silos—they thrive in connection.

Portal Price History

Since its explosive debut, PORTAL stunned the market by rocketing to an all-time high of $4.41 on February 29, 2024 — a mind-blowing 4,000%+ surge from its early lows. But what goes up often comes down.

What followed was a brutal correction. Over the past year, PORTAL has been locked in a persistent downtrend, losing over 98% of its value and bottoming out near $0.054, marking its all-time low.

Source: TradingView

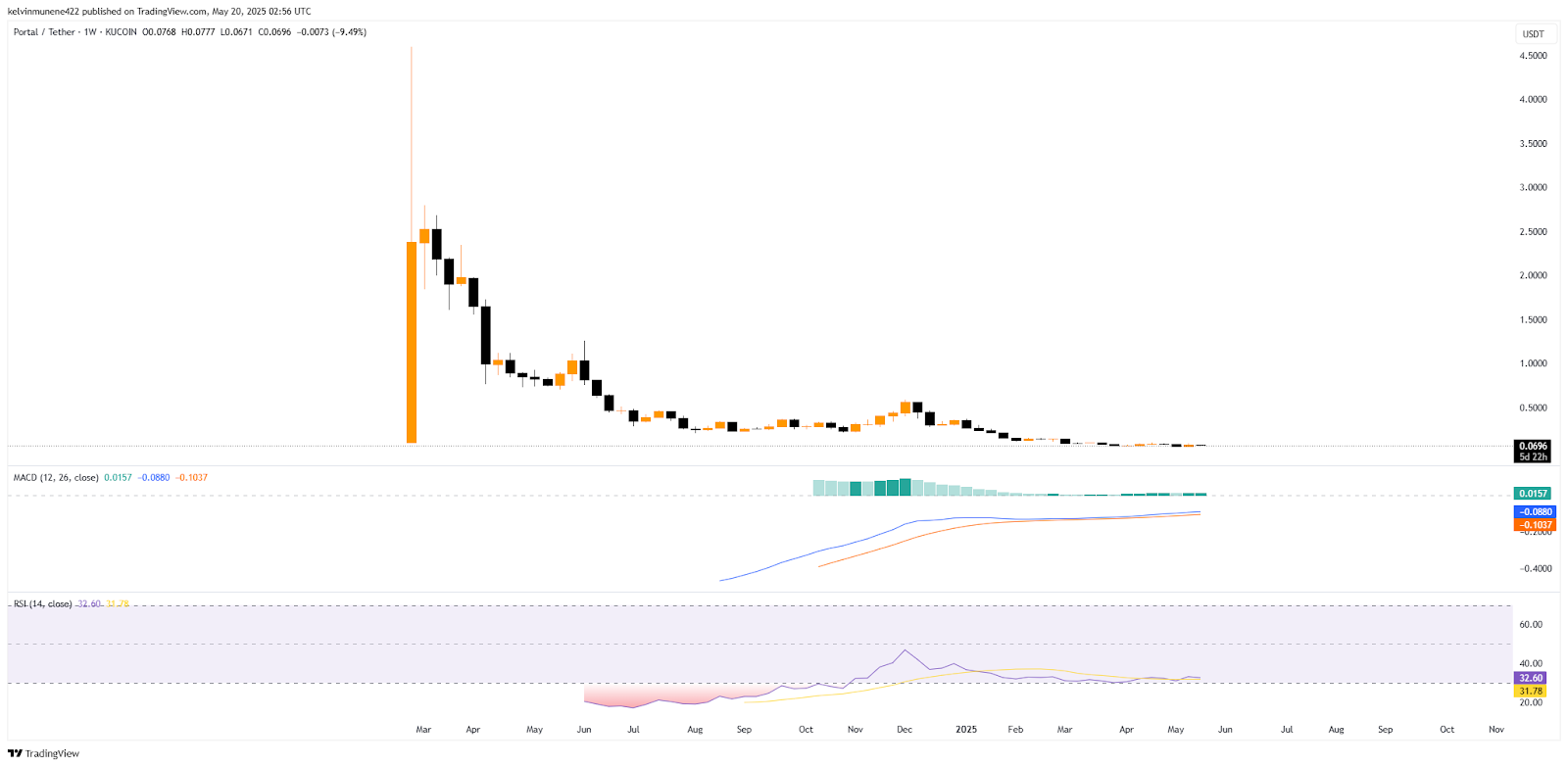

Source: TradingView On a broader scale, the weekly chart analysis reveals a long-standing descending channel that’s dictated the token’s direction. Currently, PORTAL is testing the upper boundary of this channel — a crucial make-or-break level.

A bullish breakout could spark serious momentum, pushing the price toward the $1.02–$1.26 resistance zone. This area aligns with the 23.6% Fibonacci retracement, offering a technical target for buyers.

However, if momentum continues, the next major hurdle is at the 50% Fib level around $2.32, which could mark the start of a full-blown reversal back toward the highs. On the other hand, failure to break out could drag PORTAL back to retest its all-time low, and breaching that could send it into uncharted bearish territory.

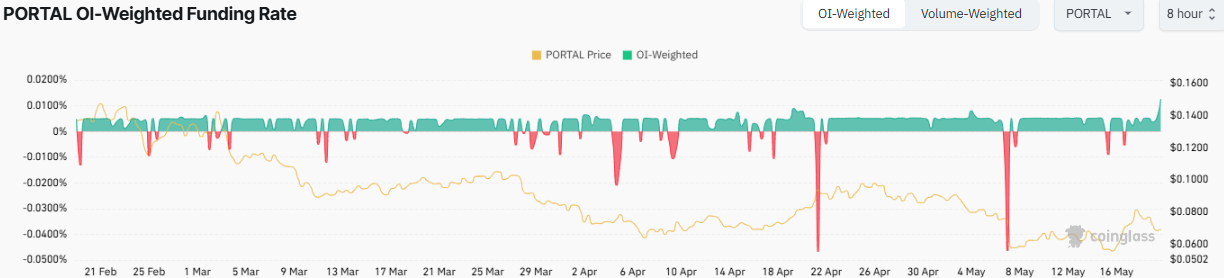

Funding Rate Signals Renewed Bullish Momentum

Adding weight to the possible breakout scenario is the current state of the Open Interest (OI)-Weighted Funding Rate, which has now turned positive and is sitting at 0.0126%—a level not seen since December last year.

Source: Coinglass

Source: Coinglass This green zone indicates a shift in market sentiment: long position holders now pay a premium to shorts to maintain their leverage. In simple terms, the bulls are showing confidence and are willing to bet on a potential upside move. This critical psychological and technical signal suggests that traders are positioning themselves for a reversal or rally.

Related: Zcash Price Prediction 2025-35: Will It Hit $15,000 by 2035?

Yearly Highs and Lows of Portal

| Year | Portal Price | |

| High | Low | |

| 2025 | $0.3722 | $0.05404 |

| 2024 | $4.41 | $0.1000 |

Portal Technical Analysis

The MACD for PORTAL has turned bullish, with the MACD line at -0.0880 now above the signal line at -0.1037, indicating a potential shift in momentum. This is supported by a steadily increasing green histogram, signaling that bearish pressure is weakening and buyers are beginning to take control.

Source: TradingView

Source: TradingView At the same time, the Relative Strength Index (RSI) sits at 32.60, hovering just above the oversold threshold of 30. This suggests that PORTAL trades at levels where its price may be undervalued. Historically, this zone often precedes a reversal or a short-term rally as sellers become exhausted.

Portal (PORTAL) Price Forecast Based on Fair Value Gap

PORTAL trades well below two major Fair Value Gaps (FVGs), which serve as critical zones for future price action. The upper FVG lies between $1.55 and $1.11—a region retested in early June 2024, only to act as a strong resistance, rejecting bullish momentum. This makes it a key zone to watch should a future rally occur, as a break above it would likely signal a major trend shift.

Source: TradingView

Source: TradingView The lower FVG, between $0.75 and $0.61, presents a closer and more attainable target. If current bullish signals—like the bullish MACD and oversold RSI—gain strength, this FVG could be revisited as the first key liquidity zone where sellers might re-emerge. Historically, FVGs act like magnets for price due to their unfilled imbalance, and this one remains untouched.

FVGs often serve as institutional interest zones where price accelerates or face strong resistance. With PORTAL’s price currently hovering near historic lows and showing signs of bullish momentum, the lower FVG may soon be tested.

Portal (PORTAL) Price Forecast Based on MA Ribbon Analysis

PORTAL is trading below its 20-week moving average (MA) of $0.1199 and well beneath the 50-week MA at $0.2584, confirming a prolonged bearish trend. The significant gap between these key indicators highlights continued downward pressure on the asset and weak buying momentum across higher timeframes.

The 20 MA, typically used to gauge short-term trends, remains sharply below the 50 MA, a longer-term trend signal. This alignment, where the shorter MA is beneath the longer one, forms what is commonly known as a bearish moving average crossover, indicating that selling pressure continues to outweigh bullish interest.

Source: TradingView

Source: TradingView This technical structure has held firm for several months, and unless the 20 MA begins to slope upward and close the gap, a reversal remains unlikely. Additionally, the price of PORTAL continues to consolidate beneath both moving averages, showing no immediate signs of reclaiming either line.

For bullish momentum to return, the token would first need to break above the 20 MA at $0.1199. Only then could it aim for a more meaningful challenge of the 50 MA at $0.2584 — a critical resistance level.

Portal (PORTAL) Price Forecast Based on Fib Analysis

PORTAL is trading well below its first key Fibonacci retracement level at 23.60% ($1.1258), highlighting the scale of its decline from the all-time high. The Fibonacci retracement tool, drawn from this ATH to the token’s current all-time low, maps out potential resistance zones and recovery targets for any bullish reversal.

Source: TradingView

Source: TradingView The 23.60% level ($1.1258) marks the first significant test of whether buying volume increases. Historically, this level often acts as initial resistance during a recovery after steep drops. Beyond this, the next levels to watch are:

- 38.20% ($1.7897) – a psychologically significant midpoint often tied to strong consolidation zones,

- 50.00% ($2.3263) – a critical level suggesting trend reversal potential,

- 61.80% ($2.8629) – known as the “golden ratio” and a typical target during bullish corrections,

- 78.60% ($3.6269) – the last resistance before a full retracement to the all-time high at 100%.

Given that PORTAL has remained deeply suppressed under even the 23.60% Fib, a rally toward these levels would require sustained volume and confirmation from other indicators.

Portal (PORTAL) Price Prediction 2025

As per CryptoTale’s projections, PORTAL is expected to ride the post-BTC halving momentum in 2025, potentially surging to new heights as retail and institutional investors flood the market. With utility expanding through node staking, NFT access, and Web2 integrations, the token could trade between $0.01 and $3.00.

Portal (PORTAL) Price Prediction 2026

Following the peak of 2025, 2026 may usher in a sharp correction as euphoria fades. According to our price outlook, market-wide pullbacks and reduced trading volumes typically lead to recession-like conditions, placing PORTAL within a forecast range of $0.50 to $2.00.

Portal (PORTAL) Price Prediction 2027

In 2027, sentiment may stabilize as the anticipation of the next Bitcoin halving grows. Portal’s technical framework, cross-chain support, and game discovery features may attract early recovery interest, with prices expected to range between $1.00 and $2.50.

Portal (PORTAL) Price Prediction 2028

The year 2028 will likely be marked by renewed optimism as the fifth halving restores the market. With improved product offerings and broader blockchain integration, CryptoTale predicts that PORTAL could climb into the $3.50 to $7.00 price range.

Portal (PORTAL) Price Prediction 2029

Fueled by hype, user growth, and institutional interest in Web3 gaming, 2029 may see PORTAL expand aggressively. Ecosystem traction could be strong, placing price levels between $6.00 and $10.00 as it attempts to reclaim bullish dominance.

Portal (PORTAL) Price Prediction 2030

After the rapid growth of 2029, 2030 may bring a cooling-off phase. Profit-taking, regulatory friction, or macroeconomic shifts could pressure prices lower. During this correction year, the forecast range for PORTAL is expected to be $5.00 to $8.00.

Portal (PORTAL) Price Prediction 2031

With the worst behind and fundamentals stronger, 2031 could be a year of steady progress. Growing platform maturity, active governance, and improved user retention may lift prices modestly within the range of $4.50 to $9.50.

Portal (PORTAL) Price Prediction 2032

The sixth Bitcoin halving is likely to reignite bullish momentum across crypto, including GameFi. If Portal maintains its edge in cross-chain gaming and adoption continues, the token could rally between $8.50 and $15.00.

Portal (PORTAL) Price Prediction 2033

The year 2033 could represent a powerful expansion cycle, powered by global gaming adoption and institutional Web3 interest. Portal’s innovations may pay off strongly here, pushing price estimates into the $12.50 to $25.50 range, as per CryptoTale.

Portal (PORTAL) Price Prediction 2034

After strong gains, the market may cool slightly in 2034 as profit-taking kicks in. However, steady usage and ecosystem strength may prevent a significant dip, with PORTAL likely hovering between $10.00 and $20.00.

Portal (PORTAL) Price Prediction 2035

Given pre-halving hype, greater regulatory clarity, and global adoption of blockchain gaming, 2035 could propel PORTAL to new heights. According to our forecast, it may reach between $30.00 and $50.00, setting a new all-time high.

Related: COTI Price Prediction 2025-35: Will It Hit $10 by 2035?

FAQs

What is PORTAL?

PORTAL is an omni-chain gaming platform powered by LayerZero that connects games across 40+ blockchains. It enables seamless multi-chain gameplay and Web3 gaming integration.

How can I purchase PORTAL?

You can buy PORTAL on major centralized exchanges (CEXs) where it’s listed, following its token generation event (TGE) on the Ethereum mainnet.

Is investing in PORTAL a wise decision?

PORTAL shows long-term potential in Web3 gaming, but like all crypto, it carries risk. Investment depends on market cycles and personal risk tolerance.

What’s the best way to securely store PORTAL?

Use the Portal Wallet for Web2-friendly access, secure Web3 wallets like MetaMask, or hardware wallets for long-term, non-custodial storage.

Who is the founder of PORTAL?

PORTAL was co-founded by Chandra Duggirala, Manoj Duggirala, George Burke, and Eric Martindale.

Which year was PORTAL launched?

PORTAL launched in Q1 2024 with its token listed on major exchanges and its gaming ecosystem and nodes beginning public rollout.

What is PORTAL’s circulating supply?

PORTAL’s circulating supply is approximately 522.68 million tokens out of 1 billion.

Will PORTAL surpass its all-time high?

Yes, forecasts suggest PORTAL could exceed its previous ATH of $4.41, potentially reaching $30–$50 by 2035 under favorable market conditions.

What is PORTAL’s lowest price?

PORTAL’s all-time low is $0.05404, reached during the bearish trend in 2025.

What will the price of PORTAL be in 2025?

According to CryptoTale, PORTAL could trade between $0.01 and $3.00 in 2025, driven by post-BTC halving momentum and Web3 gaming growth.

What will the price of PORTAL be in 2028?

In 2028, PORTAL may rise to $3.50–$7.00, supported by the fifth BTC halving hype and continued Web2 and Web3 adoption.

What will the price of PORTAL be in 2030?

In 2030, a correction may occur, placing PORTAL within a forecast range of $5.00 to $8.00 due to profit-taking and market cooling.

What will the price of PORTAL be in 2032?

Driven by the sixth BTC halving, PORTAL is projected to rally between $8.50 and $15.00 as bullish momentum returns.

What will the price of PORTAL be in 2035?

With adoption and regulation maturing, PORTAL could reach $30.00 to $50.00, hitting a new all-time high ahead of the 2036 halving.

The post Portal Price Prediction 2025-35: Will It Hit $50 by 2035? appeared first on Cryptotale.