-

Recent insights from security expert Justin Drake warn that Bitcoin’s declining transaction fees could jeopardize its long-term network security.

-

Drake suggests controversial solutions, including lifting Bitcoin’s 21 million cap or transitioning to a Proof-of-Stake model, which challenge Bitcoin’s foundational values.

-

Critics argue fee analysis should focus on USD rather than BTC, highlighting concerns over Bitcoin’s deviation from Satoshi Nakamoto’s original vision as “digital cash.”

Bitcoin’s security model faces a critical threat due to declining transaction fees. Can proposed changes preserve its integrity? Read more to find out.

Why is Bitcoin Security a “Time Bomb”?

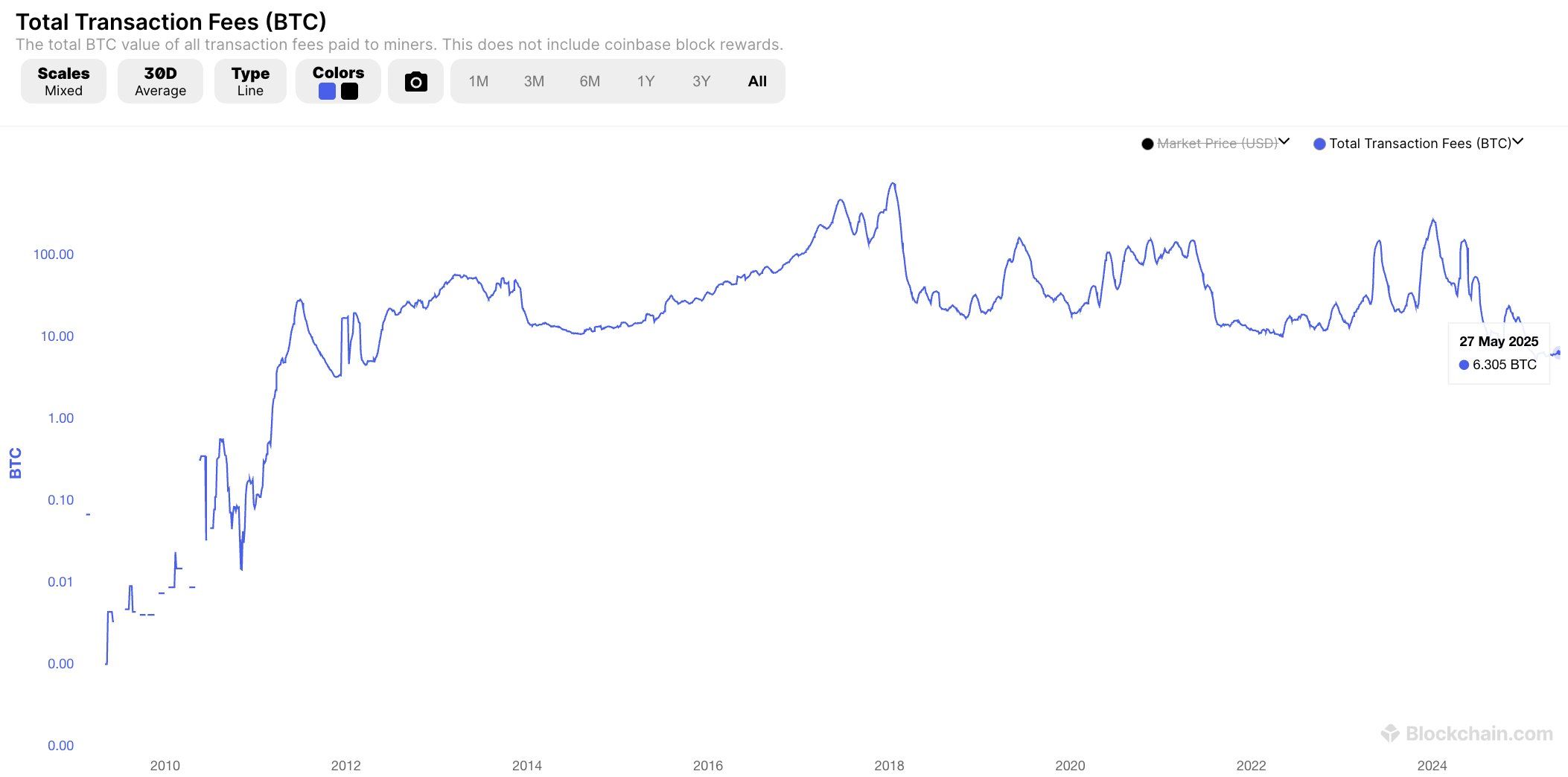

Drake’s analysis reveals a troubling trend: Bitcoin transaction fees have plummeted to a 13-year low, currently averaging less than 10 BTC daily.

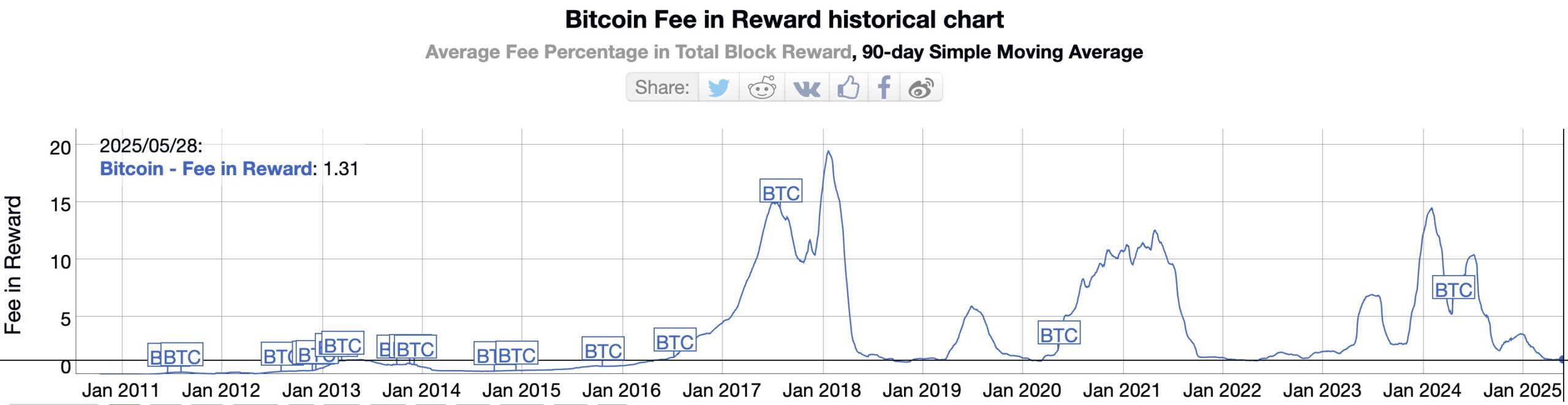

He highlights that transaction fees now contribute just about 1% of miner revenue, with the vast majority (99%) stemming from block rewards—newly minted Bitcoins designed to incentivize miners in the Proof-of-Work (PoW) ecosystem.

Yet, block rewards are halved every four years—a trend that will culminate when Bitcoin’s total supply caps at 21 million coins. The upcoming April 2024 halving will reduce the reward to only 3.125 BTC.

Contrary to expectations that declining block rewards would lead to rising transaction fees, the data indicates a troubling inverse relationship. In fact, the last decade has seen transaction fees decrease more significantly than block rewards.

For instance, during March 2016, transaction fees comprised 1% of the block reward of 25 BTC, but by April 2025, fees still represent only 1% despite the drop to 3.125 BTC. This decline directly undermines Bitcoin’s security budget—the financial backing that incentivizes miner participation, rendering the network increasingly open to potential attacks.

Drake further illustrates this point with alarming projections: “Imagine fees were the only source of miner revenue today:

→ revenue drops 100x

→ hashing infrastructure decreases 100x

→ 1% of today’s infrastructure (1 large farm) can 51% attack Bitcoin.

That’s the trajectory we’re on. The 21 million cap breaks security; it’s self-destructive. It should be clear now Satoshi made an oopsie.”

Efforts to enhance transaction utility and stimulate fees—such as the Lightning Network and Ordinals—have provided only fleeting spikes in revenue, followed by significant drops. Therefore, Bitcoin’s security remains overly reliant on diminishing block rewards, posing a substantial risk.

Contrastingly, some experts dispute Drake’s conclusions. Researcher Kushal Babel from Category Labs asserts that transaction fees should be evaluated based on dollar value, rather than BTC, to accurately gauge their relevance to network security.

“It’s incorrect to say fees are at an all-time low by denominating them in BTC. What matters for security is the fees in dollar terms—we need to consider the BTC/USD price. That may tell a different story,” Babel explained.

Did Satoshi Make a Mistake?

Drake offers two provocative solutions aimed at averting a looming security crisis, but both proposals are contentious among Bitcoin enthusiasts.

The first suggestion entails abolishing the 21 million BTC limit to introduce perpetual block rewards, fundamentally altering Bitcoin’s principle of scarcity as a digital asset. The second proposal is to transition to a Proof-of-Stake (PoS) model—akin to Ethereum’s recent shift—which prioritizes validators over computational power, offering energy efficiency and potentially enhanced security.

However, these proposals remain unacceptable to many in the Bitcoin community, as they challenge fundamental beliefs about scarcity and decentralization.

Lukasinho, Strategy Analyst at Auditless, contends that no mistakes were made by Satoshi. He believes Bitcoin has strayed from its intended purpose, evolving into a store of value devoid of sufficient transaction activity to generate consistent fees.

“Satoshi didn’t err; rather, it was the community that diverted from his vision. BTC was meant to serve as digital cash, actively used and generating transaction fees—not merely a speculative ‘pet rock’ resting in wallets,” Lukasinho remarked.

Additional considerations also arise regarding unforeseen factors such as quantum computing threats. While the likelihood of a 51% attack may appear remote, experts increasingly warn of quantum capabilities undermining Bitcoin’s cryptography, necessitating the development of robust, future-proof security measures.

Conclusion

In summary, Bitcoin stands at a critical juncture as its security model faces apparent vulnerabilities. The decline in transaction fees poses a genuine threat, raising questions about the sustainability of its PoW model. As the community grapples with proposed remedies, it’s essential to weigh their long-term implications carefully. Without timely and thoughtful action, Bitcoin may confront challenges that could reshape its future.