Circle’s Cross-Chain USDC Trading Hits All-Time High at $7.7 Billion

Circle’s Cross-Chain Transfer Protocol (CCTP) facilitated $7.7 billion in stablecoin bridging volume in May, an all-time high and an 83.3% increase from April.

The firm launched its IPO last week, rejecting outright buyout efforts to remain an active player in the stablecoin market. This impressive growth can help demonstrate Circle’s progress and solid foundations.

Circle’s CCTP Breaks Volume Records

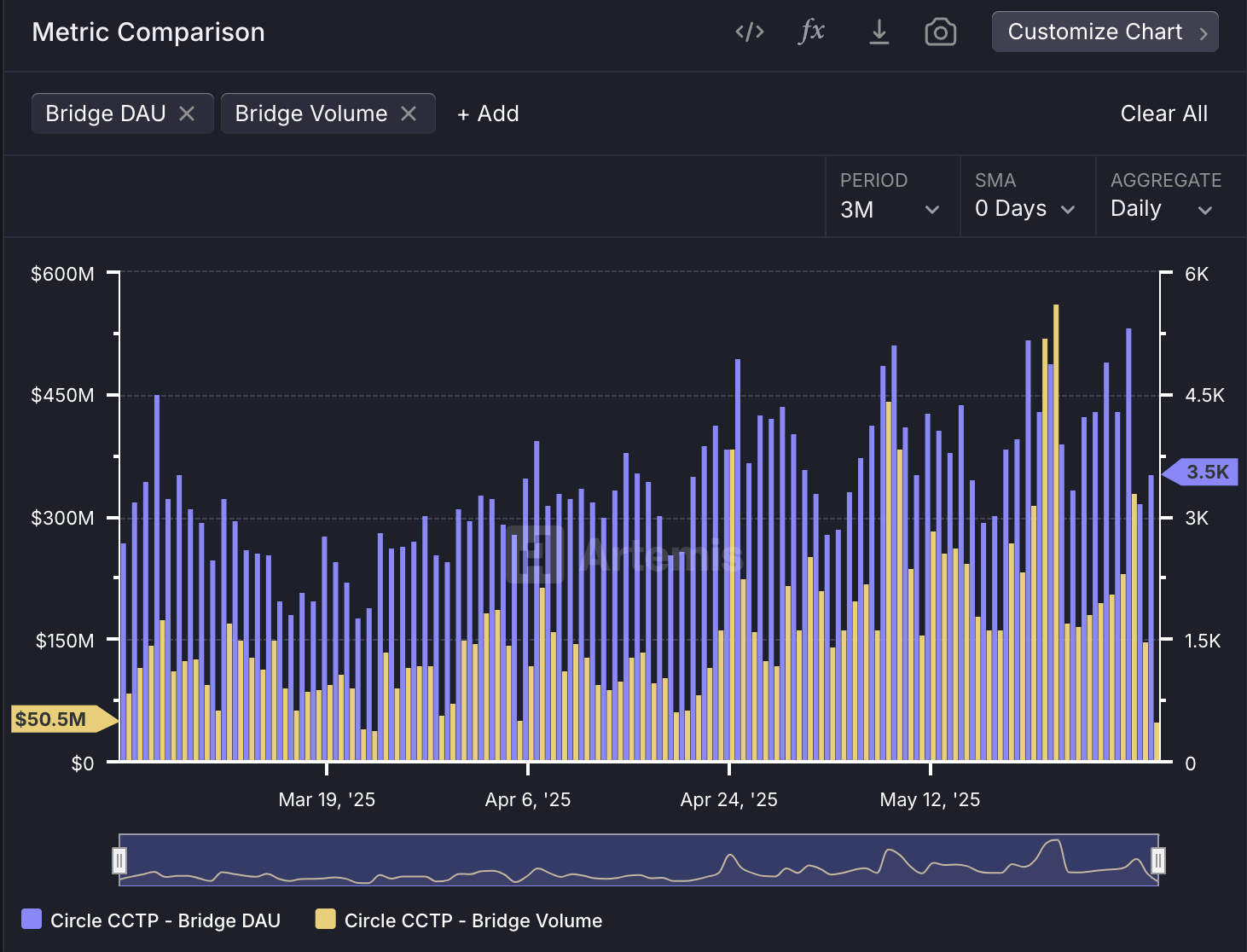

Circle, one of the largest stablecoin issuers, first launched CCTP in 2023 to seamlessly bridge USDC across blockchains. Since then, it’s integrated the protocol with a number of prominent chains, increasing USDC’s interoperability. Today, blockchain data analysis shows that CCTP hit a new all-time high for bridging volume last month:

Circle CCTP Bridging Volume. Source: Artemis

Circle CCTP Bridging Volume. Source: Artemis This CCTP volume is especially relevant for Circle for another reason. Specifically, the total number of active stablecoin addresses also reached a new record last month: 33.1 million.

In a time when the total demand for stablecoins and utility solutions is only growing, Circle is working to present its payments ecosystem as an attractive option.

The company has been planning an IPO for the last few months, but it rejected a $5 billion offer from Ripple to acquire it outright. Instead, the firm opened its stock sale last week, aiming to raise $624 million while maintaining its independence.

CCTP’s record growth could signal Circle’s long-term market potential, better enticing new capital investment. The stablecoin issuer already increased its IPO size today, setting a more ambitious target of $896 million.

While the number of active stablecoin addresses is rising, major investment banks are planning to substantially increase their presence in the industry.

Citigroup predicts a $3.7 trillion stablecoin market by 2030, and it isn’t alone in these bullish predictions. All that is to say, Circle isn’t the only issuer developing new cross-chain transaction solutions.

In other words, Circle’s record CCTP growth comes at a useful time. USDC’s trading volume also broke records in April, and now the stablecoin’s utility protocols are surging, too.

Circle is intent on remaining an independent company and positioning itself as a strong contender in this sector. To do this, it will need positive metrics like CCTP’s volume to move the market.