CME + Glassnode: Bitcoin Insight and Market Trends H1 2025

Bitcoin entered 2025 with strong institutional momentum - backed by over $38 billion in ETF inflows and expanding use of CME-regulated futures and options. Yet after reaching an all-time high of $109K, market activity slowed. Inflows tapered, volatility declined, and investor positioning shifted into a more cautious, range-bound phase.

The CME x Glassnode H1 2025 Bitcoin Report offers a data-driven lens on these developments. Through on-chain metrics, derivatives positioning, and ETF flow analysis, it captures how institutional participants are navigating this cycle - and what may lie ahead in H2.

Key Bitcoin Trends to Watch

Following a historic run-up and a cooling-off period in H1, Bitcoin markets are now defined by consolidation, structural inflows, and shifting institutional strategies. As volatility declines and capital rotation slows, several key metrics offer insight into how deeply current valuations are supported - and what catalysts might drive the next phase.

Below is a preview of the data-backed insights explored in depth within the 32-page report:

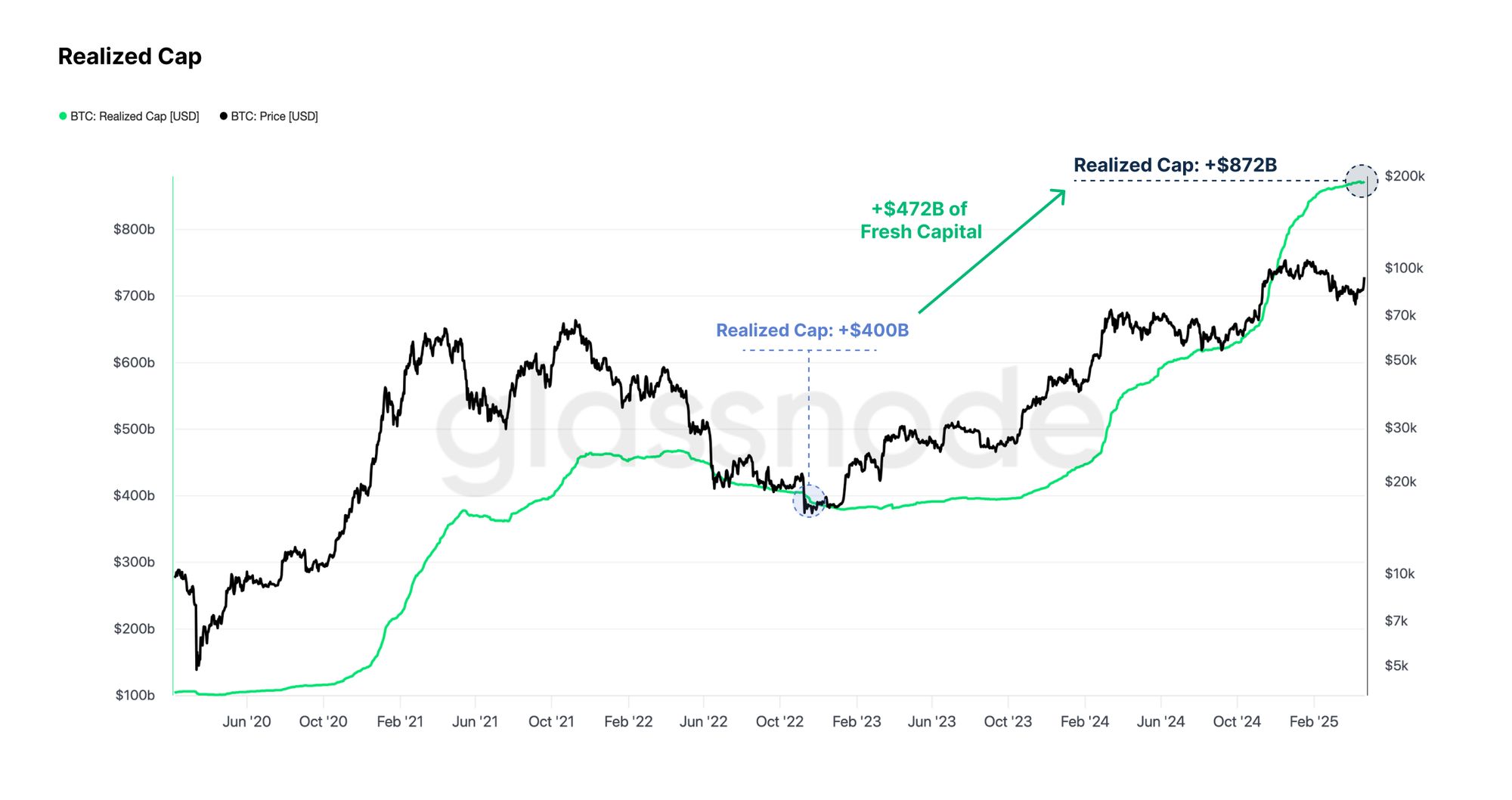

Realized Cap Hits Record $872 Billion

Bitcoin has absorbed more than $472B in net capital since the 2022 low, pushing the realized cap to an all-time high of $872B. This signals major accumulation and rising investor conviction across the board.

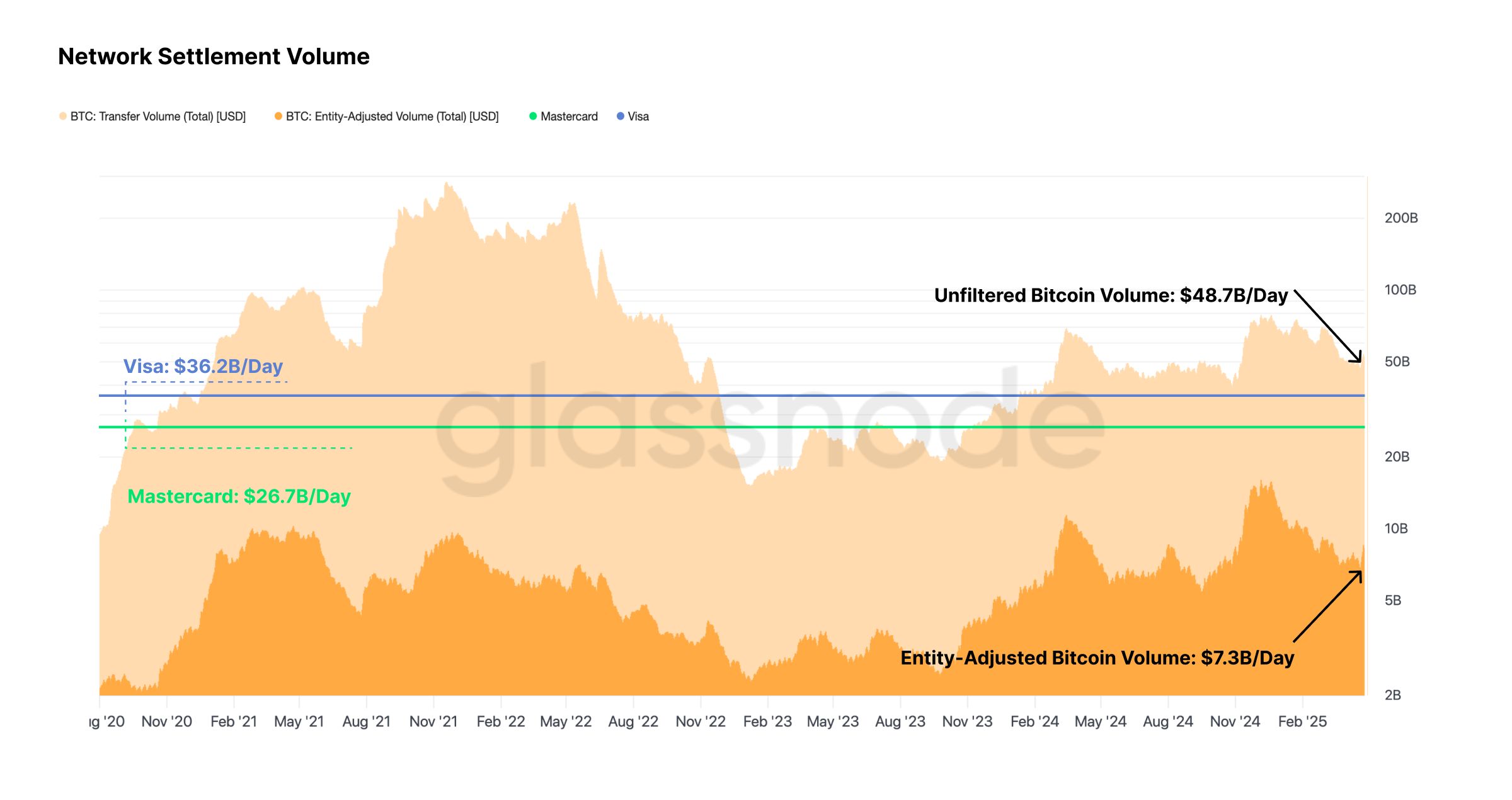

Bitcoin Settled Over $2.9 Trillion On-Chain in 2024

Even amid declining volatility, Bitcoin remains a dominant global settlement layer, rivaling traditional networks like Mastercard and Visa in transactional throughput.

ETF Giants Remain in Profit Despite Market Drawdown

BlackRock and Fidelity ETF investors hold average cost bases of $69.2K and $57.4K respectively - levels that have helped establish a resilient price floor, underscoring the anchoring effect of institutional demand.

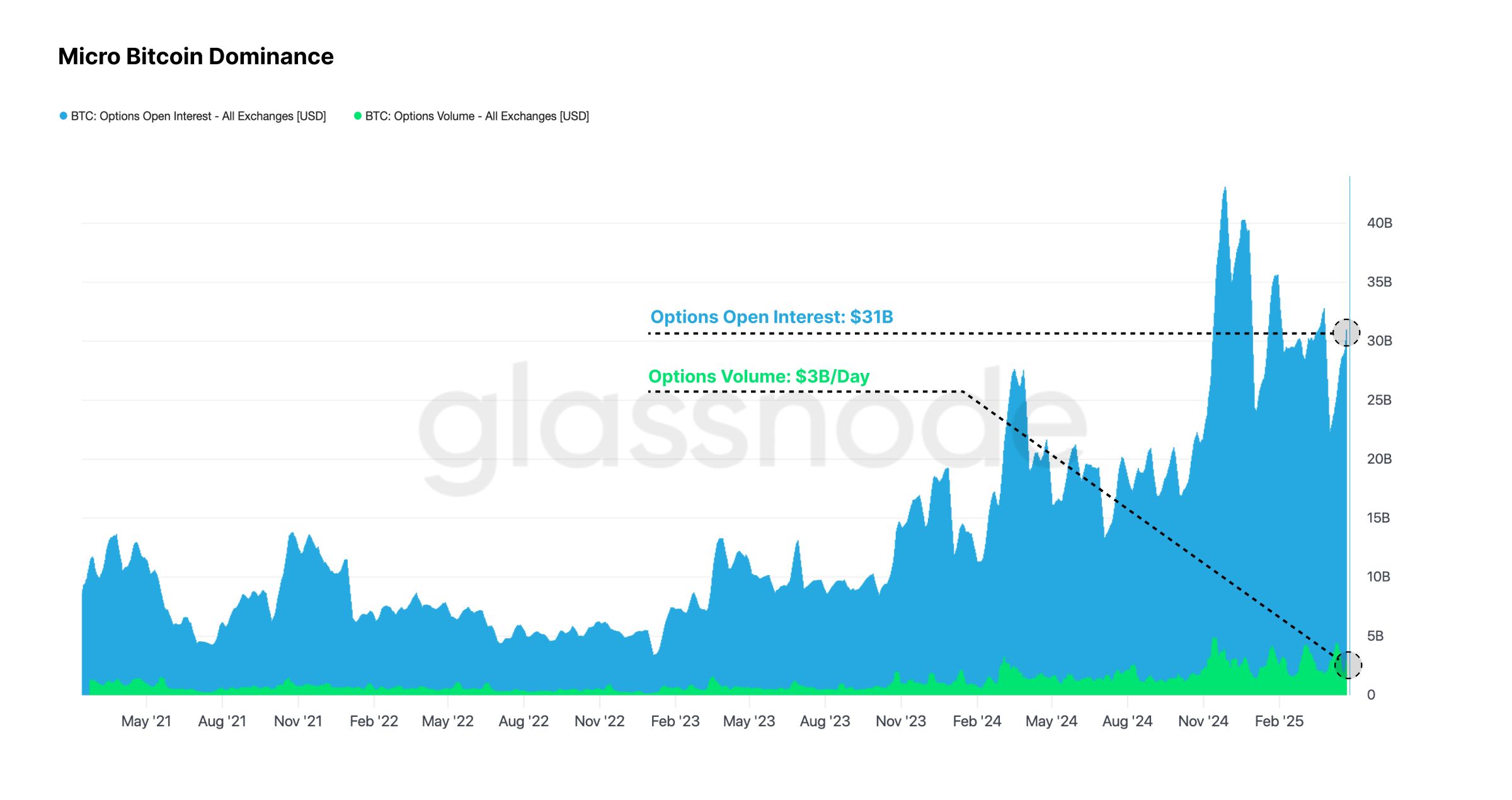

Options Open Interest Doubled Since Last Cycle

Hitting an all-time high of $43B in 2024, options open interest has surged. CME’s institutional-grade options are increasingly being used for structured exposure and long-dated strategies.

Discover More

This edition of the CME x Glassnode Bitcoin Report goes beyond surface-level trends to deliver a comprehensive institutional view of the market. Inside, you'll find:

- A breakdown of investor cost basis and capital inflow behavior

- Real-time assessments of market liquidity and volatility regimes

- Derivatives market structure and CME futures dominance

- ETF flows, cost bases, and the role of cash-and-carry strategies

- Comparative cycle analysis and drawdown profiles

Whether you're managing institutional portfolios or monitoring market structure, this report offers the critical insights needed to navigate the next phase of Bitcoin's cycle.

Download the full report.

Glassnode is a trusted data provider partner to institutions in the financial world. Our expertise in on-chain analytics complements traditional price data, providing a holistic view of the digital asset markets. Contact us to explore our offerings for data, bespoke reports, and more.