Bitcoin Flips Amazon’s $2.3T, Satoshi Ranks 11th Richest Person

- Bitcoin surpasses Amazon’s $2.3T market cap, becoming the world’s fifth-largest asset overall.

- Satoshi Nakamoto’s 1.096M BTC holdings are now worth $131B, ranking him 11th richest globally.

- Over 265 companies now hold Bitcoin, boosting institutional demand and market momentum.

Bitcoin reached a major milestone this week, flipping Amazon’s $2.3 trillion market cap for the first time in history. The surge came after seven straight days of gains, supported by record inflows into U.S. spot Bitcoin ETFs. The asset’s price soared to a new all-time high above $123,000 on Monday.

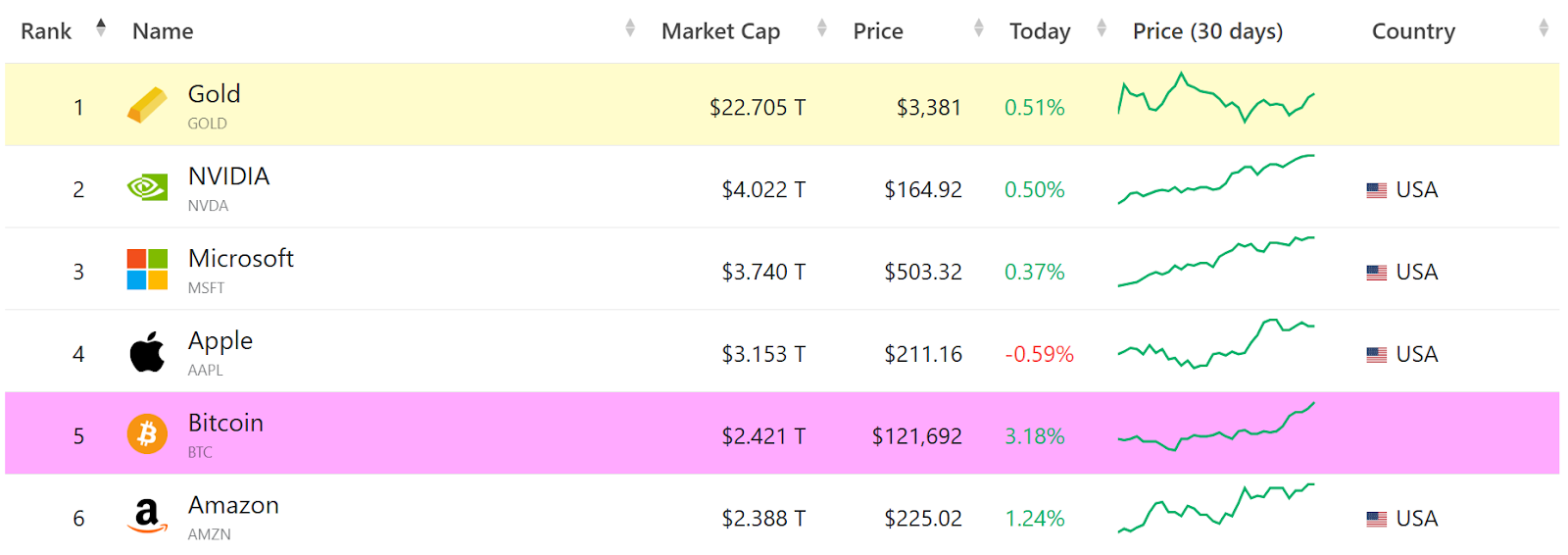

Bitcoin’s market capitalization now stands at $2.42 trillion, pushing it above Amazon, Silver, and Alphabet. Only four global assets are now valued higher than Bitcoin. These include Gold, NVIDIA, Microsoft, and Apple. At the time of writing, Bitcoin was just $730 million behind Apple’s $3.15 trillion market cap.

Source: Companiesmarketcap

Source: Companiesmarketcap Since early June, the number of companies holding Bitcoin on their balance sheets has more than doubled. Over 265 firms now hold the asset, up from 124 just weeks ago. According to on-chain data, over 3.5 million BTC is currently held in treasuries. Of this, 859,022 BTC of the total supply is held by public companies. Additionally, 1.4 million BTC, 6.6% of the supply, is stored in spot Bitcoin ETFs.

Institutional Adoption Boosts Sentiment

Bitcoin’s current rally is fueled by more than just ETF demand. Institutional adoption continues to rise rapidly as regulatory clarity improves in the United States. The U.S. Congress is actively working on three major cryptocurrency bills during what’s now being called “Crypto Week.”

These bills include the GENIUS Act, which supports U.S. dollar stablecoin issuance under a national framework. The CLARITY Act aims to clearly define crypto assets and their regulatory oversight. Meanwhile, the Anti-CBDC Surveillance State Act seeks to block the launch of a retail central bank digital currency in the U.S. Together, these legislative attempts are viewed as a means to improve trust in the larger crypto space.

Volume surged notably during Bitcoin’s breakout past $114,000, confirming strong momentum behind the move. The price had consolidated in a tight range between $110,000 and $113,000 before the breakout. This pattern mirrored previous bull-market bursts, catching traders by surprise with a sharp upward move. With volatility increasing, price discovery continues as Bitcoin enters uncharted territory.

Related: Bitcoin Tops $122K After Inflation Drops and Bulls Stay in Control

Satoshi Nakamoto Enters Billionaire Rankings

As Bitcoin’s value jumped, the fortune of its anonymous creator, Satoshi Nakamoto, grew significantly. Nakamoto is believed to hold 1.096 million BTC across thousands of untouched addresses. At current prices, that stash is worth over $131 billion.

According to blockchain firm Arkham, this puts Nakamoto just behind Sergey Brin of Google and ahead of Michael Dell on the global billionaire list. Nakamoto now theoretically ranks 11th, though Forbes does not include wallet-based holdings in its official rankings.

Satoshi’s holdings account for nearly 5.2% of Bitcoin’s capped supply. No other individual or company holds as much BTC. In comparison, all corporations and ETFs combined hold about 2.25 million coins, significantly less than Nakamoto’s stash alone.

Despite being one of the richest entities in the world, Nakamoto’s identity remains unknown. The wallets linked to Nakamoto have never moved any coins since they were mined between 2009 and 2010.

Market participants continue to monitor Bitcoin’s supply distribution. The lack of selling from Nakamoto’s wallets has helped support long-term investor confidence. Analysts often cite this as one reason why Bitcoin remains attractive despite volatility. The mystery around Nakamoto remains one of the most intriguing parts of Bitcoin’s story.

The post Bitcoin Flips Amazon’s $2.3T, Satoshi Ranks 11th Richest Person appeared first on Cryptotale.

Satoshi Nakamoto climbs into the world’s top 11 richest!

Satoshi Nakamoto climbs into the world’s top 11 richest!