FLOKI Faces Historical Reversal Cues After a 40% Rally

FLOKI has experienced a significant 40% rally over the past week, pushing the meme coin to a 6-month high. The altcoin’s price has been on an upward trajectory, reflecting strong interest and support from the market.

However, while FLOKI has garnered attention, the overall market conditions still pose challenges for the altcoin’s price stability.

FLOKI Faces Danger

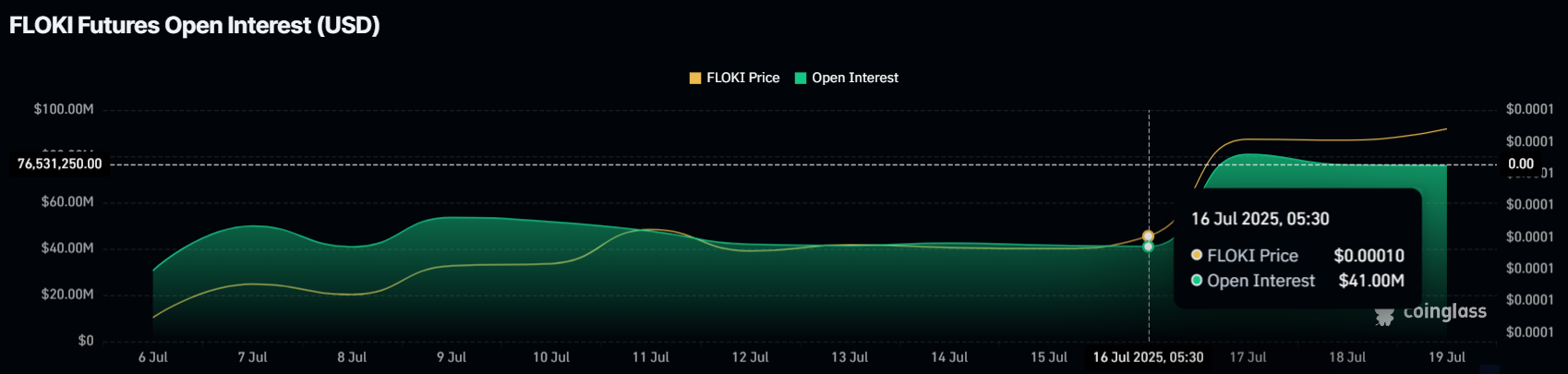

FLOKI’s price surge has been accompanied by a notable increase in open interest in the derivatives market. Over the last two days, open interest surged 87% from $40 million to $75 million, signaling growing excitement and investor interest in the meme coin.

This sharp rise in open interest reflects a heightened sense of fear of missing out (FOMO), as traders flock to capitalize on potential gains.

Additionally, the positive funding rate further confirms this trend, indicating that long contracts dominate the market. This is a clear sign of investor optimism and the anticipation that FLOKI will continue its rally.

FLOKI Open Interest. Source:

FLOKI Open Interest. Source: The broader macro momentum behind FLOKI’s recent gains is mixed. The MVRV (Market Value to Realized Value) Ratio currently sits at 32.62%, indicating that investors who bought FLOKI in the past month are sitting on 32% profits.

While this shows a positive market sentiment, past instances of the MVRV Ratio reaching this range have often resulted in reversals, as investors tend to sell when profits are high.

The 19% to 32% range in the MVRV Ratio is considered a “danger zone,” as many traders are inclined to take profits, potentially leading to a price correction.

FLOKI’s presence in this danger zone signals that the current rally may face resistance. While the market has been bullish, the risk of a reversal remains significant.

FLOKI MVRV Ratio. Source:

FLOKI MVRV Ratio. Source: Can FLOKI Price Bounce Back?

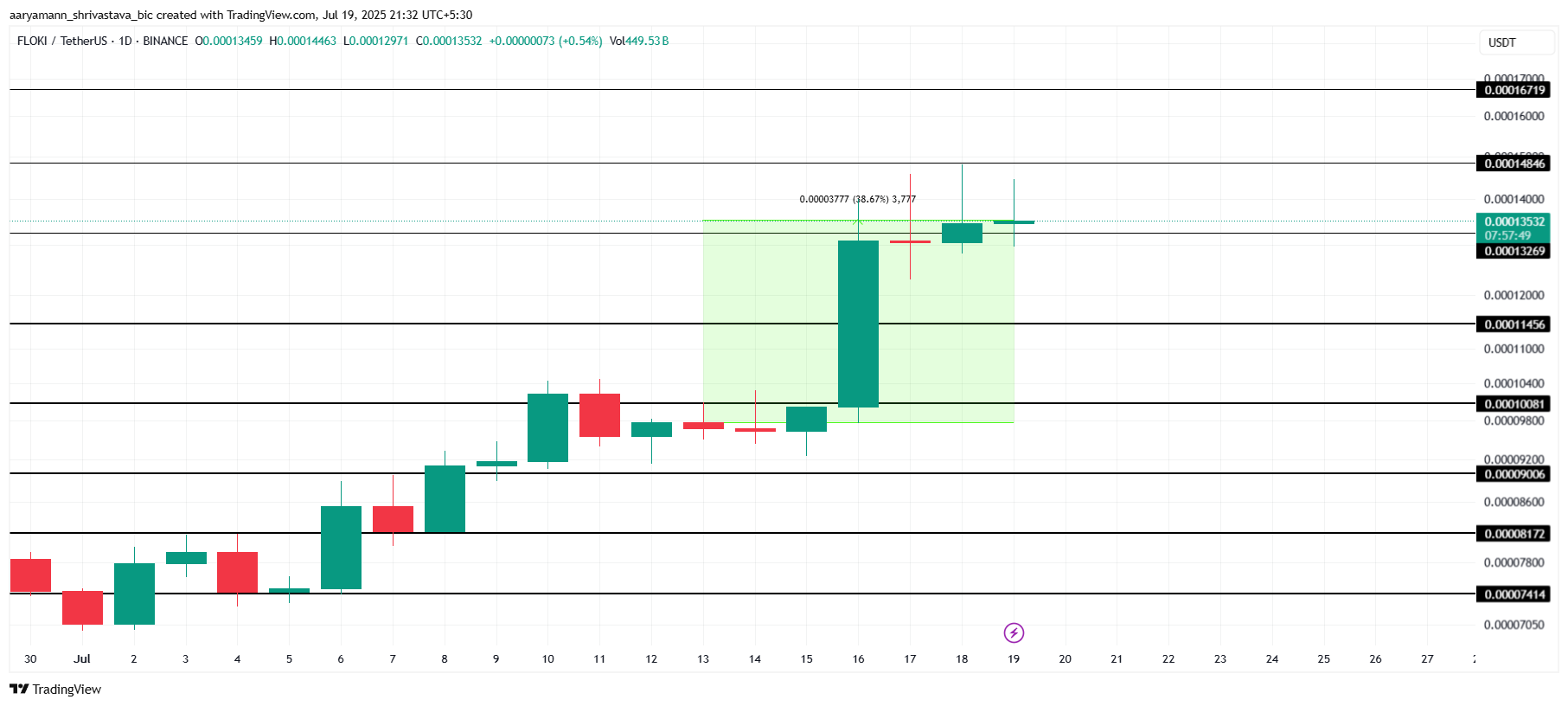

FLOKI’s price is currently trading at $0.000135, marking a 38% rise over the last seven days. The meme coin is trying to secure $0.000132 as a support floor, which is crucial for maintaining its recent gains.

If this support level holds, FLOKI could push further toward $0.000148 in the coming days.

However, if investor sentiment shifts and traders begin to sell their holdings, FLOKI’s price could experience a correction. Should the support at $0.000132 fail, the altcoin may drop to $0.000114, invalidating the bullish thesis and erasing recent gains.

FLOKI Price Analysis. Source:

FLOKI Price Analysis. Source: On the other hand, if FLOKI can breach the resistance of $0.000148, it could push even further, with the next target being $0.000167. A successful breakout past $0.000148 would suggest that the meme coin has invalidated the bearish thesis.