Dogecoin’s Consolidation Could End Soon as Hidden Bullish Divergence Surfaces

Dogecoin (DOGE) price has slipped more than 13% over the past week, cooling off after a strong 31% rally in the last three months. While the price appears range-bound for now, the consolidation might be deceiving.

Several on-chain and technical signals suggest hidden strength building below the surface, especially one key divergence that traders often overlook.

Short-Term Holders Capitulate, But Cost Basis Support Kicks In

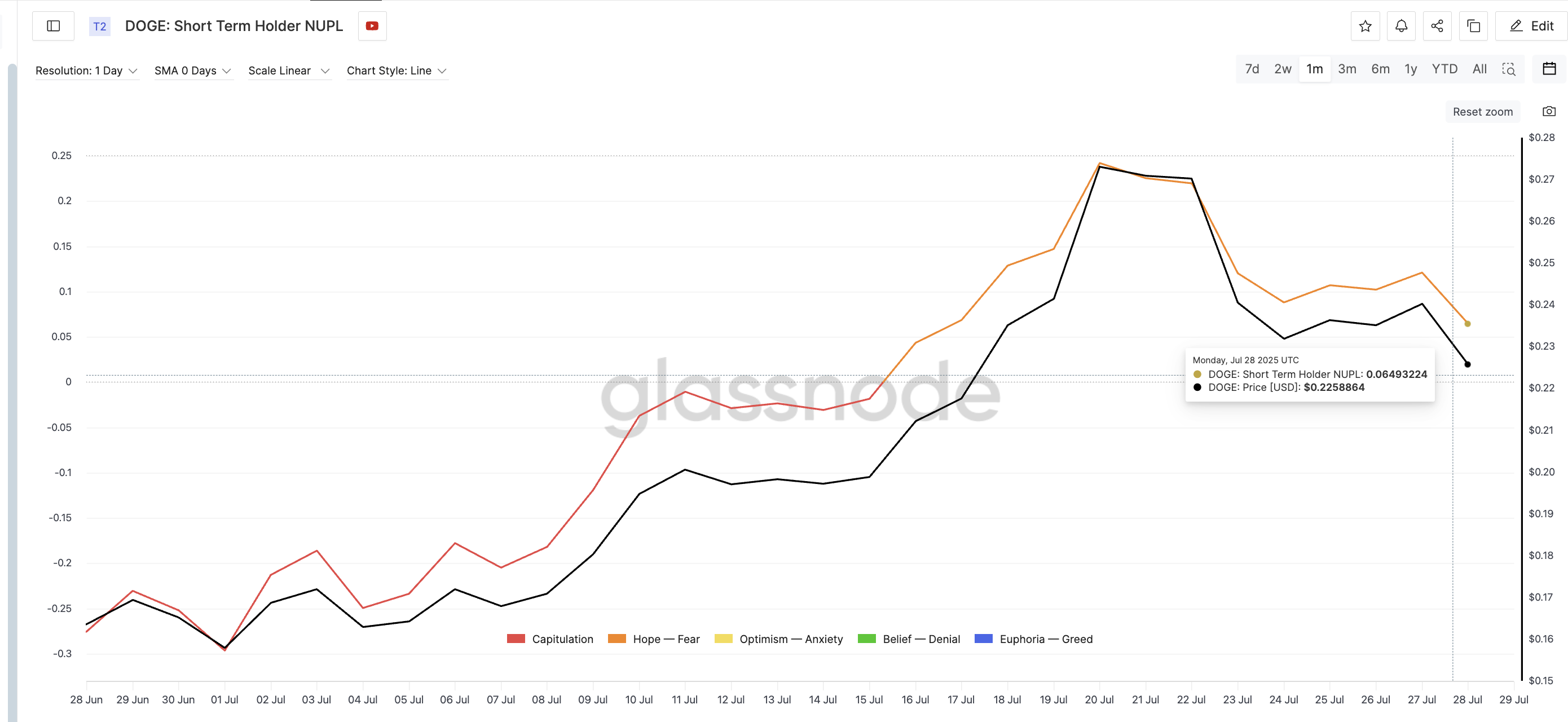

The first sign of shifting sentiment comes from short-term holder Net Unrealized Profit/Loss (NUPL). This metric tracks the unrealized profits and losses of wallets that purchased DOGE within the last 155 days; typically, these are the most reactive participants in the market.

As the price dropped from its late-July highs, short-term holder NUPL fell sharply from a high of 0.24 (July 20) to just 0.06 on July 28. That’s a clear sign that many recent entrants either sold for small profits or slipped into mild losses; a common occurrence when corrections shake out weak hands.

Dogecoin Short-term Holder NUPL: Glassnode

Dogecoin Short-term Holder NUPL: Glassnode But this wave of short-term capitulation may have hit a wall, right at a strong support zone.

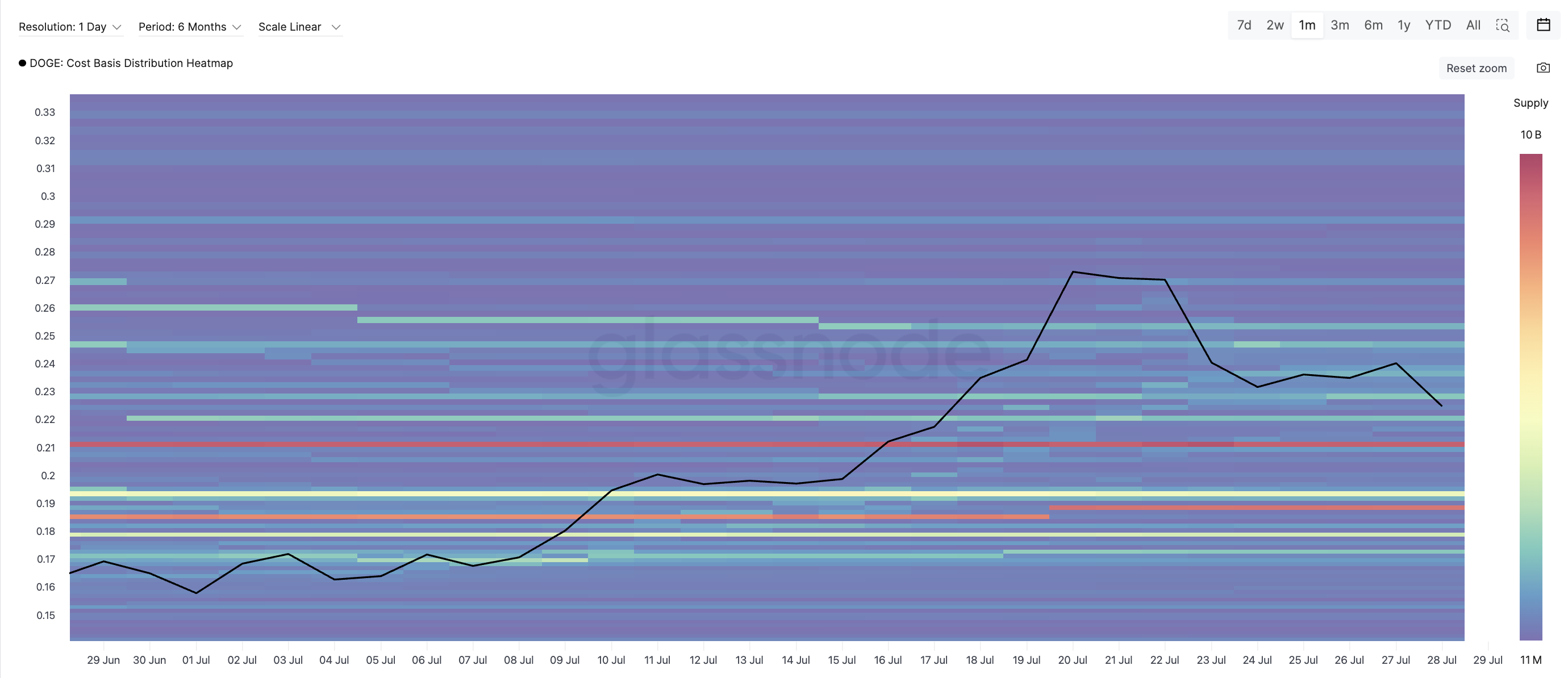

DOGE’s cost basis heatmap, which maps wallet clusters by average acquisition price, shows a massive band of supply near $0.21. More than 9.77 billion DOGE sit in this range, suggesting many holders bought at this level and are likely to defend it. Historically, these zones act as Dogecoin price support floors during corrections.

Dogecoin price and cost basis heatmap: Glassnode

Dogecoin price and cost basis heatmap: Glassnode This confluence of emotional exit (NUPL drop) and structural defense (cost basis support) sets up the perfect setup: the panic is cooling, and strong hands are holding the line.

Hidden Bullish Divergence Forms as Sellers Lose Steam

Now comes the momentum signal that could flip the script: hidden bullish divergence on the Relative Strength Index (RSI).

RSI tracks how strongly price is moving; typically, in bullish trends, both price and RSI rise together. But hidden divergence breaks that pattern.

DOGE price and RSI divergence:

DOGE price and RSI divergence: Over the past few days, Dogecoin’s price has been forming higher lows, a sign of buyers stepping in sooner during dips. Yet RSI has been carving out lower lows, revealing that while momentum has cooled, price structure remains intact. This mismatch is key; it suggests sellers are losing steam, not gaining ground.

Hidden bullish divergence often shows up in consolidations or pullbacks within larger uptrends; exactly the context here, with DOGE still up over 30% in the past three months. This form of divergence shows that the broader DOGE price uptrend holds, and what happened was a mere consolidation and not a bearish flip.

When paired with short-term holder NUPL dropping into capitulation and cost-basis heatmap support holding firm at $0.21, the RSI setup doesn’t just hint at strength; it completes the case for a bullish continuation brewing under the surface.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Dogecoin Price Needs a Breakout to Confirm the Setup

Dogecoin is currently trading just below $0.23, hovering between key Fibonacci levels; $0.23 (0.382 retracement) and $0.21 (0.5 retracement). For the bullish divergence narrative to fully play out, price needs to hold above $0.21 and reclaim $0.25.

Dogecoin price analysis:

Dogecoin price analysis: A breakout above $0.25 opens the door to $0.28, where the next resistance lies.

But if the $0.21 zone breaks, momentum fades, and price could revisit $0.19 or even $0.17, invalidating the bullish thesis. However, the cost basis heatmap clearly shows how strong the $0.21 level is.