BitMine Estimates Ethereum’s Implied Value at $60,000 Amid Latest Market Rally

In their latest presentation, BitMine Immersion Technologies suggested an implied value of $60,000 for Ethereum (ETH), citing consultations with unnamed research firms.

The valuation comes amid ETH’s notable bullish rally. The price has surged 57% over the past month, even outpacing Bitcoin’s (BTC) 10% monthly gains.

BitMine’s $60,000 Ethereum Valuation

On Monday, BitMine, the largest public holder of ETH, launched ‘The Chairman’s Message.’ This monthly video series outlines the firm’s strategic vision for cryptocurrency investments.

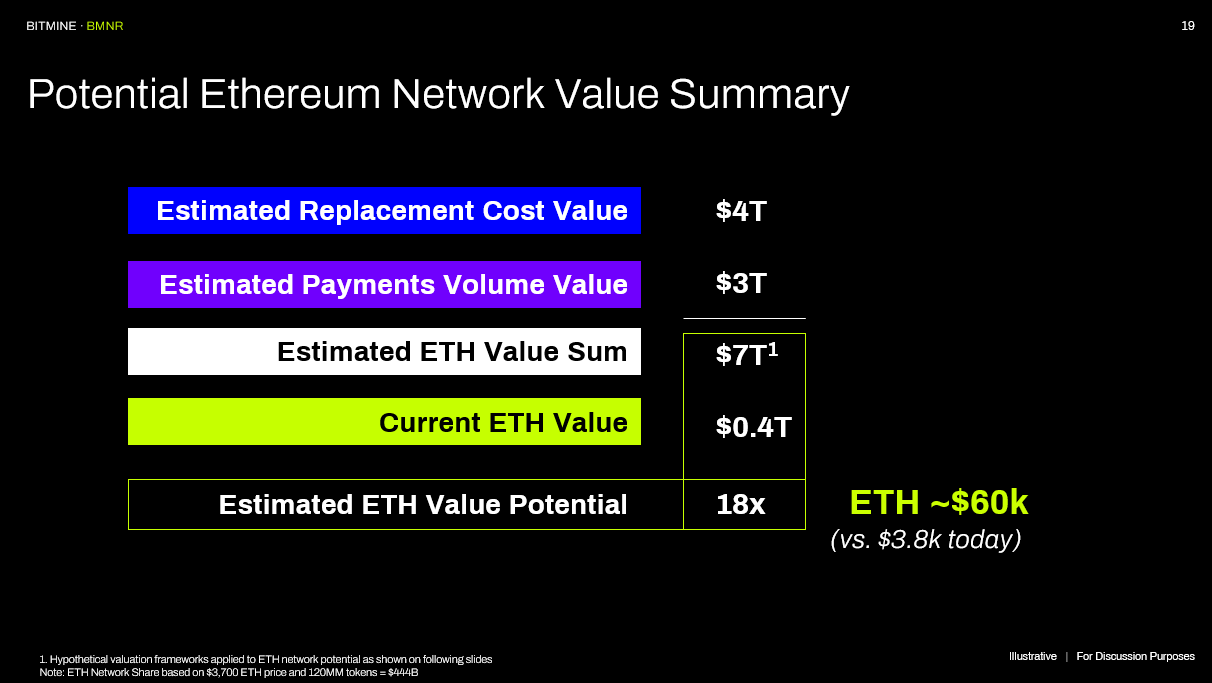

Accompanying the presentation on X (formerly Twitter) was a slide titled ‘Potential Ethereum Network Value Summary,’ highlighting Ethereum’s potential implied value.

“We asked several research firms to give us ‘replacement’ value (of Wall Street) to value ETH. Implied value for ETH is $60,000. ETH currently ~$3,800,” the post read.

Ethereum Implied Value by BitMine. Source:

Ethereum Implied Value by BitMine. Source: The $60,000 valuation posits an 18-fold increase from ETH’s current market value. However, the firm’s post framed this as an illustrative projection.

Although this projection is hypothetical, it still highlights ETH’s significant potential. This confidence in ETH coincides with the second-largest cryptocurrency experiencing impressive gains recently.

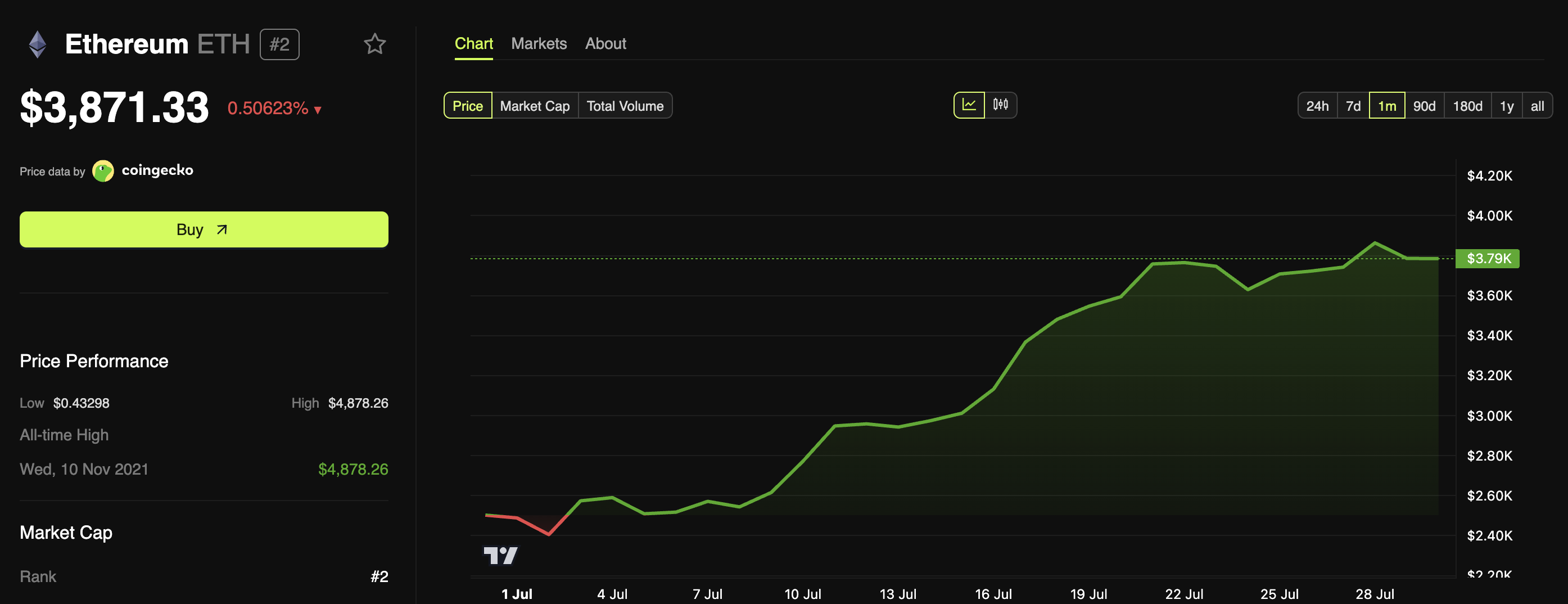

BeInCrypto data showed that yesterday, ETH surpassed $3,900 for the first time since December 2024, further fueling its ongoing recovery. At press time, Ethereum was trading at $3,871, marking a slight decline of 0.50% over the past 24 hours.

Ethereum Price Performance. Source:

Ethereum Price Performance. Source: Ethereum Price Prediction: What Analysts Expect

Meanwhile, many market analysts are increasingly forecasting higher valuations for Ethereum’s price. In a latest post on X, Bitcoinsensus suggested that Ethereum is primed for a significant upside move, similar to what Bitcoin experienced in 2020.

The analyst observed that Ethereum could experience a breakout above a multi-year trendline. This, in turn, could lead to a price increase.

“ETH is showing relative strength for a breakout, after a multi-year pressure build up below this trendline. With enough momentum, the breakout could lead to much higher prices for Ethereum in the upcoming phase of this cycle,” the post read.

Ethereum Price Prediction. Source:

Ethereum Price Prediction. Source: Moreover, Ethereum proponent Ted Pillows mentioned that the altcoin is currently undervalued. He argued that, based on the growth of the M2 money supply, Ethereum’s value should already be above $8,000.

“This shows how undervalued ETH is right now, and is probably one of the best trades out here,” Pillows said.

Meanwhile, analyst Mark highlighted that more investors are accumulating Ethereum. This is often seen as a sign of growing confidence in the asset’s future price potential.

“Ethereum’s accumulation ratio is on the rise again. After hitting a low in April 2025, the ratio has started to climb, indicating a potential increase in demand for ETH,” he noted.

This paints a bullish picture for ETH. Furthermore, the projections may not be too far-fetched, especially given a number of factors working in Ethereum’s favor.

BeInCrypto reported that institutional interest in the altcoin continues to rise, with many firms committing millions of dollars to buy Ethereum as part of their treasury strategy.

“Ethereum moves slow then all at once. When institutions rotate, it won’t be subtle,” a market watcher remarked.

I'm excited about the upcoming weeks.Things are looking very bullish right now.Bitcoin’s dominance is dropping below 60%, which shows money is flowing into other coins.$ETH is going to break $4,000, boosted by strong demand from institutional investors.Altcoins are in a… pic.twitter.com/ROF8x91jbL

— Ted (@TedPillows) July 28, 2025

Bitcoin’s dominance is declining, and many experts predict that Ethereum could be a significant beneficiary. Lastly, Ethereum’s upcoming 10th anniversary has attracted heightened interest, further putting the token in the investor spotlight.