Brian Quintenz’s CFTC Nomination in Limbo Over Kalshi Board Ties

The White House paused the process to advance Brian Quintenz’s nomination as Chair of the US Commodity Futures Trading Commission (CFTC).

In early February, President Trump tapped Quintenz, the head of policy at venture capital firm a16z, to head the CFTC.

Conflict Concerns Emerge Over Kalshi Ties During CFTC Transition

Reports cite growing concerns over potential conflicts of interest tied to Brian Quintenz’s current role on the prediction market platform Kalshi’s board.

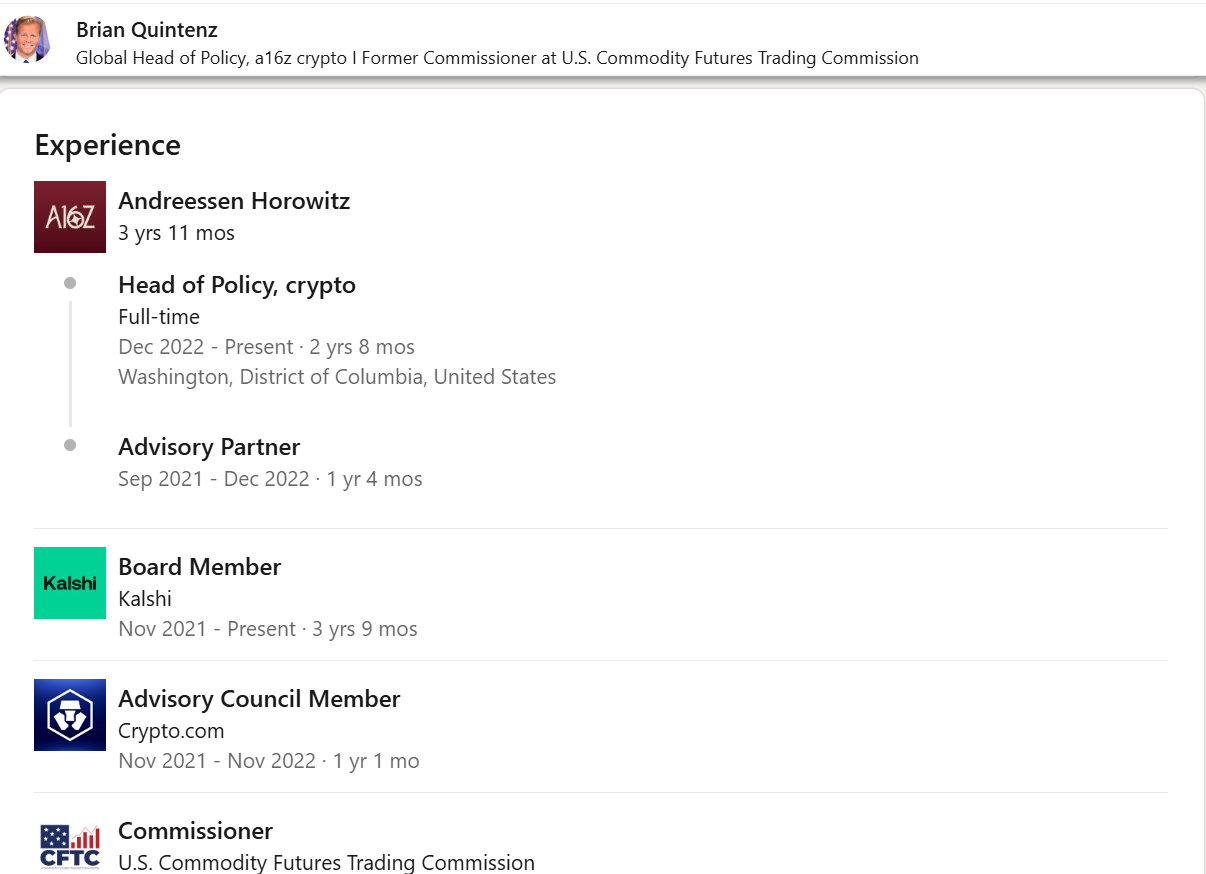

Brian Quintenz on the Kalshi Board. Source: LinkedIn

Brian Quintenz on the Kalshi Board. Source: LinkedIn Quintenz’s team reportedly sought confidential CFTC information regarding Kalshi competitors, Polymarket, and PredictIt during a transition planning process.

Meanwhile, Quintenz still holds a board seat at Kalshi, a platform regulated by the CFTC.

[ ZOOMER ]WHITE HOUSE PAUSE IN PROCESS TO INSTALL NEW CFTC CHAIR RUMOURED TO BE DUE TO HIS TEAM SEEKING CONFIDENTIAL INFORMATION ON POLYMARKET AND PREDICTITT WHILST HE CURRENTLY SITS ON RIVAL KALSHI'S BOARD: ELEANOR TERRETT

— zoomer (@zoomerfied) July 29, 2025

Eleanor Terrett, host of the Crypto America podcast, confirmed speculation, citing multiple possible triggers for the delay.

According to Terret, reasons include concerns about vote counts in the Senate and lobbying from the American Gaming Association, which opposes expanded prediction markets. There is also discomfort from prominent crypto figures such as the Winklevoss twins.

However, attention has coalesced around a detailed blog post from The Closing Line, reportedly gaining traction on Capitol Hill.

The blog, “What an FOIA Request Tells Us About the CFTC Nominee and Potential Conflicts of Interest,” presents a cache of emails obtained via a Freedom of Information Act (FOIA) request.

The emails indicate that Kevin Webb, named as Quintenz’s incoming chief of staff, reached out to CFTC staff in June.

FOIA Emails Reveal Early Access Requests to Sensitive CFTC Data on Competitors

Webb reportedly requested briefings on sensitive topics, including seriatims in circulation, a confidential internal voting process, employees on administrative leave, and a list of open applications.

More closely, some of the pending applications Webb referred to involve Kalshi competitors such as Polymarket’s recently acquired QCX platform and PredictIt’s parent company, Aristotle.

For perspective on competition, a recent regulatory clampdown against Kalshi also affected Polymarket, with the latter suffering a 40% drop in daily active addresses.

Based on this, questions arise, given that Quintenz is still a sitting Kalshi board member, and Kalshi is a CFTC-regulated Designated Contract Market (DCM).

The FOIA documents suggest that these communications may have crossed ethical boundaries due to the direct intersection with Kalshi’s competitive space.

“If Quintenz asked for and received information about DCMs that are or will be competitors of Kalshi’s… that’s arguably a conflict of interest,” read an excerpt in The Closing Line blog.

Playing devil’s advocate, however, it is worth noting that these communications are potentially routine in the context of federal agency transitions.

In his ethics statement and Senate Agriculture Committee testimony, Quintenz pledged not to participate in matters affecting Kalshi until he divests his interest or obtains a waiver.

He also committed to using a screener in his office to prevent conflicts. Nevertheless, the current scrutiny focuses on whether those safeguards were sufficiently observed during the transition phase.

The White House has not publicly stated why Monday’s scheduled vote was postponed. However, Bloomberg reports that Quintenz remains President Trump’s nominee.

Meanwhile, the Closing Line report continues circulating among crypto lobbyists and policy insiders as a possible tipping point in the nomination’s trajectory.

As the Senate considers its next steps, the episode reflects how prediction markets and the companies behind them become flashpoints in regulatory and political arenas.