Trump’s Chip Tariffs Jolt US Crypto Miners

Trump’s 100% chip tariffs threaten US crypto miners’ profits and operations. Mining stocks fell as companies face rising equipment costs and potential offshore relocations.

Market Response and Stock Performance

President Trump announced 100% tariffs on imported chips and semiconductors on Wednesday. The tariffs exempt only companies manufacturing domestically within the United States. This move targets Asian manufacturing powers as part of a broader repatriation strategy.

“If you’re making chips abroad, you’re paying the price,” Trump said. The crypto mining industry depends heavily on Asian-manufactured ASIC chips. Countries like China, Malaysia, Thailand, and Indonesia dominate global production.

Leading crypto mining stocks dropped in after-hours trading following the announcement. Marathon Digital Holdings fell 0.13% to $15.87 per share. Riot Platforms declined 0.69% to $11.58.

Singapore-based Bitdeer Technologies slid 0.62% to $12.89 on US markets. Nevada’s CleanSpark Inc. dropped 0.18% to $10.98. HIVE Digital Technologies fell 0.94% to $2.10.

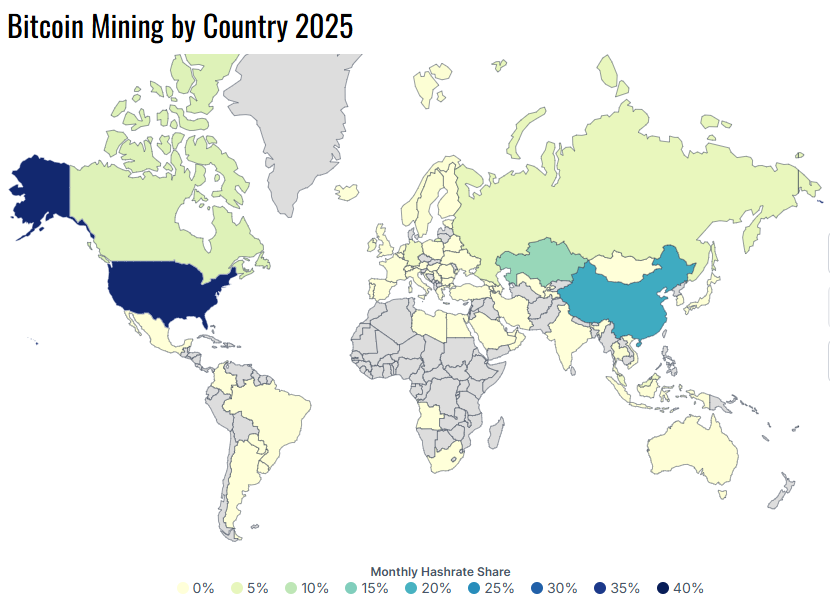

The US currently leads global cryptocurrency mining by hashrate percentage. Source: World Population Review

The US currently leads global cryptocurrency mining by hashrate percentage. Source: World Population Review Hut 8 Mining Corp saw a 0.19% decline to $20.65. Investors fear elevated duties will erode profit margins significantly. New deployments of mining rigs may face delays and higher costs.

Industry Restructuring Looms

New tariffs add over 21% in duties on ASIC imports. Many domestic miners consider this burden unsustainable for operations. Mining pool operator Luxor warns policies could accelerate offshore relocations.

Companies may relocate operations to countries with favorable trade regimes. Partnerships with foreign manufacturers could help bypass high import duties. Such moves might impact Bitcoin network decentralization and mining economics.

The US currently leads global cryptocurrency mining by hashrate percentage. However, these policy changes could trigger structural industry shifts. The total global crypto market capitalization stands at $3.76 trillion currently.

Industry observers watch how mining firms will adapt to new policies. Trump’s protectionist approach may spark domestic manufacturing growth or increased offshoring. The longer-term implications for the digital asset ecosystem remain uncertain.