XRP Flashes Rare Signal, Eyeing a Breakout Toward $24

The crypto XRP soars after Ripple’s resounding victory against the SEC. Driven by record institutional inflows and major innovations, the world’s third-largest crypto is close to a historic breakout. Traders now anticipate a new peak at 24 dollars, fueled by a finally favorable regulatory context.

In Brief

- Ripple wins against the SEC, lifting a major barrier to institutional adoption of XRP.

- Futures contract volumes up 208% on XRP and a peak at $3.27 supported by global crypto partnerships.

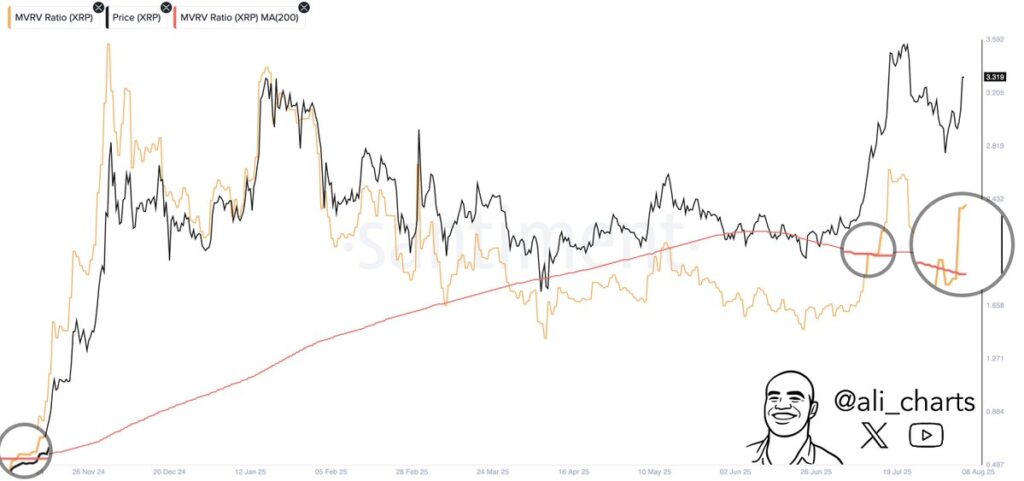

- A rare MVRV signal on XRP announces bullish potential up to 24 dollars.

End of the Ripple-SEC standoff: XRP breaks free and aims higher

After several years of tension, the Securities and Exchange Commission has officially dropped its lawsuits against Ripple Labs . This decision comes with the removal of the “bad actor” designation, opening the way for new financial partnerships and expanded institutional adoption for the crypto XRP.

This legal relief triggered an immediate market reaction: XRP’s price jumped more than 11%, reaching $3.27 before continuing its rise. This victory marks a break from years of uncertainty and could form the basis of a sustained bullish cycle in the crypto space.

Financial giants rush to XRP: volumes explode

In 24 hours, futures contract volumes on XRP exploded by 208%, reaching $12.4 billion, surpassing those of Solana. Additionally, open interest rose 15% to $5.9 billion! This signals massive long-term positioning by institutional investors on the crypto. This trend is reinforced by the scale of Ripple’s network.

This movement coincides with major upgrades to the global payment systems Fedwire and CHIPS. Also, with the expansion of Ripple corridors in the Middle East, Africa, and Southeast Asia. Meanwhile, the launch of the XDNA token on the XRP Ledger paves the way for tokenization of biological assets in partnership with African laboratories.

Crypto: a rare indicator announces a historic surge for XRP

At $3.26, XRP’s price nears its all-time high of $3.66! A key technical level that could trigger a new phase of crypto volatility.

A rare technical signal, the MVRV “golden cross“, has been triggered. Historically, this indicator has preceded increases from +54% to +630%. In this scenario, XRP could target $5.11 or even $24 if past crypto patterns repeat.

Golden Cross of XRP

Golden Cross of XRP The combination of a cleaned regulatory framework, a massive institutional inflow of nearly one billion dollars towards XRP , and bullish technical signals places Ripple in a strategic position. If the current momentum holds and the historic resistance breaks, the crypto could enter an unprecedented price phase, consolidating its role as a leader in global digital payments.